Question: answer this question in 1500 words. Question 1 Using 'A Battle Emerging in Mobile Payments' case study (Schilling, 2017, p67), what do you think will

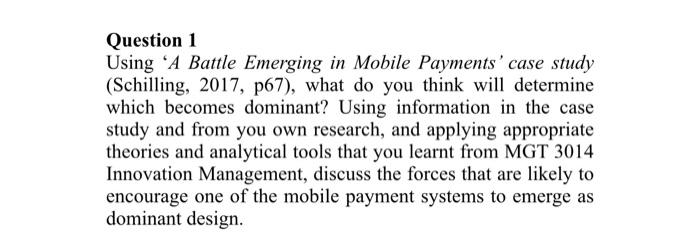

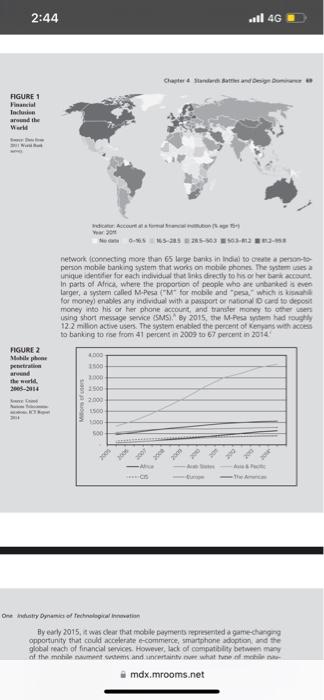

Question 1 Using 'A Battle Emerging in Mobile Payments' case study (Schilling, 2017, p67), what do you think will determine which becomes dominant? Using information in the case study and from you own research, and applying appropriate theories and analytical tools that you learnt from MGT 3014 Innovation Management, discuss the forces that are likely to encourage one of the mobile payment systems to emerge as dominant design. A Battle Emerging in Mobile Payments By 2014, theie were 6.6 bllion mobile phone subscriptions in the worlt and of thase, 23 billon had active moble broudband subsoription that would enuble users to access the micble web." Mobile payment yysters offered the potental of enabling all of these usen to perorm firancial tranactions on thei phones, simiar to how they would perlorm those trancections using pesoral compuser. However, in 2015, there was no dominant mobile puyment pritin, and a burtle among competing mobile parment mechanisms and standarts was unfolding. In the United States, several large plowers, naluding Apple, Simoung and a joirt venture called Sottcard between Goople, Af St, T Mable, and Veraon Wrries, had NFC chips enable cormuniciton between a moble devige and a poist of-sale nge bem just by having the devices in dose prowimity." The systrmb beng develcped by Apple, 5arrsung, and Sothcard teanslected the costomer sitformation wretensy and then used mechant baniss and credt card sintems luch as Van or MecterCard ao complete the vansection. These sustems wee this iery tuch ike esising wirn of using credit cards but enabled completion of the purchave without contact. Other competitom, such as Square (with Square Wallet) and Payfil, did not. requre a smartiphone with an NFC chip but instead used a dowrloksidie apeiceton and the Web to trarsmit a custemer's information, Square had gained exly. fame by otiening small, free, credit cart feaders that could be pluppitd ento the audio jack of a smartghone. These readers enikled vendors that wolld nermaly orly take cash (street wendors, babjsitters, etc) to accept mapor cendt cards. Square processed 530 bilion in payments in 2014, meking the company one of the fartest gowing tech start-ups in Slicon Valiy. Sequare takes about 2 . is of 3 pescent from each traraaction it processes but must split that wh credt card comparies and other finanolal inphtusces. in teris of intaled berse, however, Paypal had the clear advantage, with over 161 millon active iegstened acrource With Payeat, customess could corrplese purchaies simply by ontering their phone numbers and a pen number or we a Paypal-isued magnetic ste pe caite Inicke to their Pappal accounts. Usens could opt to link their Parpal accounts to thee credit cards or drectly to their bank accounts. Peypal abo owned a sernce cales Venmo that enabled peento-peer enchanges with a facebook-ike inturfane that was gowing in popularify as a wiry to exchange money without carrying cinh. Venmo charged a 3 percent foe if the transaction used a maor credt card bue was free if the eonsumer used in with a major barik cied and detir cast. As noted abave, some of the syatems being develaged did not rooine ingkt: ment of the major credit card corpanief- which poterslaly freach that bilkens of dollass in trandaction fees right be avoided or captured by a new player. Rayfa., and its peer-10-peo 3 ystem venmo, for instance did not require oest cards: A goup of large mercharts that incuded WalMart, Old Navy, fest fay. 7 einer. and more had atso developed their own payment systom-" Cument C2 dovenloodable application for a ynartotione that enabled purchases to be dedicted drectly from the cursomer's bank accounta. This would enable the marctuants ta aveid the 2 - peroent charges that merohants paid on credt card transactionsamburting to biliars of dollars in sivings for the particiating mectanta:" for cansumers, the key dimensices that intluenced adoption weer conie rience fe.9, would the customer have to tyoe in a code at the point of pur. chase? Was it early accessble on a device the ind volul abcedy onfesth risk of fraud (eg. was she individual's identiby and financat inlormetion at mik? and ubiguty le.9. could the spstem be uurd evrywhere? Did a enable peretito-perer Iransactions? for merchants, travd was also a big concern- tipecoly in ifar tions wheee the transaction was not guaranceed by a thied party, and cont in y. what were the foxed coss and vanswacion tees of uilng the syosen?l Afple Foy tad a significant convenience advantage in that a cantomer coild pay with thei fingerprint' Cument-C, by contrast had a seprous conueniense deadugeinge bectuse consamers would have to open the application on their phone and get a CR code that would need to be scarned at the checkout ade. Soch Apcie FRey and Cutrens- C had abo experienced fravd problems, with miltile reporta of hacked accounts emeiging ty early 2015 . in the United states, almost half of al corbumeat had used ther smartyhenes to make a poyment at a meichant location by eurty 2515 . Mobile peyments accounted for $52 tulion in frarcactions in 2014 and were esected to be $67 bilian in 2015. in other paets of the word, ntrigung alternuties for moble barking ses gaining traction even taster. In lidid and Africa, for exarple, there are crontious populatiors of "untunked" or "undertuniad" people lindwiak who de not have bank accounts or make limited ise of banking servick) in these regond, the proporton of pecple with mohle phones vartly excteds the propartion of pecole with orest carck in Africa, for eumple less than 3 persent of the peovlation vid estimated to have a credit card, whereas 69 percent af the populaton wis atsmated to have mable phones. Woubly, the macmum fxed Hine ghone pecication ever achieved in Africh was 1.6 percent-resched in 2009 - demorohating the ing world. The opporturity, thef, of giving such people access to fast and inestent Whe funds tranter is enominous. The leading sysket in indit in the lntet-bark Mable Faymert Sentce sties. oped by National Payments Corporation of inda ONFCO. NFC ieveraged its afM FIGURE 1 Finanial Tadtuisen areund the Werl4 menter pear 2 int network fconecting more than 65 lerge fariks in indiai to ceedte a penan-s. person moble banking system that work on mobile phones. The systren uses a urique identider for ead individual that inis drectly to his or her bark account In parts of Afric, where the proportion of people wha are vorbanked as even far moneyl enables any indiadual with a pasport or nabend 0 cars to defose money into his or her phone accourt, and tharster inoney to other isens using short mesage perice iSM5), 8y2015, the M-Pea syten hud roughly 12.2 million active users. The system enabled the perceat of Kenpars wath access to banking to foe feom 41 percent in 2003 to 67 perceat in 2014 . HoUke 2 Bletile pliat petniration arvend the neide 20082014 finn chen One intity onamia of fecholsoral hermation By eily 2015, i war cleir that mokle pagment repreented a game-changng opportunity that could accelerate e-commerce, smartphone adoption, and the globil reach of financial servios. However, lack of coripateility between mieng indenty 9 mamick of Techroilegical innevation Gy carly 2015 , i was clear that roble palyments represeried a game-tharging opportanity thest could asceherate e-comimerce, smartahane atioption. and tite wumer and merchant adoption. Discussion Questions 1. What are some of the advantagen and diatwantages of mobise piny ent Syttero in (a) developed countries arra fby deini ioping countres?: 2. What are the key factors that differentiate the difterent motie purpace merchabits cafe mast about? 3. Are there ferces that are la ely to encourage ane-of tire mokile gayrmest fygs terms to emperge as dominant? if 40 , what do you think will detemrine xnhich beconines dernenant? 4. is there anyching the inobile puryent systens could do to incerire the likre. hosd of them becortung datnaran:? 5. How dio these differt roicule systems insfease ar decriase the pouver at at? banks, bl ctedit cards? Atwiers linie 20 th. Arivia in in lith. IEW focus their effoms sit impousing fher effikietcy in mandacturing, Alelictring, murtefang ir Goploging this doaminant devign, nrther than continue ag devolig and comader alhernutive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts