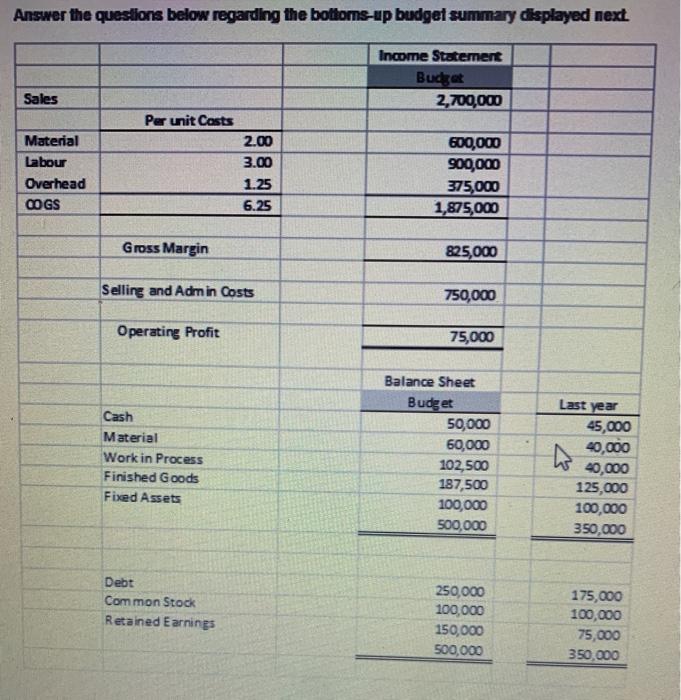

Question: Answer the questions below regarding the bottoms-up budget summary displayed next Income Statement Budget 2,700,000 Sales Per unit Casts Material 2.00 600,000 900,000 375,000

Answer the questions below regarding the bottoms-up budget summary displayed next Income Statement Budget 2,700,000 Sales Per unit Casts Material 2.00 600,000 900,000 375,000 1,875,000 Labour 3.00 Overhead 1.25 COGS 6.25 Gross Margin 825,000 Selling and Adm in Costs 750,000 Operating Profit 75,000 Balance Sheet Budget Last year Cash 50,000 45,000 40,000 Material 60,000 102,500 Work in Process 40,000 125,000 Finished Goods 187,500 Fixed Assets 100,000 100,000 500,000 350,000 Debt 250,000 175,000 100,000 Com mon Stock 100,000 150,000 Retained Earnings 75,000 350,000 500,000 Data: Sales in the budget are 300,000 units sold at $9 per unit The per unit cost of material, labour and factory overhead are indicated above Desired finished goods ending inventory is 30,000 units where beginning inventory was 20,000 units Material used in in production in dollars is estimated at $620,000 Desired material ending inventory is $60,000 where beginning inventory was $40,000 Labour hours for production is estimated at 77,500 hours at $12 per hour Factory overhead is estimated at $5 per labour hour worked Beginning work in process inventory is $40,000 Selling and administrative costs are $750,000 in the Budget Questions regarding the bottoms-up budget 1. Show the calculation of sales 2. Show the calculation of cost of goods sold (COGS) 3. How much material is purchased in the budget 4. What are total labour costs in the budget 5. What are total factory overhead costs in the budget 6. Show the development of work in process inventory in the budget 7. Show the development of the cost of finished goods inventory in the budget 8. What is a major driver of cash and, thus, should be an important execution goal coming out of the budget I

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

1Calculation of sales 300000 unitsS 9unit 2700000 2Calculation of Cost ... View full answer

Get step-by-step solutions from verified subject matter experts