Question: Answer the question 7, 8 and 10 in CLEAR STEPS. 10. Calculate (a) the amount financed, (b) the total finance charge. Round the Finance charge

Answer the question 7, 8 and 10 in CLEAR STEPS.

|

| ||

10.

| Calculate (a) the amount financed, (b) the total finance charge. Round the "Finance charge" to the nearest cent and "APR" to the nearest tenth percent.) |

| ||||||

| Purchase price of a used car | Down payment | Number of monthly payments | Amount financed | Total of monthly payments | Total finance charge | APR | |

| $5,793 | $1,283 | 48 | $ | $5,849.76 | $ | % | |

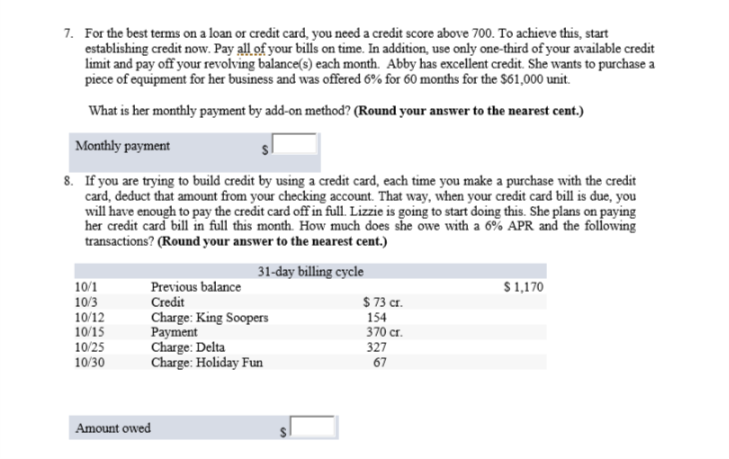

. For the best terms on a loan or credit card, you need a credit score above 700. To achieve this, start establishing credit now. Pay all of your bills on time. In addition, use only one-third of your available credit limit and pay off your revolving balance(s) each month. Abby has excellent credit. She wants to purchase a piece of equipment for her business and was offered 6% for 60 months for the S6 1,000 unit. What is her monthly payment by add-on method? (Round your answer to the nearest cent.) Monthly payment If you are trying to build credit by using a credit card, each time you make a purchase with the credit card, deduct that amount from your checking account. That way, when your credit card bill is due, you will have enough to pay the credit card off in full Lizzie is going to start doing this. She plans on paying her credit card bill in full this month. How much does she owe with a 6% APR and the following transactions? (Round your answer to the nearest cent.) 8. 31-day billing cycle 10/1 10/3 10/12 10/15 10/25 10/30 Previous balance Credit Charge: King Soopers Payment Charge: Delta Charge: Holiday Fun 1,170 $73 cr 154 370 cr 327 67 Amount owed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts