Question: Answer these easy problems quickly and correctly for automatic thumbs up. Thanks so much! Assume that you are the portfolio manager of the SF Fund,

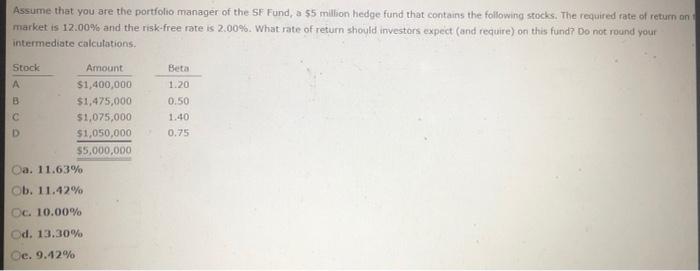

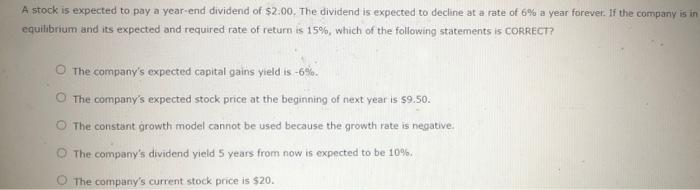

Assume that you are the portfolio manager of the SF Fund, a 55 million hedge fund that contains the following stocks. The required rate of return on market is 12.00% and the risk-free rate is 2.00%. What rate of return should investors expect (and require) on this fund? Do not round your intermediate calcutations Stock Amount A $1,400,000 B $1,475,000 $1,075,000 D $1,050,000 $5,000,000 Ca. 11.63% Beta 1.20 0.50 1.40 0.75 b. 11.42% OC. 10.00% Ed. 13.30% Oe. 9.42% A stock is expected to pay a year-end dividend of $2.00. The dividend is expected to decline at a rate of 6% a year forever. If the company is in equilibrium and its expected and required rate of return is 15%, which of the following statements is CORRECT? The company's expected capital gains yield is -6%. The company's expected stock price at the beginning of next year is $9.50. The constant growth model cannot be used because the growth rate is negative The company's dividend yield 5 years from now is expected to be 10% The company's current stock price is $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts