Question: answer this ^^ use that to help you ^^ here is another photo that may help. Journalize and post closing entries and complete the closing

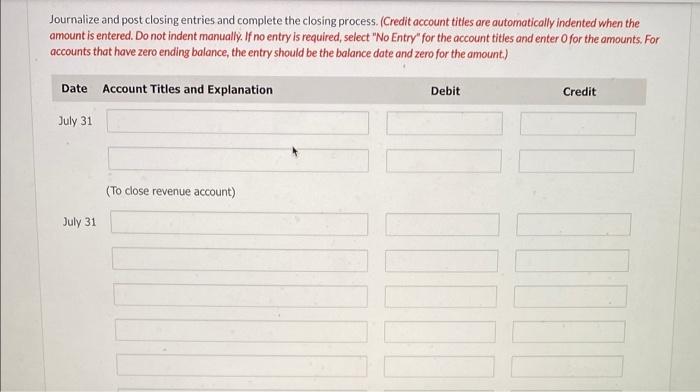

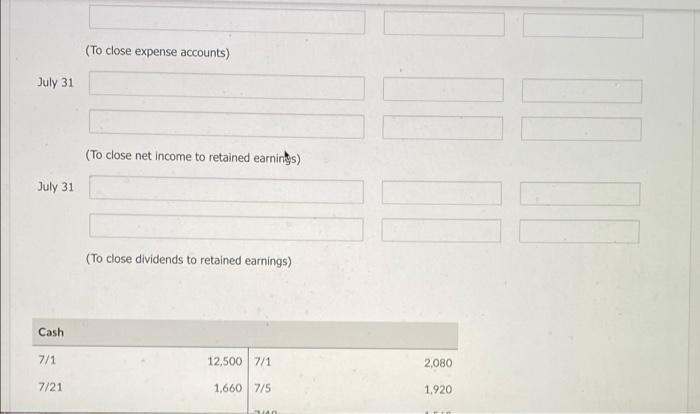

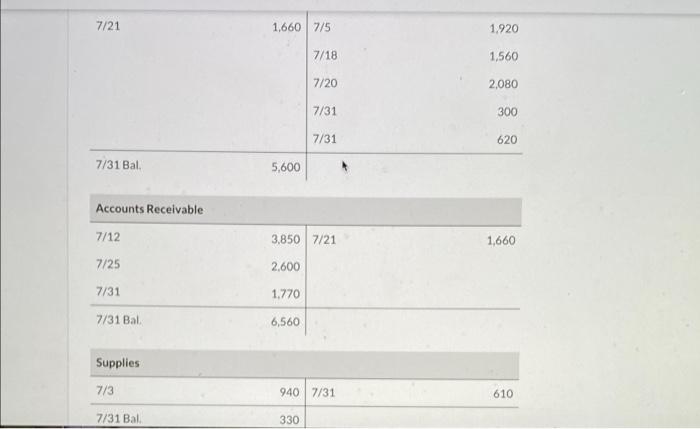

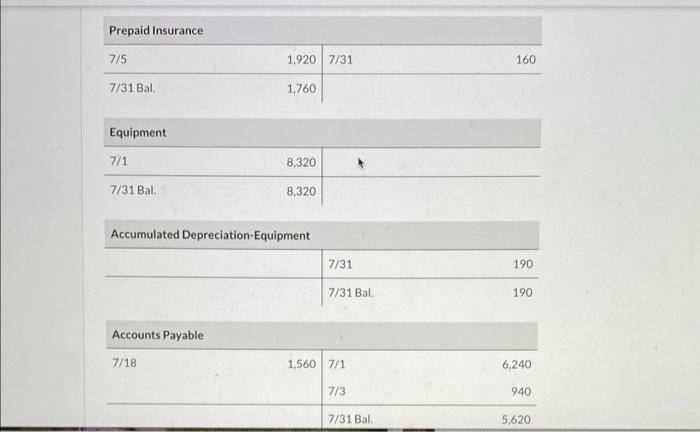

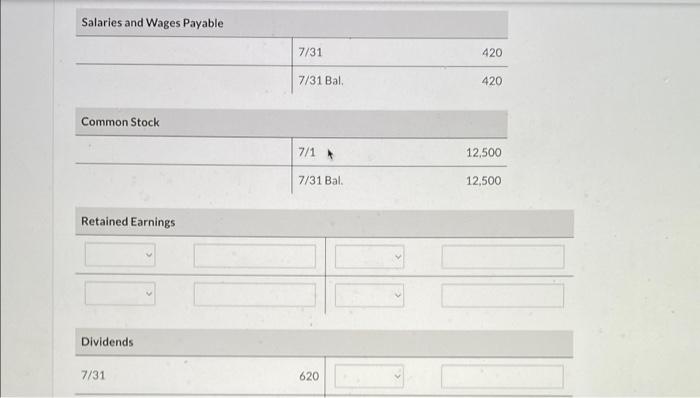

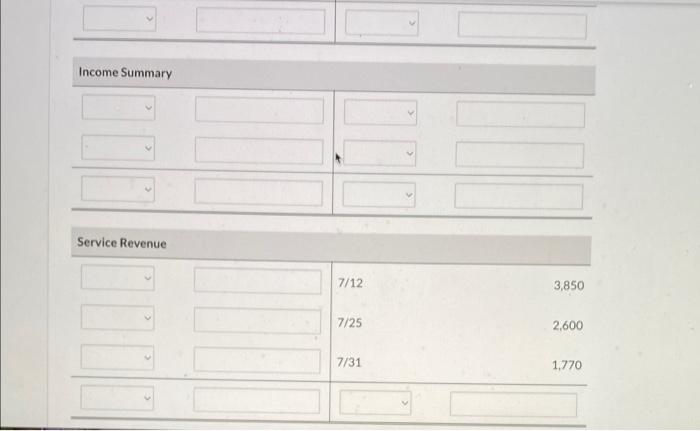

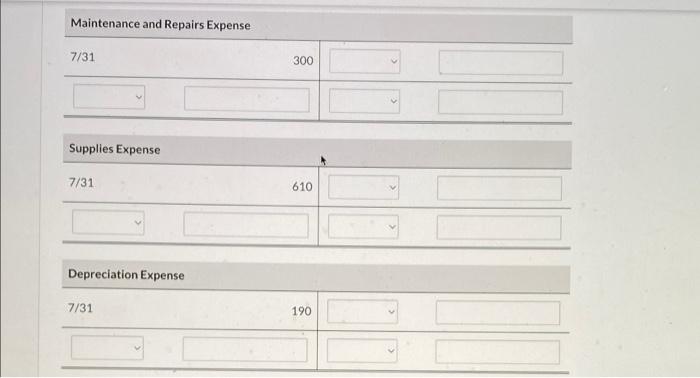

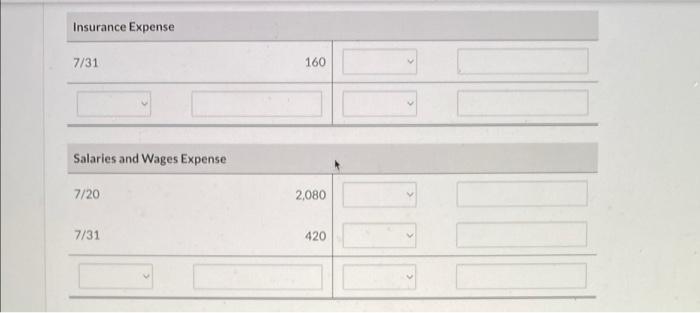

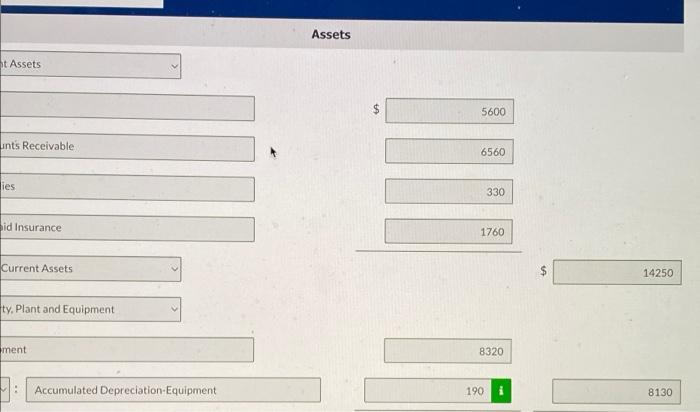

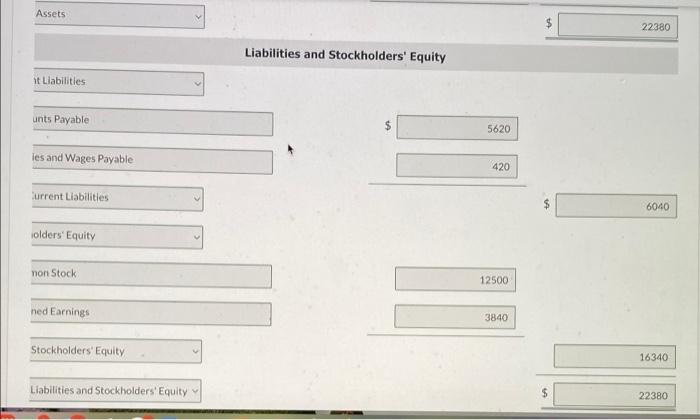

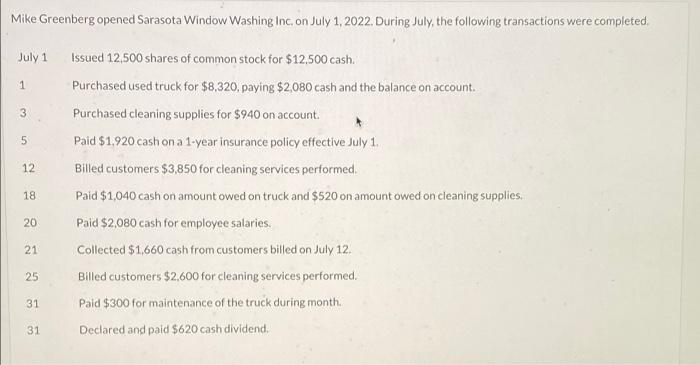

Journalize and post closing entries and complete the closing process. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. For accounts that have zero ending balance, the entry should be the balance date and zero for the amount) Date Account Titles and Explanation Debit Credit July 31 (To close revenue account) July 31 (To close expense accounts) July 31 (To close net income to retained earnings) July 31 (To close dividends to retained earnings) Cash 7/1 12,500 7/1 2,080 7/21 1,660775 1.920 7/21 1,660775 1.920 7/18 1,560 7/20 2,080 7/31 300 7/31 620 7/31 Bal 5,600 Accounts Receivable 7/12 3.8507/21 1,660 7/25 2,600 7/31 1.770 7/31 Bal 6,560 Supplies 7/3 9407/31 610 7/31 Bal 330 Prepaid Insurance 7/5 1,9207/31 160 7/31 Bal. 1,760 Equipment 7/1 8,320 7/31 Bal. 8,320 Accumulated Depreciation Equipment 7/31 190 7/31 Bal 190 Accounts Payable 7/18 1,560 7/1 6,240 7/3 940 7/31 Bal. 5,620 Salaries and Wages Payable 7/31 420 7/31 Bal 420 Common Stock 7/1 12,500 7/31 Bal. 12,500 Retained Earnings Dividends 7/31 620 Income Summary Service Revenue 7/12 3,850 7/25 2.600 7/31 1,770 Maintenance and Repairs Expense 7/31 300 Supplies Expense 7/31 610 Depreciation Expense 7/31 190 Insurance Expense 7/31 160 Salaries and Wages Expense 7/20 2,080 7/31 420 Assets ht Assets $ 5600 Lints Receivable 6560 ies 330 id Insurance 1760 Current Assets 14250 ty, Plant and Equipment ment 8320 Accumulated Depreciation Equipment 190 8130 Assets 22380 Liabilities and Stockholders' Equity it Liabilities unts Payable 5620 les and Wages Payable 420 Current Liabilities 6040 olders' Equity non Stock 12500 ned Earnings 3840 Stockholders' Equity 16340 Liabilities and Stockholders' Equity 22380 Mike Greenberg opened Sarasota Window Washing Inc, on July 1, 2022. During July, the following transactions were completed, July 1 1 3 5 12 18 Issued 12,500 shares of common stock for $12,500 cash. Purchased used truck for $8,320, paying $2,080 cash and the balance on account. Purchased cleaning supplies for $940 on account. Paid $1.920 cash on a 1-year insurance policy effective July 1. Billed customers $3,850 for cleaning services performed. Paid $1,040 cash on amount owed on truck and $520 on amount owed on cleaning supplies. Paid $2,080 cash for employee salaries. Collected $1,660 cash from customers billed on July 12 Billed customers $2,600 for cleaning services performed. Paid $300 for maintenance of the truck during month. Declared and paid $620 cash dividend, 20 21 25 31 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts