Question: - Answer these questions based on the example of the car sale set out in the Chapter 13 Notes. Fully explain each answer. - Based

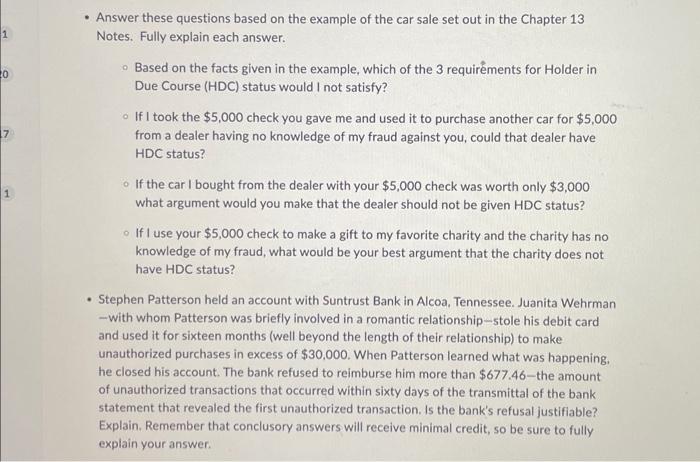

- Answer these questions based on the example of the car sale set out in the Chapter 13 Notes. Fully explain each answer. - Based on the facts given in the example, which of the 3 requirements for Holder in Due Course (HDC) status would I not satisfy? - If I took the $5,000 check you gave me and used it to purchase another car for $5,000 from a dealer having no knowledge of my fraud against you, could that dealer have HDC status? If the car I bought from the dealer with your $5,000 check was worth only $3,000 what argument would you make that the dealer should not be given HDC status? If I use your $5,000 check to make a gift to my favorite charity and the charity has no knowledge of my fraud, what would be your best argument that the charity does not have HDC status? - Stephen Patterson held an account with Suntrust Bank in Alcoa, Tennessee. Juanita Wehrman -with whom Patterson was briefly involved in a romantic relationship-stole his debit card and used it for sixteen months (well beyond the length of their relationship) to make unauthorized purchases in excess of $30,000. When Patterson learned what was happening. he closed his account. The bank refused to reimburse him more than $677.46-the amount of unauthorized transactions that occurred within sixty days of the transmittal of the bank statement that revealed the first unauthorized transaction. Is the bank's refusal justifiable? Explain. Remember that conclusory answers will receive minimal credit, so be sure to fully explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts