Question: (ANSWERED PLEASE SOLVE QUESTION 2) Problem 1 : Suppose that a car-rental agency offers insurance for a week that costs $100. A minor fender bender

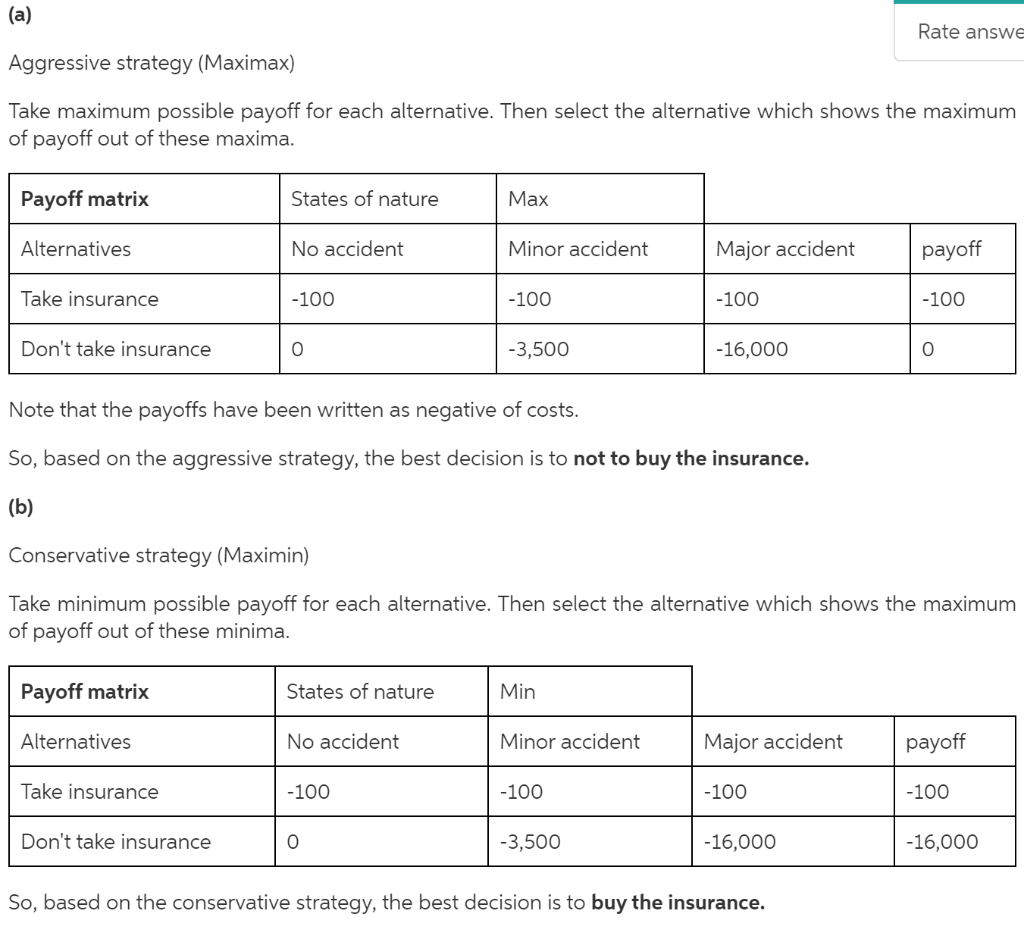

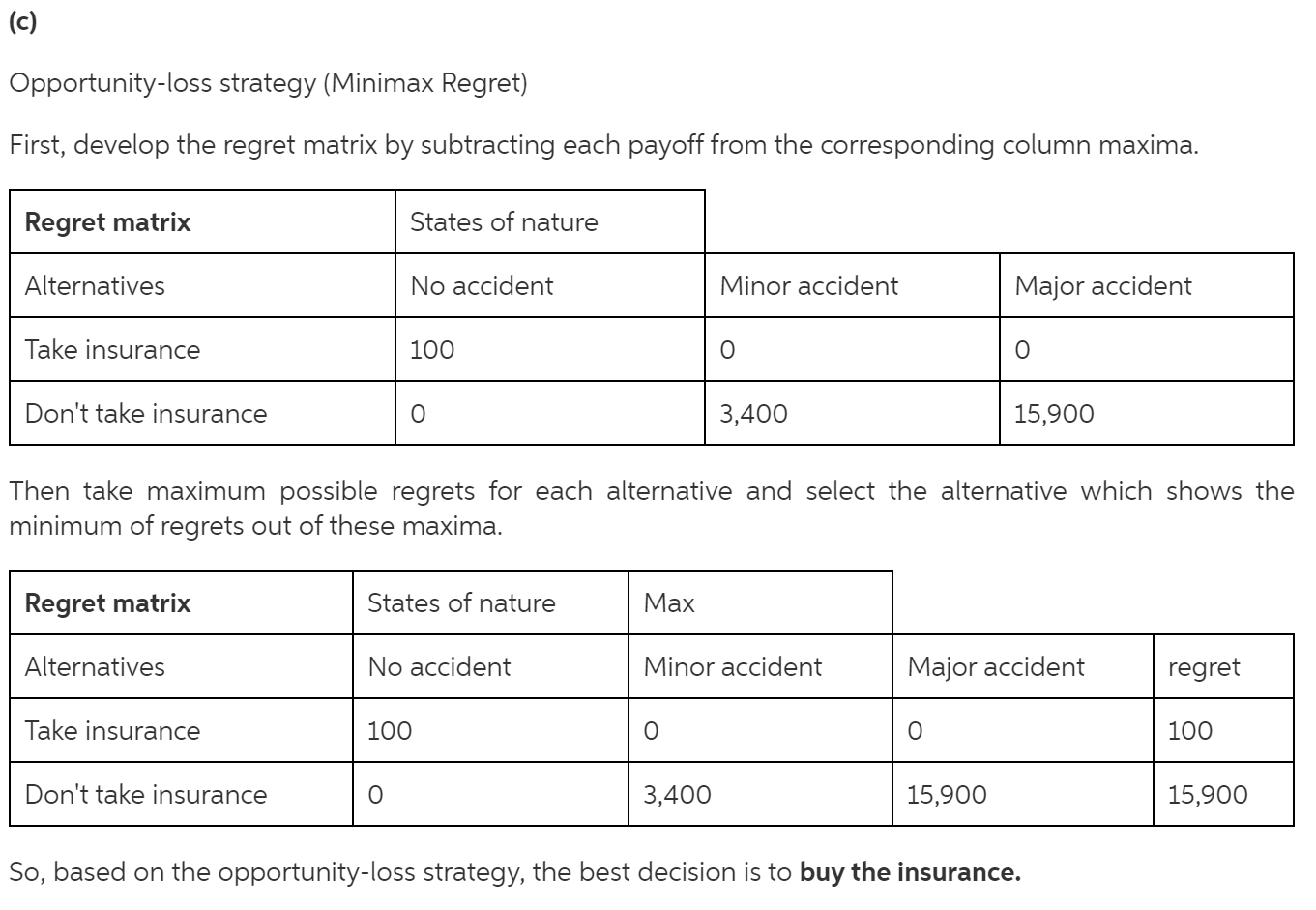

(ANSWERED PLEASE SOLVE QUESTION 2) Problem 1: Suppose that a car-rental agency offers insurance for a week that costs $100. A minor fender bender will cost $3,500, whereas a major accident might cost $16,000 in repairs. Without the insurance, you would be personally liable for any damages. What should you do? Clearly, there are two decision alternatives: take the insurance, or do not take the insurance. The uncertain consequences, or events that might occur, are that you would not be involved in an accident, that you would be involved in a fender bender, or that you would be involved in a major accident. Develop a payoff table for this situation. What decision should you make using each of the following strategies?

Problem 2: The DoorCo Corporation is a leading manufacturer of garage doors. All doors are manufactured in their plant in Carmel, Indiana, and shipped to distribution centers or major customers. DoorCo recently acquired another manufacturer of garage doors, Wisconsin Door, and is considering moving its wood door operations to the Wisconsin plant. Key considerations in this decision are the transportation, labor, and production costs at the two plants. Complicating matters is the fact that marketing is predicting a decline in the demand for wood doors. The company developed the following three scenarios: Scenario 1 (Probability of happening 0.15): Demand falls slightly, with no noticeable effect on production Scenario 2 (Probability of happening 0.40): Demand and production decline 20% Scenario 3 (Probability of happening 0.45): Demand and production decline 40%

The following table shows the total costs under each decision and scenario.

Use this information to answer the following: a) What is the Expected Value of the decision "Stay in Carmel" b) What is the Expected Value of the decision "Move to Wisconsin" c) Should DoorCo Stay in Carmel or Move to Wisconsin? Explain your answer.

(a) Rate answe Aggressive strategy (Maximax) Take maximum possible payoff for each alternative. Then select the alternative which shows the maximum of payoff out of these maxima. Payoff matrix States of nature Max Alternatives No accident Minor accident Major accident payoff Take insurance -100 -100 -100 -100 Don't take insurance 0 -3,500 -16,000 0 Note that the payoffs have been written as negative of costs. So, based on the aggressive strategy, the best decision is to not to buy the insurance. (b) Conservative strategy (Maximin) Take minimum possible payoff for each alternative. Then select the alternative which shows the maximum of payoff out of these minima. Payoff matrix States of nature Min Alternatives No accident Minor accident Major accident payoff Take insurance -100 -100 -100 -100 Don't take insurance 0 -3,500 -16,000 -16,000 So, based on the conservative strategy, the best decision is to buy the insurance. (c) Opportunity-loss strategy (Minimax Regret) First, develop the regret matrix by subtracting each payoff from the corresponding column maxima. Regret matrix States of nature Alternatives No accident Minor accident Major accident Take insurance 100 0 0 Don't take insurance 0 3,400 15,900 Then take maximum possible regrets for each alternative and select the alternative which shows the minimum of regrets out of these maxima. Regret matrix States of nature Max Alternatives No accident Minor accident Major accident regret Take insurance 100 0 0 100 Don't take insurance 0 3,400 15,900 15,900 So, based on the opportunity-loss strategy, the best decision is to buy the insurance. (a) Rate answe Aggressive strategy (Maximax) Take maximum possible payoff for each alternative. Then select the alternative which shows the maximum of payoff out of these maxima. Payoff matrix States of nature Max Alternatives No accident Minor accident Major accident payoff Take insurance -100 -100 -100 -100 Don't take insurance 0 -3,500 -16,000 0 Note that the payoffs have been written as negative of costs. So, based on the aggressive strategy, the best decision is to not to buy the insurance. (b) Conservative strategy (Maximin) Take minimum possible payoff for each alternative. Then select the alternative which shows the maximum of payoff out of these minima. Payoff matrix States of nature Min Alternatives No accident Minor accident Major accident payoff Take insurance -100 -100 -100 -100 Don't take insurance 0 -3,500 -16,000 -16,000 So, based on the conservative strategy, the best decision is to buy the insurance. (c) Opportunity-loss strategy (Minimax Regret) First, develop the regret matrix by subtracting each payoff from the corresponding column maxima. Regret matrix States of nature Alternatives No accident Minor accident Major accident Take insurance 100 0 0 Don't take insurance 0 3,400 15,900 Then take maximum possible regrets for each alternative and select the alternative which shows the minimum of regrets out of these maxima. Regret matrix States of nature Max Alternatives No accident Minor accident Major accident regret Take insurance 100 0 0 100 Don't take insurance 0 3,400 15,900 15,900 So, based on the opportunity-loss strategy, the best decision is to buy the insuranceStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts