Question: Answering using excel would help tremendously! Consider the following four risky assets: The risk-free rate is 6%. A client has formed Portfolio A with weights

Answering using excel would help tremendously!

Answering using excel would help tremendously!

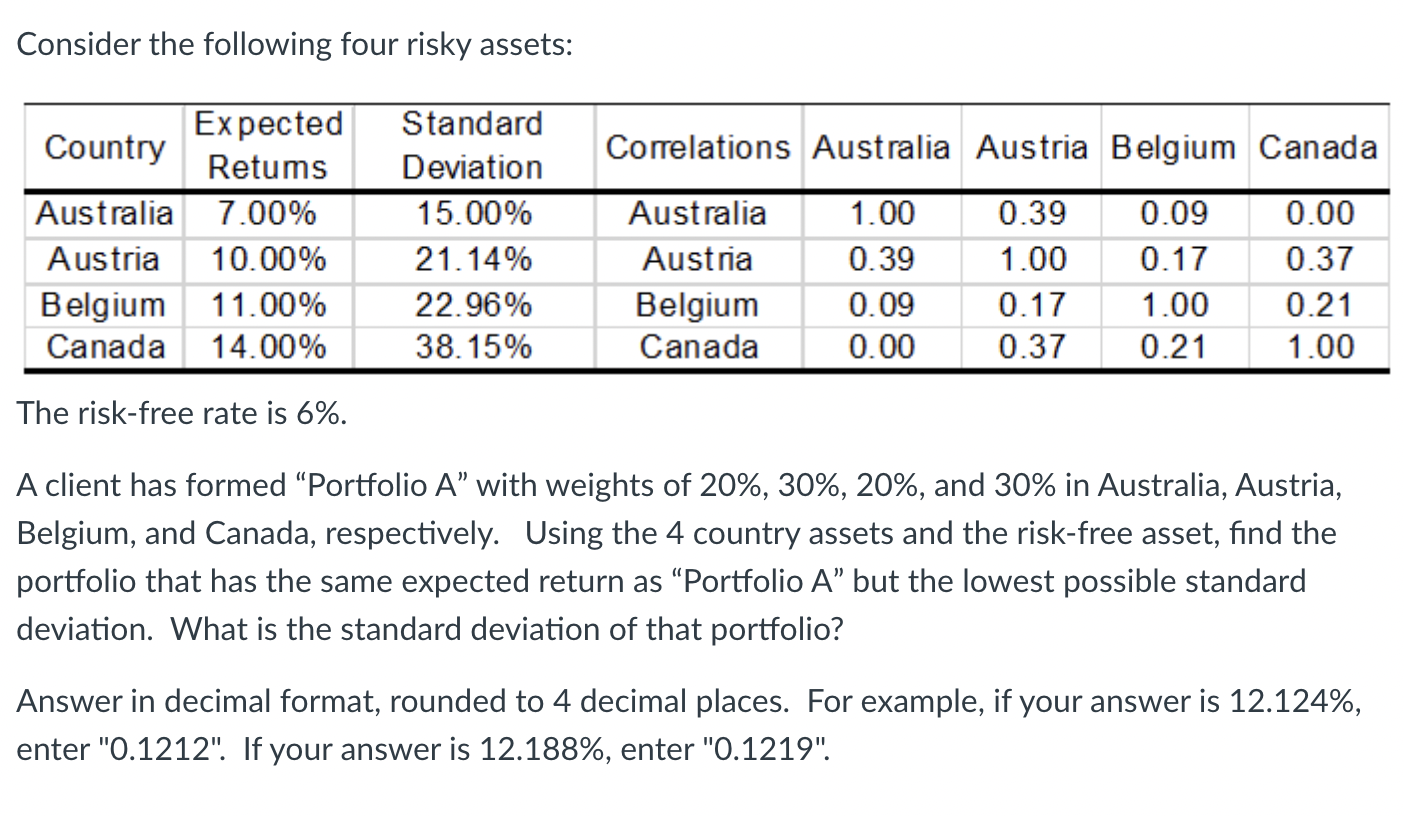

Consider the following four risky assets: The risk-free rate is 6%. A client has formed "Portfolio A" with weights of 20%,30%,20%, and 30% in Australia, Austria, Belgium, and Canada, respectively. Using the 4 country assets and the risk-free asset, find the portfolio that has the same expected return as "Portfolio A " but the lowest possible standard deviation. What is the standard deviation of that portfolio? Answer in decimal format, rounded to 4 decimal places. For example, if your answer is 12.124%, enter "0.1212". If your answer is 12.188%, enter "0.1219". Consider the following four risky assets: The risk-free rate is 6%. A client has formed "Portfolio A" with weights of 20%,30%,20%, and 30% in Australia, Austria, Belgium, and Canada, respectively. Using the 4 country assets and the risk-free asset, find the portfolio that has the same expected return as "Portfolio A " but the lowest possible standard deviation. What is the standard deviation of that portfolio? Answer in decimal format, rounded to 4 decimal places. For example, if your answer is 12.124%, enter "0.1212". If your answer is 12.188%, enter "0.1219

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts