Question: answer this queation correctly plz ************************************************ Companies outside the United States often have two classes of stock outstanding. One class of shares is vot- ing

answer this queation correctly plz ************************************************ Companies outside the United States often have two classes of stock outstanding. One class of shares is vot- ing and is held by the incumbent managers of the firm. The other class is nonvoting and represents the bulk of traded shares. What are the consequences for corporate governance? ***********************************************

this is all queation and i I want the seventh question

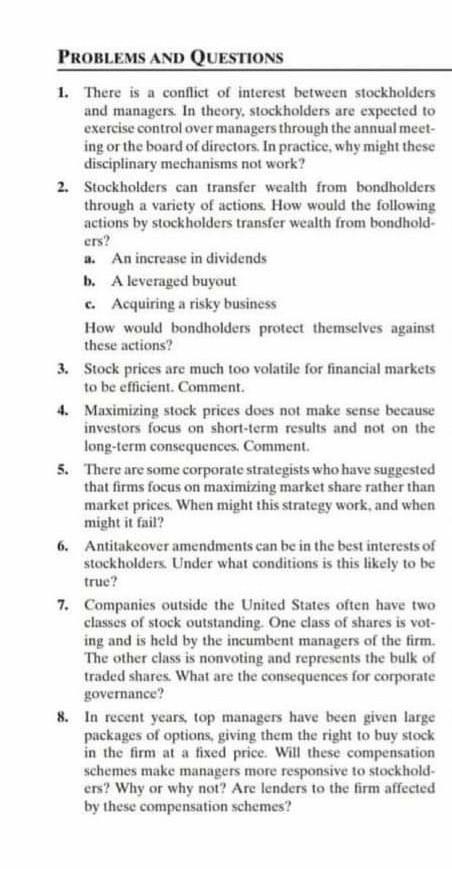

PROBLEMS AND QUESTIONS 1. There is a conflict of interest between stockholders and managers. In theory, stockholders are expected to exercise control over managers through the annual meet- ing or the board of directors. In practice, why might these disciplinary mechanisms not work? 2. Stockholders can transfer wealth from bondholders through a variety of actions. How would the following actions by stockholders transfer wealth from bondhold- ers? 1. An increase in dividends b. A leveraged buyout c. Acquiring a risky business How would bondholders protect themselves against these actions? 3. Stock prices are much too volatile for financial markets to be efficient. Comment 4. Maximizing stock prices does not make sense because investors focus on short-term results and not on the long-term consequences. Comment 5. There are some corporate strategists who have suggested that firms focus on maximizing market share rather than market prices. When might this strategy work, and when might it fail? 6. Antitakeover amendments can be in the best interests of stockholders Under what conditions is this likely to be true? 7. Companies outside the United States often have two classes of stock outstanding. One class of shares is vol- ing and is held by the incumbent managers of the firm. The other class is nonvoting and represents the bulk of traded shares. What are the consequences for corporate governance? 8. In recent years, top managers have been given large packages of options, giving them the right to buy stock in the firm at a fixed price. Will these compensation schemes make managers more responsive to stockhold- ers? Why or why not? Are lenders to the firm affected by these compensation schemes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts