Question: answer using excel pease You work for a large investment management firm. The analysts with your firm have made the following forecasts for the returns

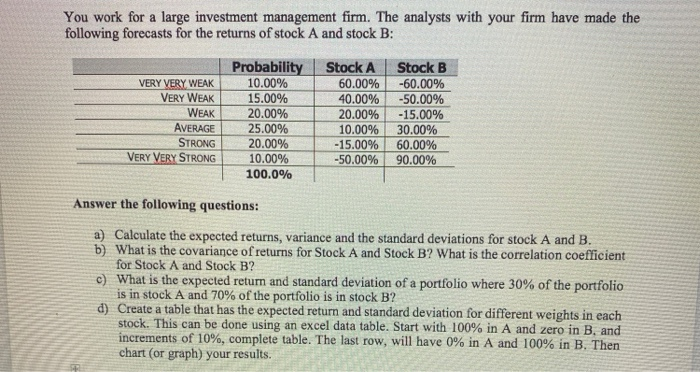

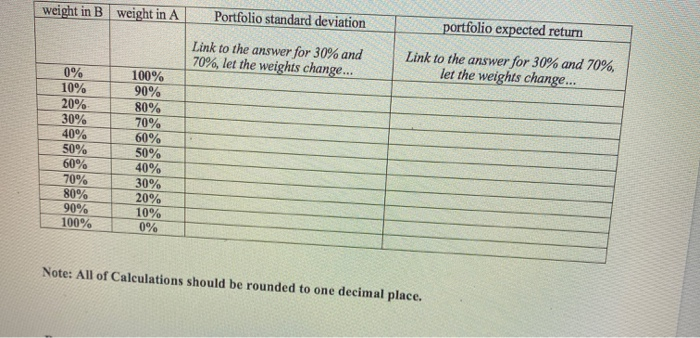

You work for a large investment management firm. The analysts with your firm have made the following forecasts for the returns of stock A and stock B: VERY VERY WEAK VERY WEAK WEAK AVERAGE STRONG VERY VERY STRONG Probability 10.00% 15.00% 20.00% 25.00% 20.00% 10.00% 100.0% Stock A 60.00% 40.00% 20.00% 10.00% -15.00% -50.00% Stock B -60.00% -50.00% -15.00% 30.00% 60.00% 90.00% Answer the following questions: a) Calculate the expected returns, variance and the standard deviations for stock A and B. b) What is the covariance of returns for Stock A and Stock B? What is the correlation coefficient for Stock A and Stock B? c) What is the expected retum and standard deviation of a portfolio where 30% of the portfolio is in stock A and 70% of the portfolio is in stock B? d) Create a table that has the expected return and standard deviation for different weights in each stock. This can be done using an excel data table. Start with 100% in A and zero in B. and increments of 10%, complete table. The last row, will have 0% in A and 100% in B. Then chart (or graph) your results. weight in B weight in A Portfolio standard deviation portfolio expected return Link to the answer for 30% and 70%, let the weights change... Link to the answer for 30% and 70%, let the weights change... 0% 10% 20% 30% 40% 50% 60% 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 70% 80% 90% 100% Note: All of Calculations should be rounded to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts