Question: answer the questions below and explain your reasoning and calculations 1 015 points On January 1, 2011, Dexter Corporation purchased a piece of equipment, which

answer the questions below and explain your reasoning and calculations

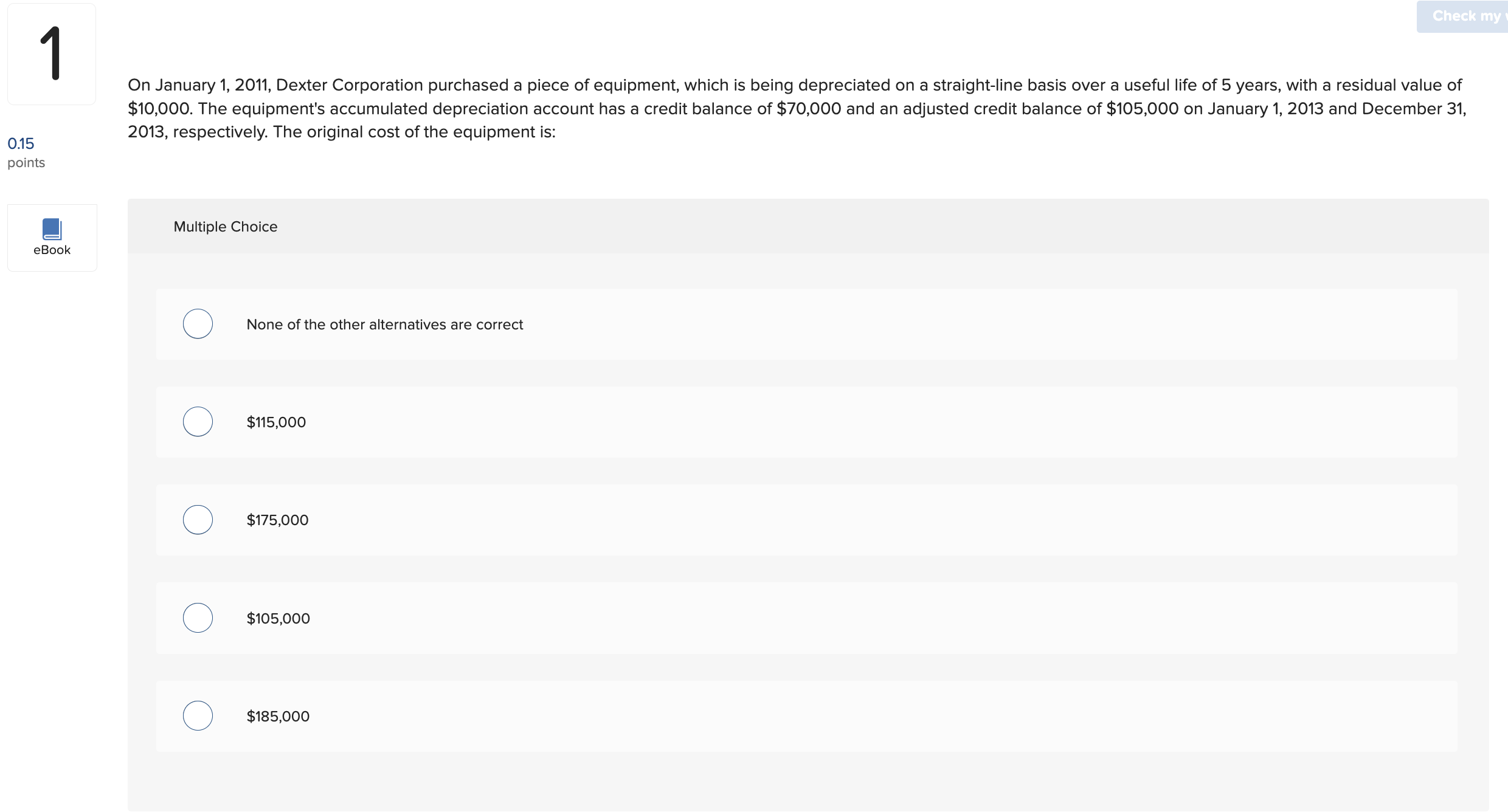

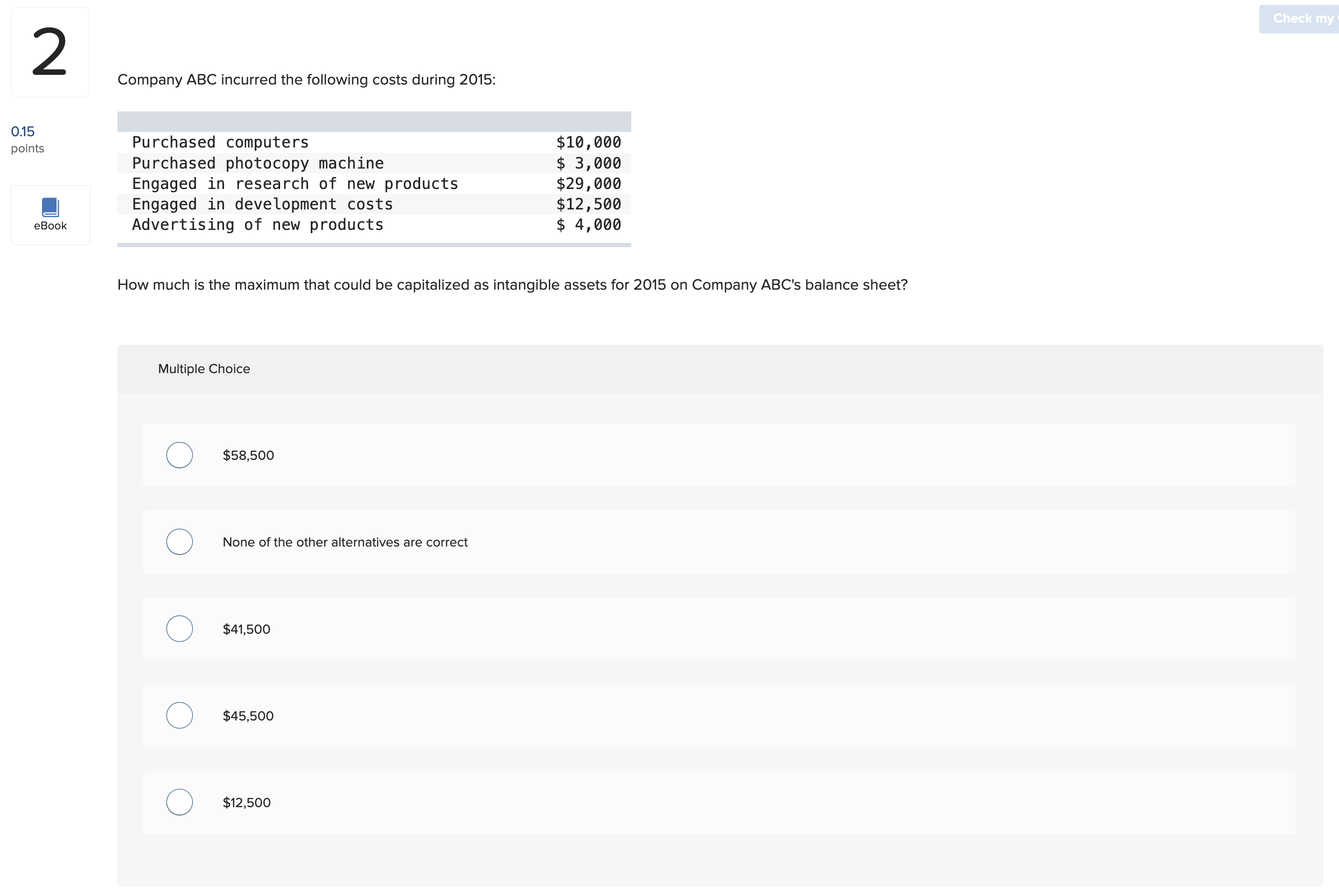

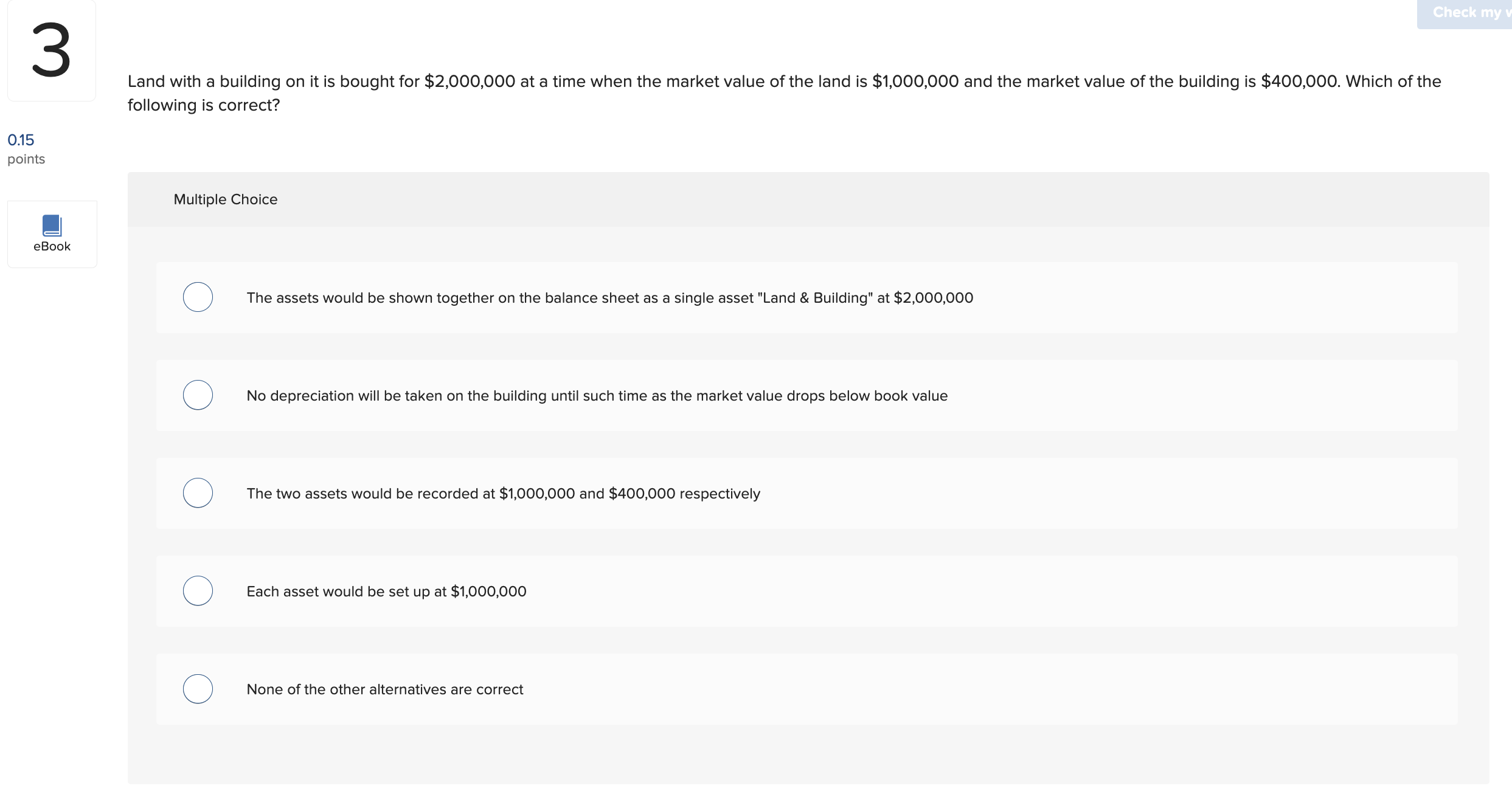

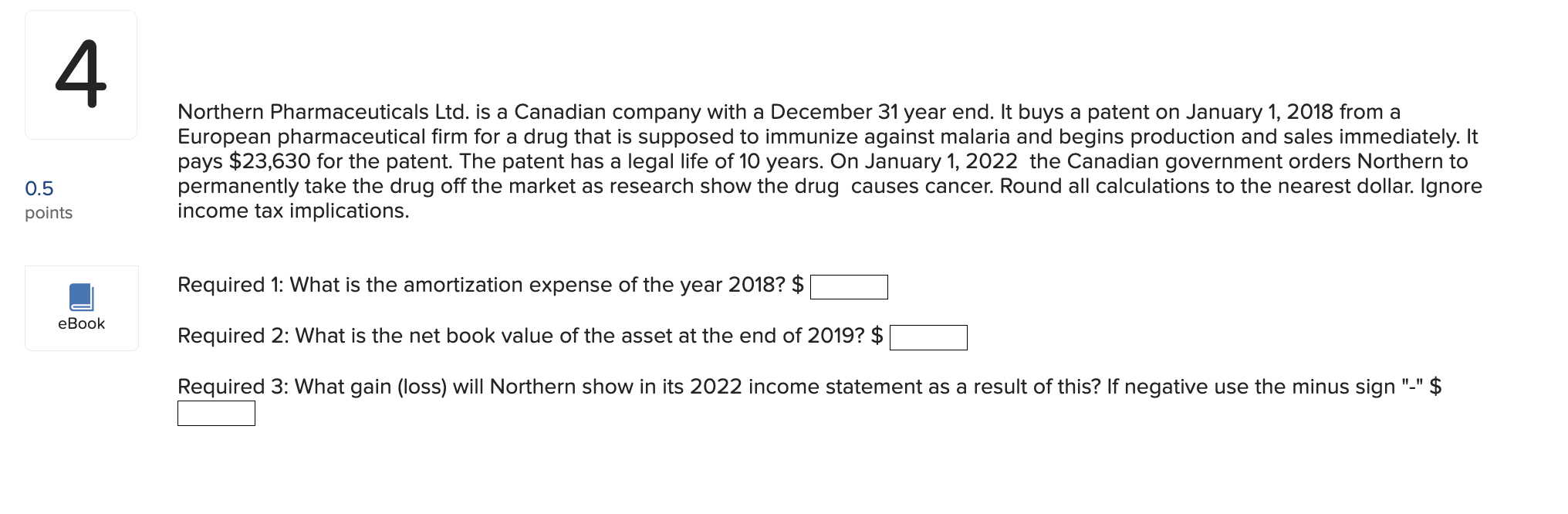

1 015 points On January 1, 2011, Dexter Corporation purchased a piece of equipment, which is being depreciated on a straight-line basis over a useful life of 5 years, with a residual value of $10,000. The equipment's accumulated depreciation account has a credit balance of $70,000 and an adjusted credit balance of $105,000 on January 1, 2013 and December 31, 2013, respectively. The original cost of the equipment is: !I Multiple Choice eBook None of the other alternatives are correct $115,000 $175,000 $105,000 O ONONCONO $185,000 Check my 2 Company ABC incurred the following costs during 2015: 0.15 points Purchased computers $10, 000 Purchased photocopy machine $ 3,000 Engaged in research of new products $29, 000 Engaged in development costs $12, 500 Book Advertising of new products $ 4,000 How much is the maximum that could be capitalized as intangible assets for 2015 on Company ABC's balance sheet? Multiple Choice O $58,500 O None of the other alternatives are correct O $41,500 O $45,500 O $12,5003 015 points Land with a building on it is bought for $2,000,000 at a time when the market value of the land is $1,000,000 and the market value of the building is $400,000. Which of the following is correct? Multiple Choice eBook The assets would be shown together on the balance sheet as a single asset "Land & Building" at $2,000,000 No depreciation will be taken on the building until such time as the market value drops below book value The two assets would be recorded at $1,000,000 and $400,000 respectively Each asset would be set up at $1,000,000 OO NONONO None of the other alternatives are correct 4 Northern Pharmaceuticals Ltd. is a Canadian company with a December 31 year end. It buys a patent on January 1, 2018 from a European pharmaceutical firm for a drug that is supposed to immunize against malaria and begins production and sales immediately. It pays $23,630 for the patent. The patent has a legal life of 10 years. On January 1, 2022 the Canadian government orders Northern to 0.5 permanently take the drug off the market as research show the drug causes cancer. Round all calculations to the nearest dollar. Ignore points income tax implications. !| Required 1: What is the amortization expense of the year 20182 $ eBook Required 2: What is the net book value of the asset at the end of 2019? $ Required 3: What gain (loss) will Northern show in its 2022 income statement as a result of this? If negative use the minus sign "-" $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts