Question: Answer quickly and correctly for automatic thumbs up! Thanks so much! Assume that you manage a $10.00 million mutual fund that has a beta of

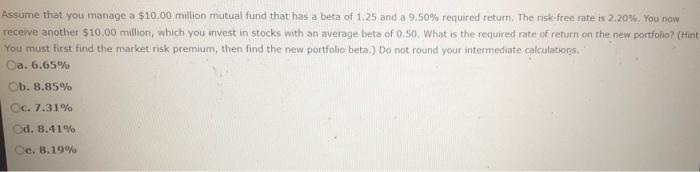

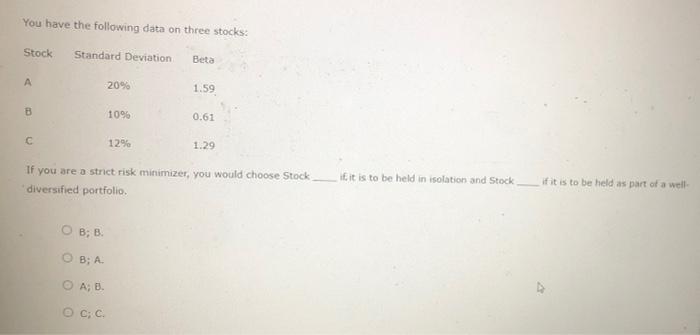

Assume that you manage a $10.00 million mutual fund that has a beta of 1.25 and a 9.50% required return. The risk-free rate is 2.20%. You now receive another $10.00 million, which you invest in stocks with an average beta of 0.50. What is the required rate of return on the new portfolo (Hint You must first find the market risk premium, then find the new portfolio beta.) Do not round your intermediate calculations. a. 6.65% ob. 8.85% c. 7.31% Od. 8.41% Ce, 8.19% You have the following data on three stocks: Stock Standard Deviation Beta A 20% 1.59 B 1096 0.61 12% 1.29 If you are a strict risk minimizer, you would choose Stock diversified portfolio Eit is to be held in isolation and Stock if it is to be held as part of a well- OB; B. B; A A; B. C; C. Stocks A and Beach have an expected return of 12%, a beta of 1.2, and a standard deviation of 25%. The returns on the two stocks have a correlation of +0.6. Portfolio P has 50% in Stock A and 50% in Stock B. Which of the following statements is CORRECT? Portfolio P has an expected return that is less than 12% Portfolio P has a beta that is less than 1.2. Portfolio P has a beta that is equal to 1.2 Portfolio P has a standard deviation that is greater than 25%. Portfolio P has a standard deviation that is equal to 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts