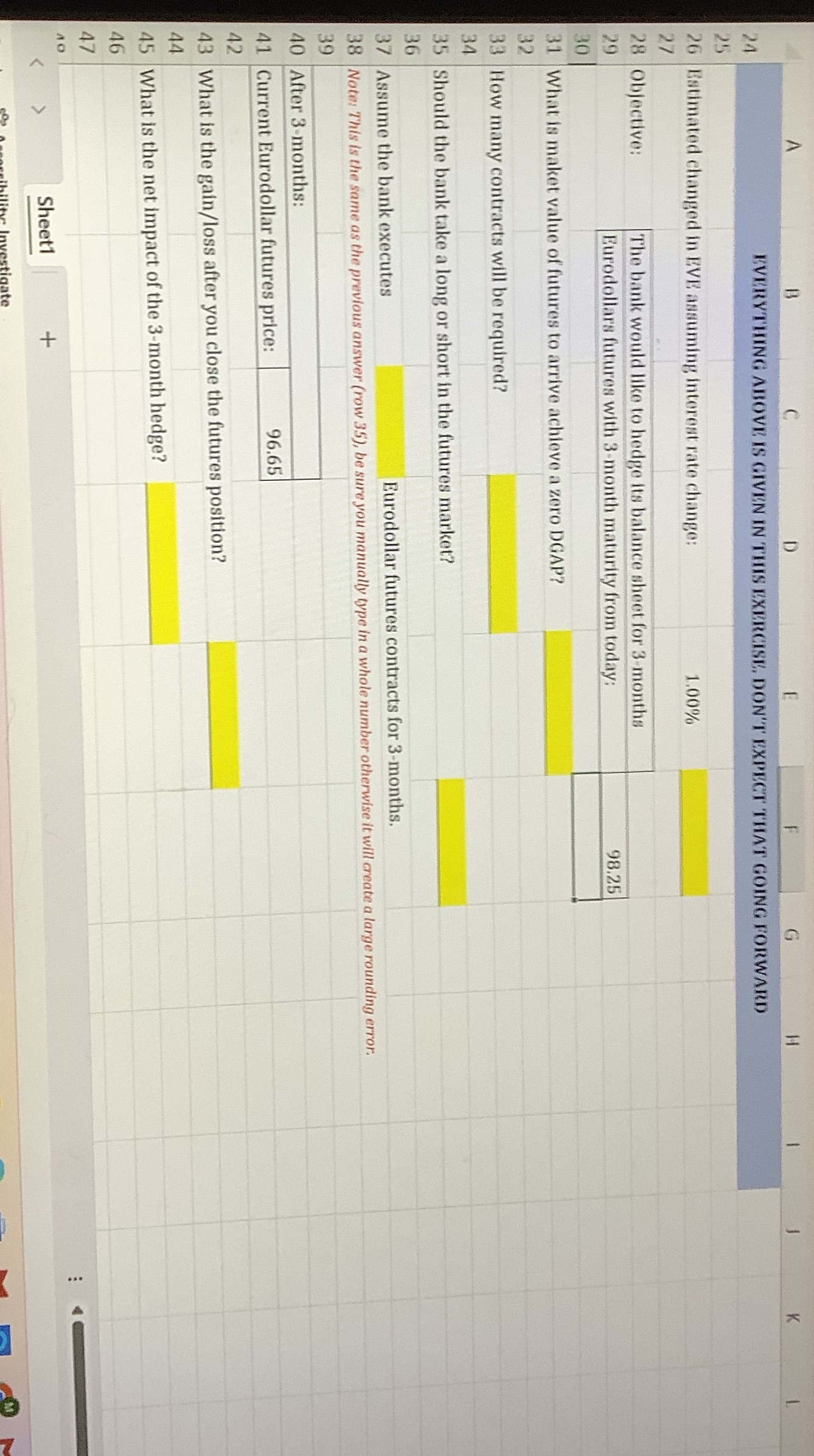

Question: answer these questions with the attached copy EVERYTHING ABOVE IS GIVEN IN THIS EXERCISE. DON'T EXPECT THAT GOING FORWARD Estimated changed in EVE assuming interest

answer these questions with the attached copy

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock