Question: Answers needed for each part with step by step solution thanks :) I got 5.62% for part (i) and 2.7 for part (ii), not sure

Answers needed for each part with step by step solution thanks :)

I got 5.62% for part (i) and 2.7 for part (ii), not sure if they are correct though

Also need solutions for (iii) and (iv) with step by steps thank you :)

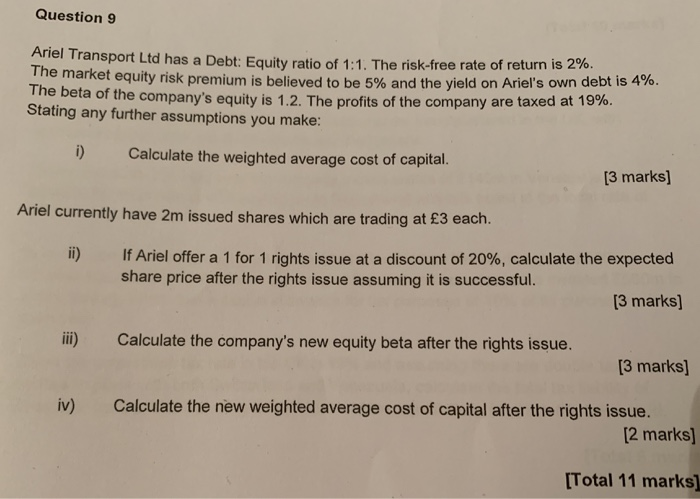

Question 9 Ariel Transport Ltd has a Debt: Equity ratio of 1:1. The risk-free rate of return is 2%. The market equity risk premium is believed to be 5% and the yield on Ariel's own debt is 4%. The beta of the company's equity is 1.2. The profits of the company are taxed at 19%. Stating any further assumptions you make: i) Calculate the weighted average cost of capital. [3 marks] Ariel currently have 2m issued shares which are trading at 3 each. ii) If Ariel offer a 1 for 1 rights issue at a discount of 20%, calculate the expected share price after the rights issue assuming it is successful. [3 marks] ii) Calculate the company's new equity beta after the rights issue. [3 marks] iv) Calculate the new weighted average cost of capital after the rights issue. [2 marks] ITotal 11 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts