Question: answer the question use the excel formula. Shower me the formula. Instructions Question 1 Question 2 Question 3 financial p... Question4_Bond (+ G H Suppose

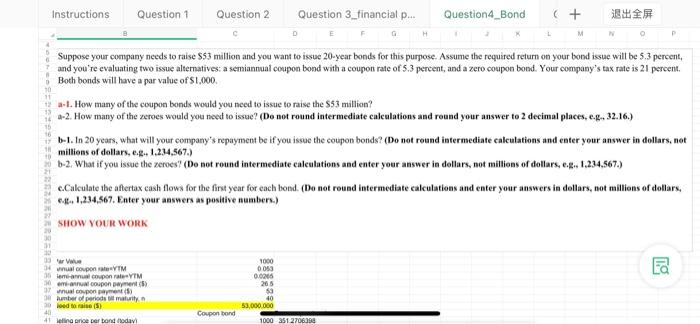

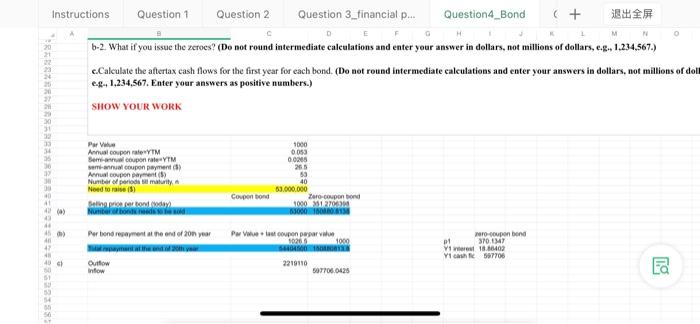

Instructions Question 1 Question 2 Question 3 financial p... Question4_Bond (+ G H Suppose your company needs to raise $53 million and you want to issue 20-year bonds for this purpose. Assume the required return on your bond issue will be 5.3 percent, and you're evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 5.3 percent, and a zero coupon bond. Your company's tax rate is 21 percent. Both bonds will have a par value of $1,000 -1. How many of the coupon bonds would you need to issue to raise the 553 million? 3-2. How many of the zeroes would you need to issue? (Do not round intermediate calculations and round your answer to 2 decimal places, e.... 32.16) b-1. In 20 years, what will your company's repayment be if you issue the coupon bonds? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, eg. 1.234,567.) 1-2. What if you issue the zeroes? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, ep. 1.234.567.) c.Calculato the aftertax cash flows for the first year for each bond. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, 6.4., 1,234,567. Enter your answers as positive numbers.) SHOW YOUR WORK a 3 we 14 val op YTM al coupon YTM mul coupon payment) vnual con payment umber of periods maurity 20 led to me (5) 41 41 Jelling price per bond today! 1000 0053 0.0005 265 53 40 53.000.000 Coupon bord 1000 251 2706390 Instructions Question 1 Question 2 Question 3 financial p... Question4_Bond (+ M 0 6-2. What if you issue the zeroes? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, eg, 1.234.567.) c.Calculate the aftertax cash flows for the first year for each bond. (Do not round intermediate calculations and enter your answers in dollars, not millions of dol ,1,234,567. Enter your answers as positive numbers.) SHOW YOUR WORK 33 0 Perhe Annual coupon rateYTM Ser coupon YTM coupon payment) Annual coupon payment Number of primary Need to raise (5) Stown Nud 1000 0053 00200 265 53 40 61.000.000 Zero-couponbond 1000000 OM Coupon bond 41 45 Per biondreament at the end of onyo Porte + corren peper 1000 SAS 2219110 5977060425 ro-couponbond p1 30. Y11816402 Ya 597706 c) Outflow infow Instructions Question 1 Question 2 Question 3 financial p... Question4_Bond (+ G H Suppose your company needs to raise $53 million and you want to issue 20-year bonds for this purpose. Assume the required return on your bond issue will be 5.3 percent, and you're evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 5.3 percent, and a zero coupon bond. Your company's tax rate is 21 percent. Both bonds will have a par value of $1,000 -1. How many of the coupon bonds would you need to issue to raise the 553 million? 3-2. How many of the zeroes would you need to issue? (Do not round intermediate calculations and round your answer to 2 decimal places, e.... 32.16) b-1. In 20 years, what will your company's repayment be if you issue the coupon bonds? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, eg. 1.234,567.) 1-2. What if you issue the zeroes? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, ep. 1.234.567.) c.Calculato the aftertax cash flows for the first year for each bond. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, 6.4., 1,234,567. Enter your answers as positive numbers.) SHOW YOUR WORK a 3 we 14 val op YTM al coupon YTM mul coupon payment) vnual con payment umber of periods maurity 20 led to me (5) 41 41 Jelling price per bond today! 1000 0053 0.0005 265 53 40 53.000.000 Coupon bord 1000 251 2706390 Instructions Question 1 Question 2 Question 3 financial p... Question4_Bond (+ M 0 6-2. What if you issue the zeroes? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, eg, 1.234.567.) c.Calculate the aftertax cash flows for the first year for each bond. (Do not round intermediate calculations and enter your answers in dollars, not millions of dol ,1,234,567. Enter your answers as positive numbers.) SHOW YOUR WORK 33 0 Perhe Annual coupon rateYTM Ser coupon YTM coupon payment) Annual coupon payment Number of primary Need to raise (5) Stown Nud 1000 0053 00200 265 53 40 61.000.000 Zero-couponbond 1000000 OM Coupon bond 41 45 Per biondreament at the end of onyo Porte + corren peper 1000 SAS 2219110 5977060425 ro-couponbond p1 30. Y11816402 Ya 597706 c) Outflow infow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts