Question: Answer the questions from the case study provided Negotiating Supplier Cost Reductions at Deere and Company Jack Williams, manager of supply management for Deere &

Answer the questions from the case study provided

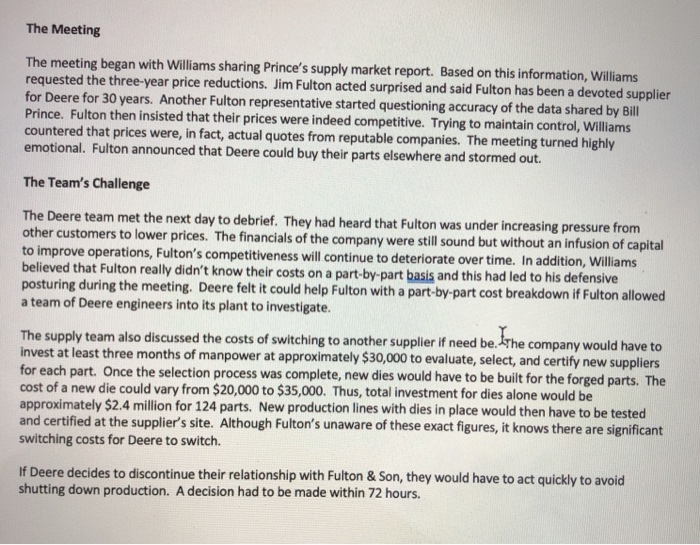

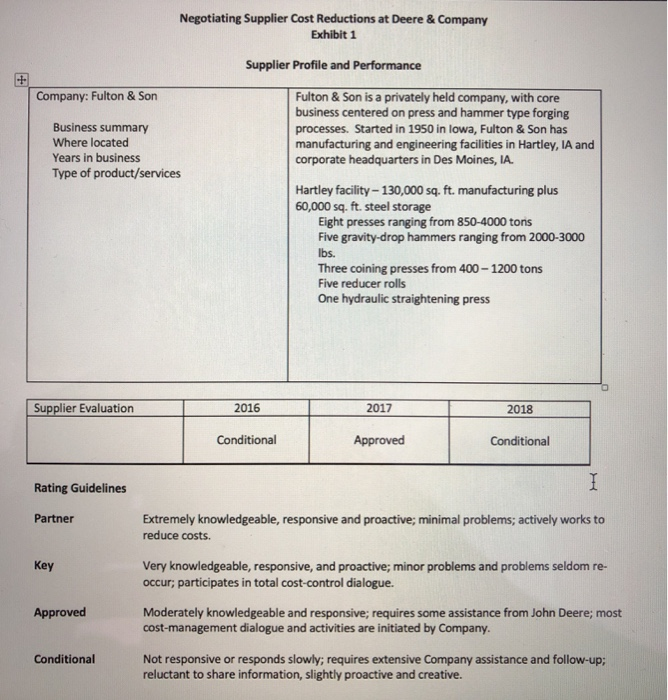

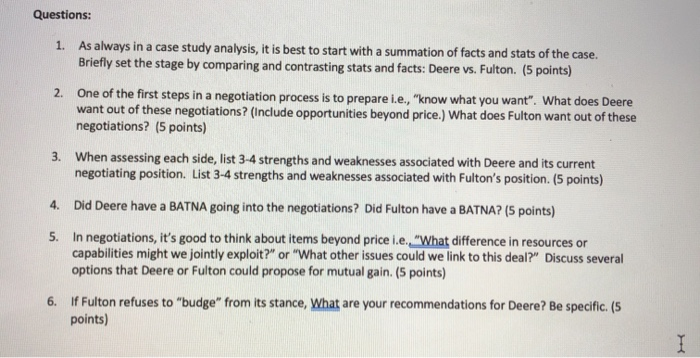

Negotiating Supplier Cost Reductions at Deere and Company Jack Williams, manager of supply management for Deere & Company's Drive Train and Axle Division in Waterloo, lowa had just returned to his office after a contentious meeting with one of its suppliers, Fulton & Son, a maker of forged parts that go into the tractor's drive train. Williams' team asked for a three-year price reduction on all Fulton forged parts. After a heated discussion, Fulton & Son's vice president, Jim Fulton, countered, "If you can find better prices, move your business elsewhere!" and stormed out. Drive Train and Axle Division The Drive Train and Axle Division was part of the Agricultural Tractors and Major Components Division for John Deere and Company, Annual spend for forged parts was $30 million. Fulton & Son Fulton & Son, a privately-owned company and key supplier to Deere & Company for 30 years, accounted for $5 million in purchases of forged parts in 2018. Deere respected Fulton and viewed the long-term relationship as very good for many years. However, Deere now believed Fulton had become complacent. It expected Deere's work given its proximity to the plant and its longevity as a supplier and didn't do much effort to improve performance or prices over time. Supplier Evaluation Based on a simple supplier evaluation system, Deere classified Fulton & Son as a "conditional supplier" in 2018, defined as slow to respond to Deere's requirements and needing extensive assistance and follow-up (See Exhibit 1). Additionally, Fulton & Son did not support Deere's program to pursue cost-reduction opportunities. Cost reduction (deflation) is a major initiative by Corporate and suppliers are asked routinely to come up with new ideas to reduce costs. Meeting Preparation In early 2019, Bill Prince, a supply specialist, was directed by Jack Williams to develop a competitive assessment on forged parts. Quotes were gathered from domestic and international suppliers on the 124 parts produced by Fulton & Son. Exhibit 2 shows that annual savings could be obtained by sourcing elsewhere ranging from 5 to 10 percent domestically to 10 to 25 percent internationally. (Assume the international sources would incur additional costs of 3% for total landed costs.) Based on Prince's report, the team decided to ask Fulton for a three-year contract with price reductions of 5% (year 1), 4% (year 2), and 3% (year 3). A meeting between Deere and Fulton was arranged for May 2019. The Meeting The meeting began with Williams sharing Prince's supply market report. Based on this information, Williams requested the three-year price reductions. Jim Fulton acted surprised and said Fulton has been a devoted supplier for Deere for 30 years. Another Fulton representative started questioning accuracy of the data shared by Bill Prince. Fulton then insisted that their prices were indeed competitive. Trying to maintain control, Williams countered that prices were, in fact, actual quotes from reputable companies. The meeting turned highly emotional. Fulton announced that Deere could buy their parts elsewhere and stormed out. The Team's Challenge The Deere team met the next day to debrief. They had heard that Fulton was under increasing pressure from other customers to lower prices. The financials of the company were still sound but without an infusion of capital to improve operations, Fulton's competitiveness will continue to deteriorate over time. In addition, Williams believed that Fulton really didn't know their costs on a part-by-part basis and this had led to his defensive posturing during the meeting. Deere felt it could help Fulton with a part-by-part cost breakdown if Fulton allowed a team of Deere engineers into its plant to investigate. The supply team also discussed the costs of switching to another supplier if need be the company would have to invest at least three months of manpower at approximately $30,000 to evaluate, select, and certify new suppliers for each part. Once the selection process was complete, new dies would have to be built for the forged parts. The cost of a new die could vary from $20,000 to $35,000. Thus, total investment for dies alone would be approximately $2.4 million for 124 parts. New production lines with dies in place would then have to be tested and certified at the supplier's site. Although Fulton's unaware of these exact figures, it knows there are significant switching costs for Deere to switch. If Deere decides to discontinue their relationship with Fulton & Son, they would have to act quickly to avoid shutting down production. A decision had to be made within 72 hours. Negotiating Supplier Cost Reductions at Deere & Company Exhibit 1 Supplier Profile and Performance Company: Fulton & Son Business summary Where located Years in business Type of product/services Fulton & Son is a privately held company, with core business centered on press and hammer type forging processes. Started in 1950 in lowa, Fulton & Son has manufacturing and engineering facilities in Hartley, IA and corporate headquarters in Des Moines, IA. Hartley facility - 130,000 sq. ft. manufacturing plus 60,000 sq. ft. steel storage Eight presses ranging from 850-4000 tons Five gravity-drop hammers ranging from 2000-3000 lbs. Three coining presses from 400 - 1200 tons Five reducer rolls One hydraulic straightening press Supplier Evaluation 2016 2017 2018 Conditional Approved Conditional Rating Guidelines Partner Extremely knowledgeable, responsive and proactive; minimal problems; actively works to reduce costs. Key Very knowledgeable, responsive, and proactive; minor problems and problems seldom re. occur, participates in total cost-control dialogue. Approved Moderately knowledgeable and responsive; requires some assistance from John Deere; most cost-management dialogue and activities are initiated by Company. Conditional Not responsive or responds slowly; requires extensive Company assistance and follow-up: reluctant to share information, slightly proactive and creative. Negotiating Supplier Cost Reductions at Deere & Company Exhibit 2 Competitive Analysis - Selected Cost Data (Domestic and International Sources) Competitive Quote ($/Unit) Fulton's Price ($/unit) Dollar Difference ($/unit) Percent Differential (%) Tooling Costs Required ($/part) 6,500.00 R167074 ARF 88210 ARF 108475 ARE 1ORROS ARF 108896 ARF 109488 ARF 129557 ARF 100874 ARF 42444 ARF 48253 7.50 2.35 5.72 7.09 5.14 7.10 4.49 7.51 2.66 4.05 10.36 2.58 7.46 10.06 5.41 8.70 5.01 9.39 3.30 4.80 (2.86) (0.23) (1.74) (2.97) (0.27) (1.60) (0.52) (1.88) (0.64) (0.75) -28% -9% -23% -30% -5% - 18% - 10% -20% - 19% -16% 1,900.00 1,900.00 1,900.00 1,900.00 1,900.00 2,300.00 0 Questions: 1. As always in a case study analysis, it is best to start with a summation of facts and stats of the case. Briefly set the stage by comparing and contrasting stats and facts: Deere vs. Fulton. (5 points) 2. One of the first steps in a negotiation process is to prepare i.e., "know what you want". What does Deere want out of these negotiations? (Include opportunities beyond price.) What does Fulton want out of these negotiations? (5 points) 3. When assessing each side, list 3-4 strengths and weaknesses associated with Deere and its current negotiating position. List 3-4 strengths and weaknesses associated with Fulton's position. (5 points) 4. Did Deere have a BATNA going into the negotiations? Did Fulton have a BATNA? (5 points) 5. In negotiations, it's good to think about items beyond price i.e. "What difference in resources or capabilities might we jointly exploit?" or "What other issues could we link to this deal?" Discuss several options that Deere or Fulton could propose for mutual gain. (5 points) 6. If Fulton refuses to "budge" from its stance, What are your recommendations for Deere? Be specific (5 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock