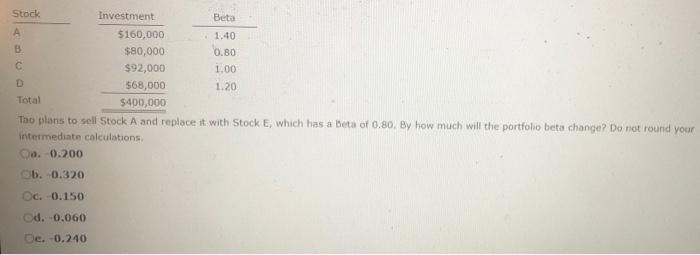

Question: Answer these quickly and correctly for guaranteed thumbs up! Thanks so much! Stock Investment Beta $160,000 1.40 B $80,000 0.80 $92,000 1.00 D $68,000 1.20

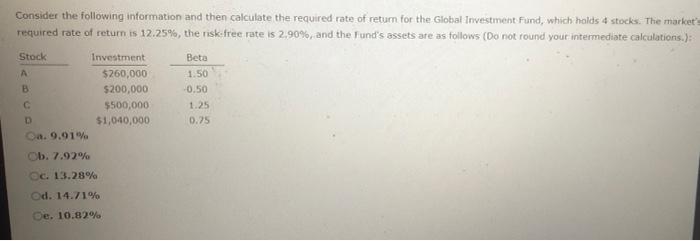

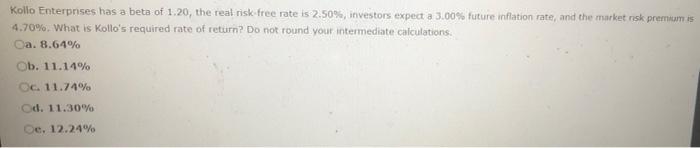

Stock Investment Beta $160,000 1.40 B $80,000 0.80 $92,000 1.00 D $68,000 1.20 Total $400,000 Tao plans to sell Stock A and replace it with Stock E, which has a Beta of 0.80. By how much will the portfolio beta change? Do not round your intermediate calculations O.0.200 b. 0.320 C. 0,10 Od. -0.060 De. 0.240 Consider the following information and then calculate the required rate of return for the Global Investment Fund, which holds 4 stocks. The market required rate of return is 12.25%, the risk free rate is 2.90%, and the Fund's assets are as follows (Do not round your intermediate calculations.); Stock Investment Beta A $260,000 1.50 B $200,000 0.50 C $500,000 1.25 D $1,040,000 0.75 Ca. 9.91% Ob. 7.92% OC 13.28% Od. 14.71% De. 10.82% Kollo Enterprses has a beta of 1.20, the real risk free rate is 2.50%, investors expect a 3.00% future inflation rate, and the market nisk premum is 4.70%. What is Kollo's required rate of return? Do not round your intermediate calculations. Ca. 8.64% Ob. 11.14% OC 11.74% Od. 11.30% Oe. 12.24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts