Question: Answer the questions posed for problem 5.13 on pages 385 and 386. Please submit your answers only on a Word document. No, PDFs. For part

Answer the questions posed for problem 5.13 on pages 385 and 386. Please submit your answers only on a Word document. No, PDFs.

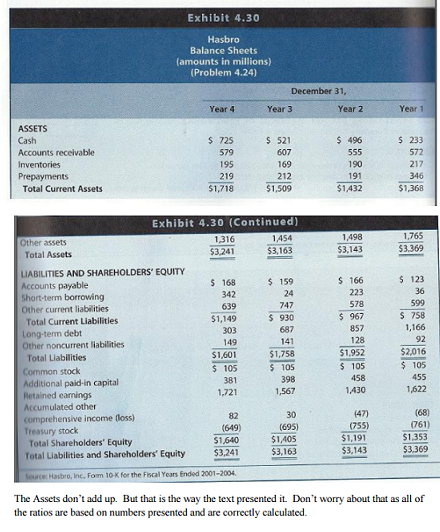

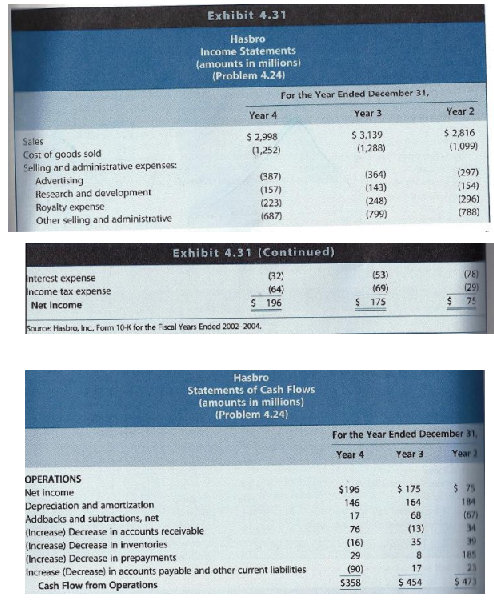

For part a, it is suggested that you set up an excel spreadsheet that includes the Balance Sheet, Income Statement and Cash Flow Statement from problem 4.24 on pages 306 and 307.

Then, make sure you have the correct formulas to get the same numbers as are presented for Year 2 and Year 3. Year 4 should then be a simple case of moving the formulas over.

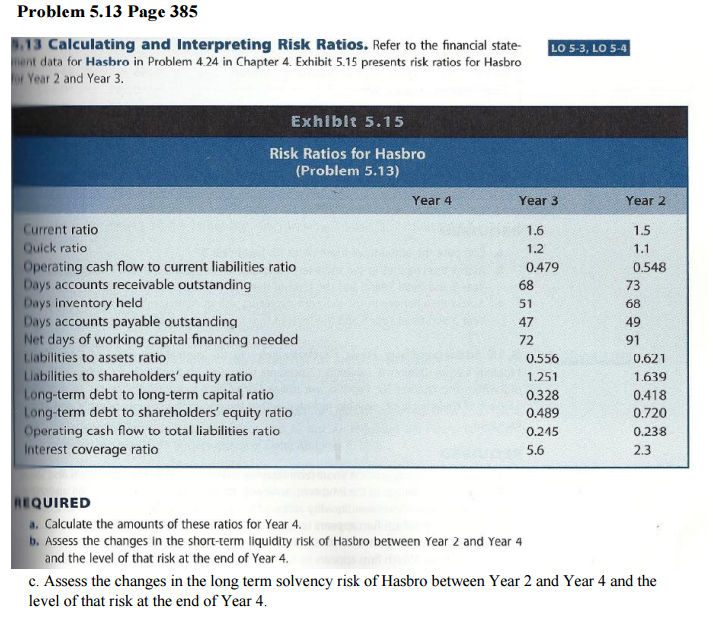

Problem 5.13 Page 385 E13 calculating and Interpreting Risk Ratios. Refer to the financial state- OAS10m LO 5-3, LO 5-4 nt data for Hasbro in Problem 4.24 in Chapter 4. Exhibit 5.15 presents risk ratios for Hasbro Year 2 and Year 3. Exhibit 5.15 Risk Ratios for Hasbro (Problem 5.13) Year 4 Year 3 Year 2 Current ratio Quick ratio Operating cash flow to current liabilities ratio Days accounts receivable outstanding Days inventory held Days accounts payable outstanding Net days of working capital financing needed Liabilities to assets ratio Liabilities to shareholders' equity ratio Long-term debt to long-term capital ratio Long-term debt to shareholders' equity ratio Operating cash flow to total liabilities ratio nterest coverage ratio 1.6 1.5 1.2 1.1 0.479 68 51 47 72 0.548 73 68 49 91 0.556 1.251 0.328 0.489 0.245 5.6 0.621 1.639 0.418 0.720 0.238 2.3 QUIRED a. Calculate the amounts of these ratios for Year 4. b. Assess the changes in he short-term liquidity risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4. c. Assess the changes in the long term solvency risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts