Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q5) A proposed new project has projected

Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work

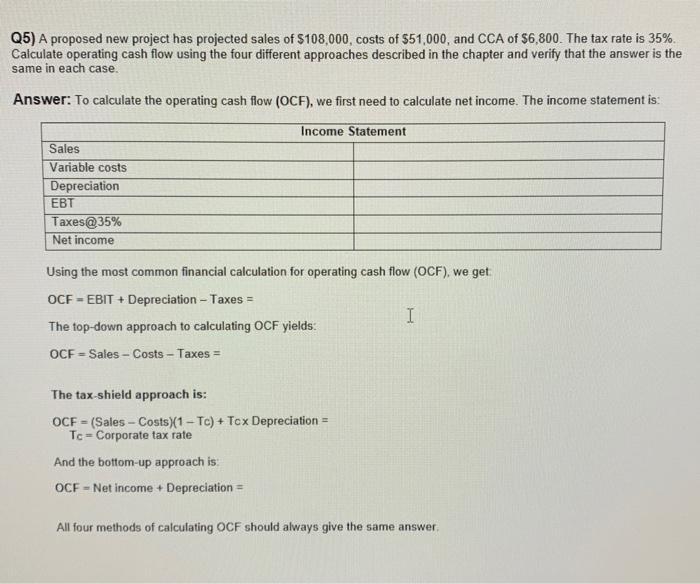

Q5) A proposed new project has projected sales of $108,000, costs of $51,000, and CCA of $6,800. The tax rate is 35%. Calculate operating cash flow using the four different approaches described in the chapter and verify that the answer is the same in each case. Answer: To calculate the operating cash flow (OCF), we first need to calculate net income. The income statement is: Using the most common financial calculation for operating cash flow (OCF), we get OCF=EBIT+Depreciation-Taxes= The top-down approach to calculating OCF yields: OCF=SalesCostsTaxes= The tax-shield approach is: OCF=(SalesCosts)(1Tc)+TcDepreciation= Tc= Corporate tax rate And the bottom-up approach is: OCF=Netincome+Depreciation= All four methods of calculating OCF should always give the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts