Question: Answer this 2 part question (4 questions total) correctly with work and within a reasonably time for thumbs up! Thanks I will be able to

Answer this 2 part question (4 questions total) correctly with work and within a reasonably time for thumbs up! Thanks

I will be able to see instantly if the answer is correct or not. thanks so much

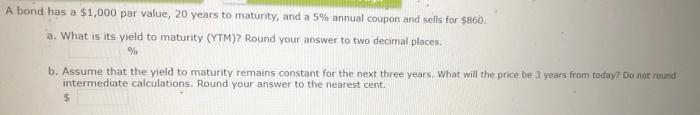

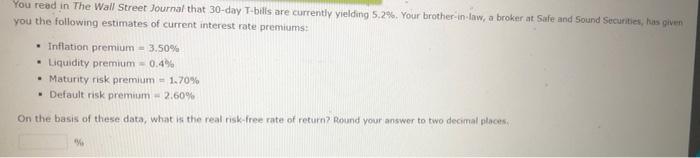

A bond has a $1,000 par value, 20 years to maturity, and a 5% annual coupon and sells for $860. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. % b. Assume that the yield to maturity remains constant for the next three years. What will the price be 3 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. $ You read in The Wall Street Journal that 30-day T-bills are currently yielding 5.2%. Your brother-in-law, a broker at Safe and Sound Securities, has given you the following estimates of current interest rate premiums: Inflation premium = 3.50% Liquidity premium = 0.4% Maturity risk premium - 1.70% Default risk premium - 2.60% . On the basis of these data, what is the real risk-free rate of return? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts