Question: answer the question below. Question A derivatives trader is modelling the volatility of an equity index using the following discrete-time model: Model 1: 0, =

answer the question below.

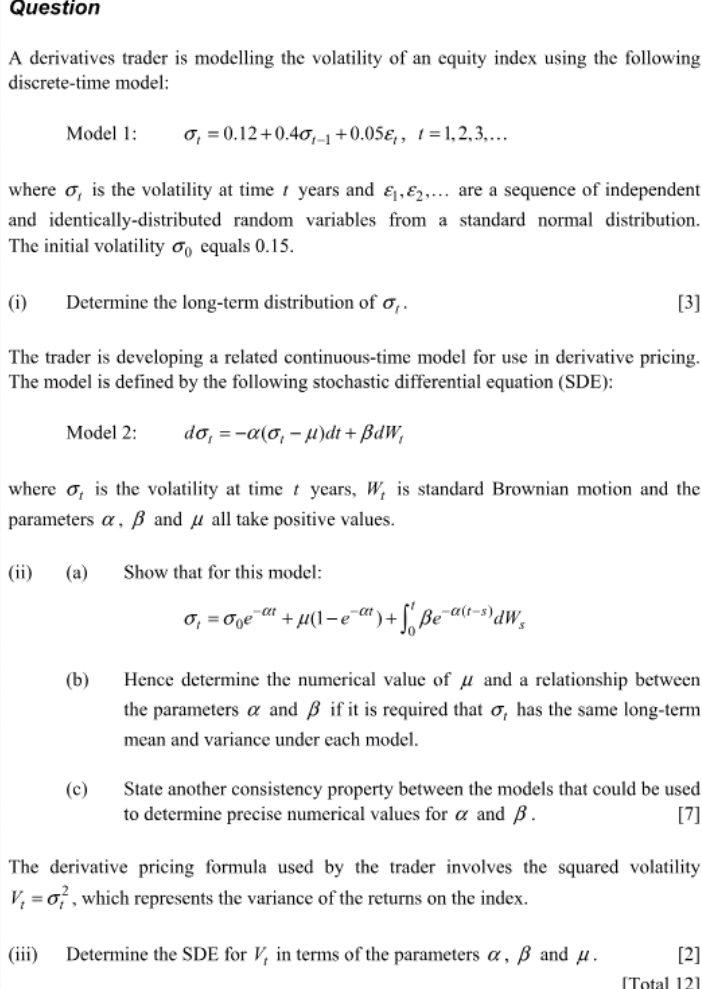

Question A derivatives trader is modelling the volatility of an equity index using the following discrete-time model: Model 1: 0, = 0.12+0.40,_1 +0.058, , 1=1,2,3.... where o, is the volatility at time / years and &, 62,... are a sequence of independent and identically-distributed random variables from a standard normal distribution. The initial volatility To equals 0.15. (i) Determine the long-term distribution of of . [3] The trader is developing a related continuous-time model for use in derivative pricing. The model is defined by the following stochastic differential equation (SDE): Model 2: do, =-a(0, - 4)di + BdW, where o, is the volatility at time t years, W, is standard Brownian motion and the parameters a , B and / all take positive values. (ii) (a) Show that for this model: Of =One " + u(1-e ")+ [Be alt-s) dw} (b) Hence determine the numerical value of / and a relationship between the parameters o and B if it is required that o, has the same long-term mean and variance under each model. (c) State another consistency property between the models that could be used to determine precise numerical values for o and B. [7] The derivative pricing formula used by the trader involves the squared volatility V, =0, , which represents the variance of the returns on the index. (iii) Determine the SDE for , in terms of the parameters o, B and H. [2] [Total 121

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts