Question: Answers needed for each part with step by step solution thanks :) An insurance company is calculating its reserves. For one class of business the

Answers needed for each part with step by step solution thanks :)

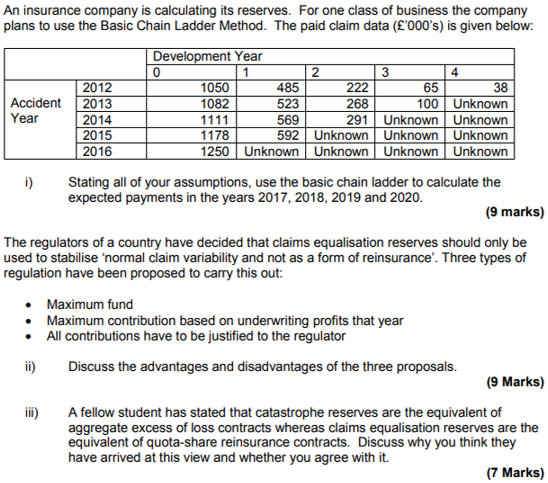

An insurance company is calculating its reserves. For one class of business the company plans to use the Basic Chain Ladder Method. The paid claim data (000's) is given below Development Year 1 1050 1082 2 3 222 4 2012 2013 485 523 569 65 38 Unknown Accident Year 268 291 Unknown Unknown Unknown 100 2014 2015 2016 1111 1178 Unknown 592 Unknown 1250 Unknown Unknown Unknown Unknown i) Stating all of your assumptions, use the basic chain ladder to calculate the expected payments in the years 2017, 2018, 2019 and 2020. (9 marks) The regulators of a country have decided that claims equalisation reserves should only be used to stabilise 'normal claim variability and not as a form of reinsurance'. Three types of regulation have been proposed to cary this out Maximum fund Maximum contribution based on underwriting profits that year All contributions have to be justified to the regulator ii) Discuss the advantages and disadvantages of the three proposals. (9 Marks) A fellow student has stated that catastrophe reserves are the equivalent of aggregate excess of loss contracts whereas claims equalisation reserves are the equivalent of quota-share reinsurance contracts. Discuss why you think they have arrived at this view and whether you agree with it. (7 Marks) An insurance company is calculating its reserves. For one class of business the company plans to use the Basic Chain Ladder Method. The paid claim data (000's) is given below Development Year 1 1050 1082 2 3 222 4 2012 2013 485 523 569 65 38 Unknown Accident Year 268 291 Unknown Unknown Unknown 100 2014 2015 2016 1111 1178 Unknown 592 Unknown 1250 Unknown Unknown Unknown Unknown i) Stating all of your assumptions, use the basic chain ladder to calculate the expected payments in the years 2017, 2018, 2019 and 2020. (9 marks) The regulators of a country have decided that claims equalisation reserves should only be used to stabilise 'normal claim variability and not as a form of reinsurance'. Three types of regulation have been proposed to cary this out Maximum fund Maximum contribution based on underwriting profits that year All contributions have to be justified to the regulator ii) Discuss the advantages and disadvantages of the three proposals. (9 Marks) A fellow student has stated that catastrophe reserves are the equivalent of aggregate excess of loss contracts whereas claims equalisation reserves are the equivalent of quota-share reinsurance contracts. Discuss why you think they have arrived at this view and whether you agree with it. (7 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts