Question: Answer this question based on the following three statements: 1. Corporations are subject to the corporate income tax while partnerships are subject to partnership income

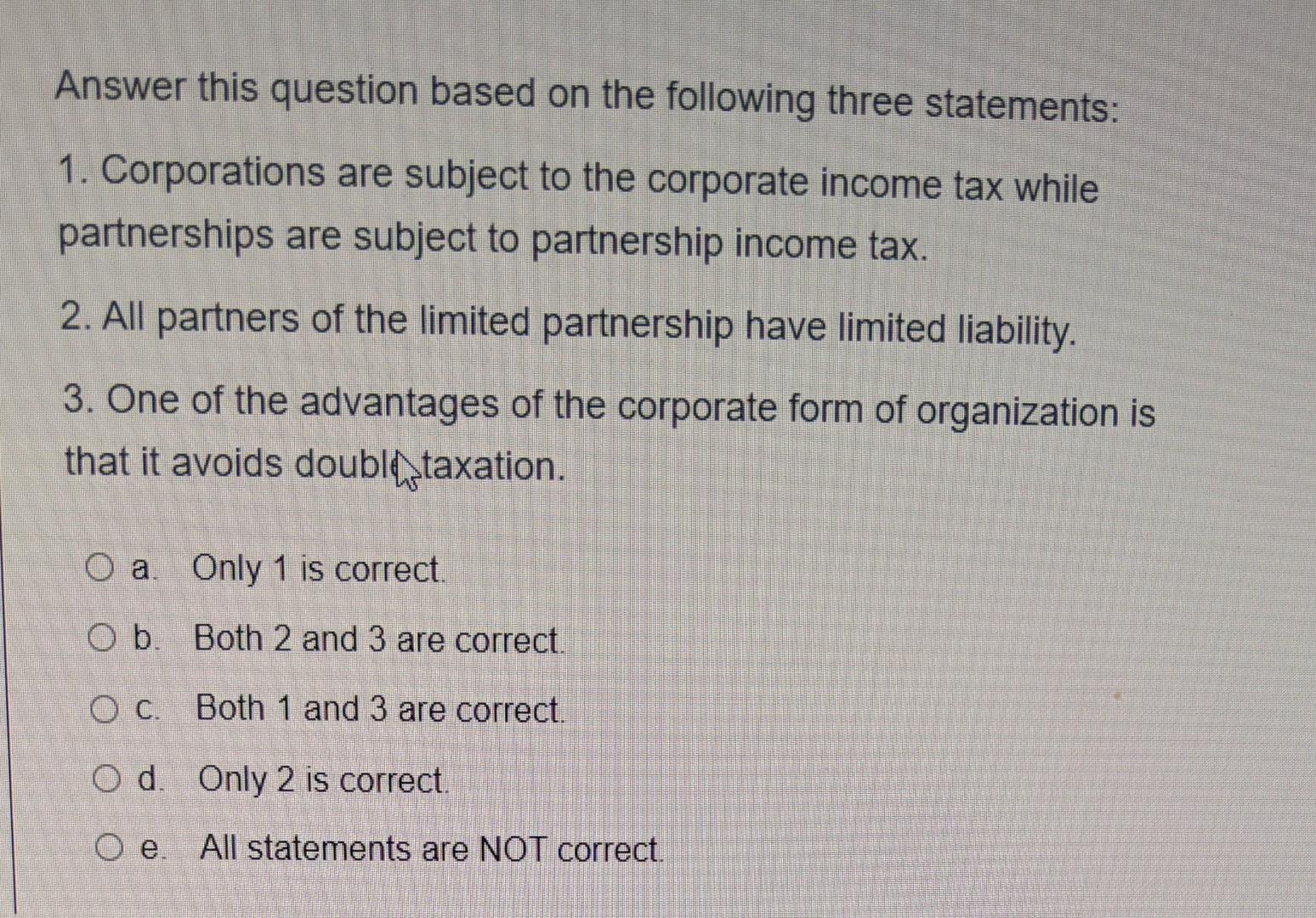

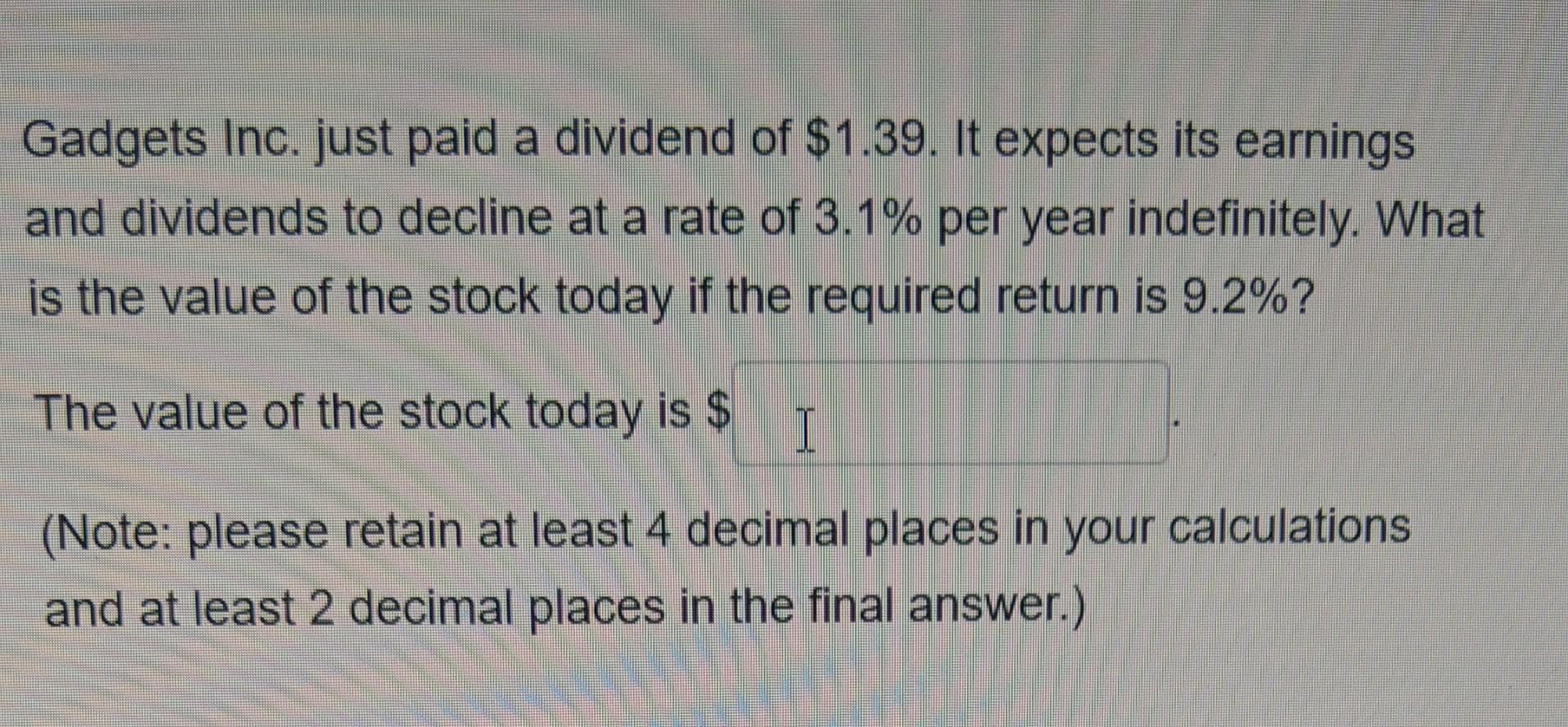

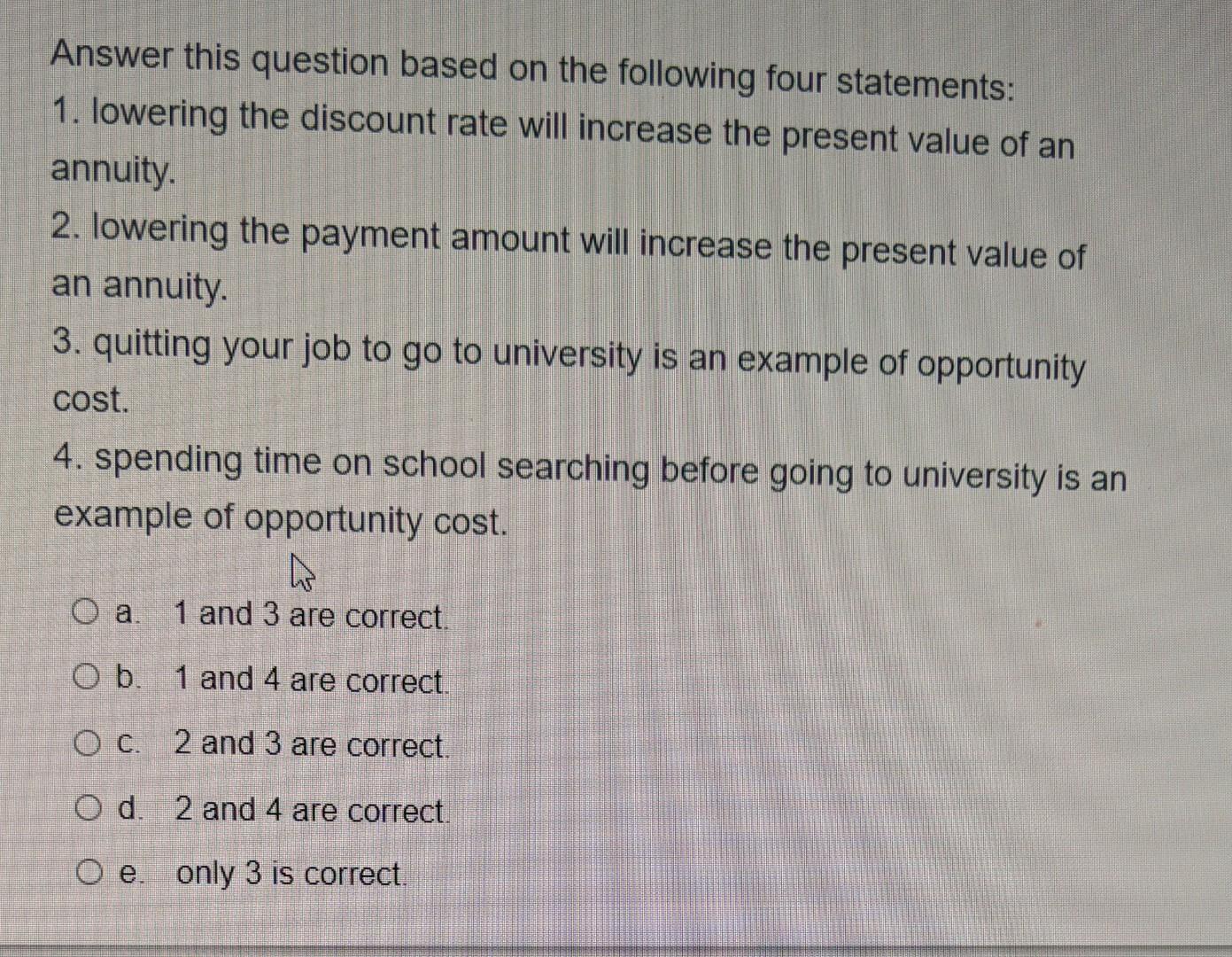

Answer this question based on the following three statements: 1. Corporations are subject to the corporate income tax while partnerships are subject to partnership income tax. 2. All partners of the limited partnership have limited liability. 3. One of the advantages of the corporate form of organization is that it avoids double taxation. O a Only 1 is correct O b. Both 2 and 3 are correct. O c. Both 1 and 3 are correct. O d. Only 2 is correct O. All statements are NOT correct. Gadgets Inc. just paid a dividend of $1.39. It expects its earnings and dividends to decline at a rate of 3.1% per year indefinitely. What is the value of the stock today if the required return is 9.2%? The value of the stock today is $ I (Note: please retain at least 4 decimal places in your calculations and at least 2 decimal places in the final answer.) Answer this question based on the following four statements: 1. lowering the discount rate will increase the present value of an annuity. 2. lowering the payment amount will increase the present value of an annuity. 3. quitting your job to go to university is an example of opportunity cost. 4. spending time on school searching before going to university is an example of opportunity cost. w O a. 1 and 3 are correct O b. 1 and 4 are correct. OC. 2 and 3 are correct. O d. 2 and 4 are correct. O e. only 3 is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts