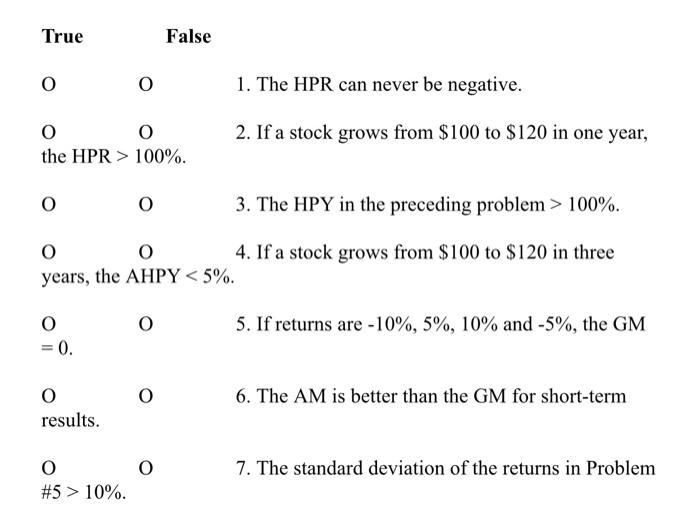

Question: True False 1. The HPR can never be negative. O 2. If a stock grows from $100 to $120 in one year, the HPR >

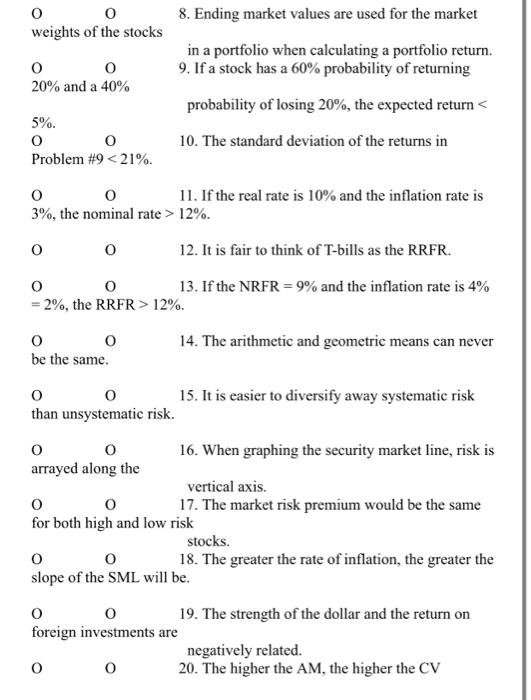

True False 1. The HPR can never be negative. O 2. If a stock grows from $100 to $120 in one year, the HPR > 100%. 3. The HPY in the preceding problem > 100%. O O 4. If a stock grows from $100 to $120 in three years, the AHPY 10%. 8. Ending market values are used for the market o o weights of the stocks in a portfolio when calculating a portfolio return. 9. If a stock has a 60% probability of returning O 0 20% and a 40% probability of losing 20%, the expected return 5%. o o Problem #9 12%. 11. If the real rate is 10% and the inflation rate is O 0 12. It is fair to think of T-bills as the RRFR. 13. If the NRFR = 9% and the inflation rate is 4% o o = 2%, the RRFR> 12%. 14. The arithmetic and geometric means can never o o be the same. o 0 15. It is easier to diversify away systematic risk than unsystematic risk. o O 16. When graphing the security market line, risk is arrayed along the vertical axis. o o 17. The market risk premium would be the same for both high and low risk stocks. o 0 18. The greater the rate of inflation, the greater the slope of the SML will be. o O 19. The strength of the dollar and the return on foreign investments are negatively related. O O 20. The higher the AM, the higher the CV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts