Question: Answer with 4 Decimals YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 4 years, Coupon rate =

Answer with 4 Decimals

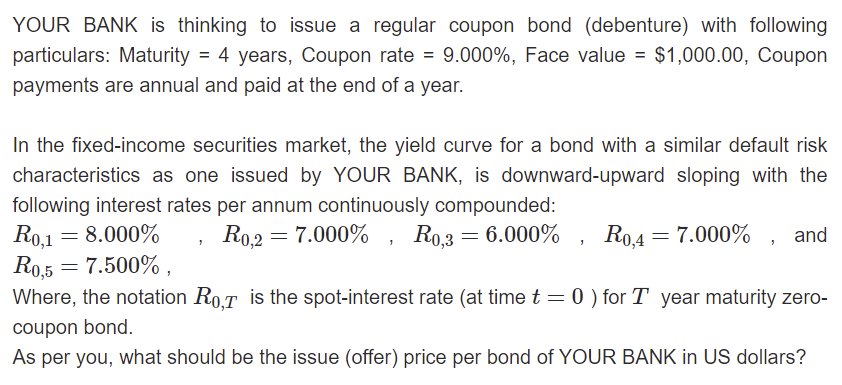

YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 4 years, Coupon rate = 9.000%, Face value = $1,000.00, Coupon payments are annual and paid at the end of a year. = In the fixed-income securities market, the yield curve for a bond with a similar default risk characteristics as one issued by YOUR BANK, is downward-upward sloping with the following interest rates per annum continuously compounded: R0,1 = 8.000% R0,2 7.000% , R0,3 = 6.000% , R0,4 = 7.000% , and R0,5 = 7.500%, Where, the notation Ro,t is the spot-interest rate (at time t= 0 ) for T year maturity zero- coupon bond. As per you, what should be the issue (offer) price per bond of YOUR BANK in US dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts