Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q8) Big Pond lnc. has an issue

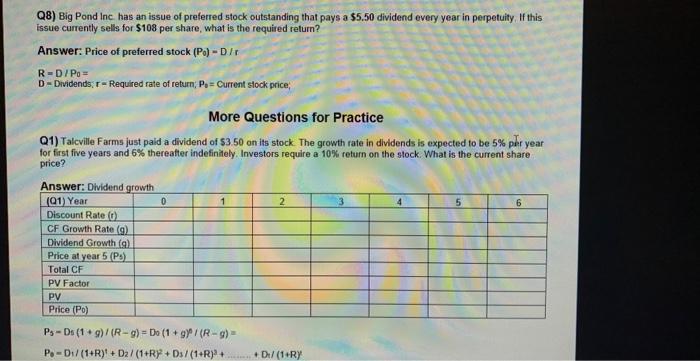

Q8) Big Pond lnc. has an issue of preferred stock outstanding that pays a $5.50 dividend every year in perpetuity. If this issue currently sells for $108 per share, what is the required return? Answer: Price of preferred stock (P0)=D/r R=D/P0= D= Dividends, r= Required rate of return; Pt= Current slock price; More Questions for Practice Q1) Talcville Farms just paid a dividend of $3.50 on its stock. The growth rate in dividends is expected to be 5% per year for first five years and 6% thereafter indefinitely. Investors require a 10% return on the stock. What is the current share price? P5=D5(1+g)f(Rg)=D0(1+g)0/(Rg)=P0=D1/(1+Rt+D2/(1+R2+D3/(1+R2++D1/(1+R)2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts