Question: answer with true or false. 1. The HPR can never be negative. 2. If a stock grows from $100 to $120 in one year, the

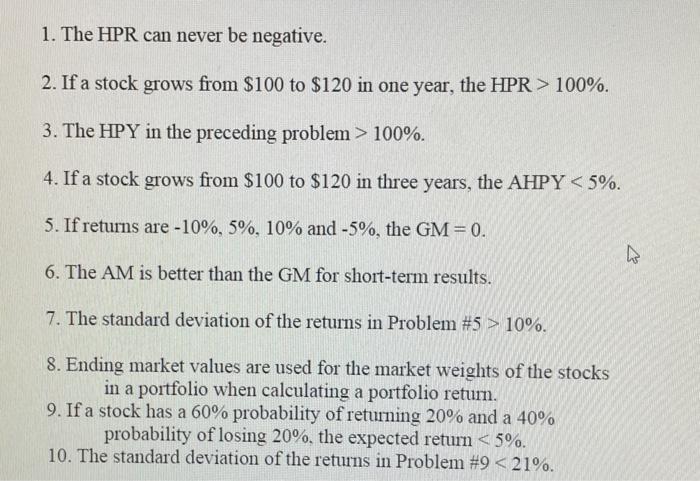

1. The HPR can never be negative. 2. If a stock grows from $100 to $120 in one year, the HPR > 100%. 3. The HPY in the preceding problem > 100%. 4. If a stock grows from $100 to $120 in three years, the AHPY 10%. 8. Ending market values are used for the market weights of the stocks in a portfolio when calculating a portfolio return. 9. If a stock has a 60% probability of returning 20% and a 40% probability of losing 20%, the expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts