Question: Answers needed for each part with step by step solution thanks :) i) You work for a general insurance company that is about to submit

Answers needed for each part with step by step solution thanks :)

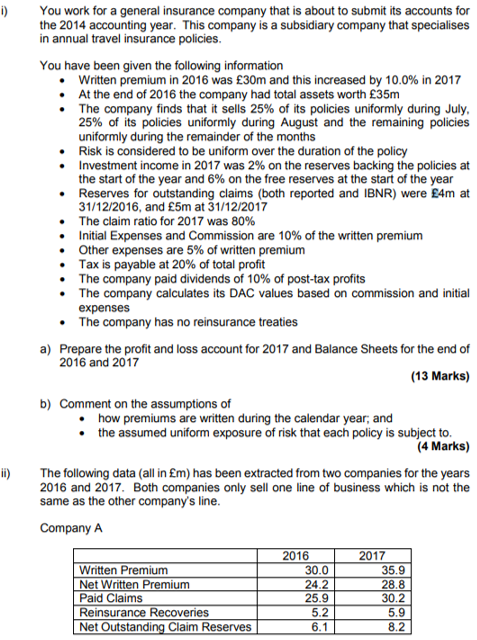

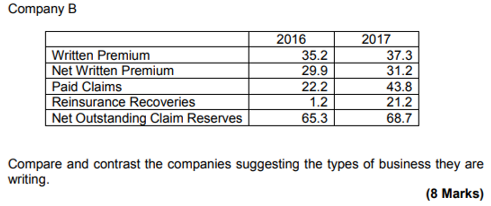

i) You work for a general insurance company that is about to submit its accounts for the 2014 accounting year. This company is a subsidiary company that specialises in annual travel insurance policies You have been given the following information Written premium in 2016 was 30m and this increased by 10.0% in 2017 At the end of 2016 the company had total assets worth 35m The company finds that it sells 25% of its policies uniformly during July, 25% of its policies uniformly during August and the remaining policies uniformly during the remainder of the months Risk is considered to be uniform over the duration of the policy Investment income in 2017 was 2 % on the reserves backing the policies at the start of the year and 6% on the free reserves at the start of the year Reserves for outstanding claims (both reported and IBNR) were 4m at 31/12/2016, and 5m at 31/12/2017 The claim ratio for 2017 was 80 % Initial Expenses and Commission are 10% of the written premium Other expenses are 5% of written premium Tax is payable at 20 % of total profit The company paid dividends of 10% of post-tax profits The company calculates its DAC values based on commission and initial expenses The company has no reinsurance treaties a) Prepare the profit and loss account for 2017 and Balance Sheets for the end of 2016 and 2017 (13 Marks) b) Comment on the assumptions of how premiums are written during the calendar year; and the assumed uniform exposure of risk that each policy is subject to. (4 Marks) i) The following data (all in m) has been extracted from two companies for the years 2016 and 2017. Both companies only sell one line of business which is not the same as the other company's line. Company A 2016 2017 Written Premium 30.0 35.9 24.2 25.9 Net Written Premium Paid Claims Reinsurance Recoveries Net Outstanding Claim Reserves 28.8 30.2 5.2 5.9 6.1 8.2 98292 Company B 2016 2017 Written Premium Net Written Premium Paid Claims Reinsurance Recoveries Net Outstanding Claim Reserves 35.2 29.9 37.3 31.2 22.2 43.8 1,2 21.2 65.3 68.7 Compare and contrast the companies suggesting the types of business they are writing. (8 Marks) i) You work for a general insurance company that is about to submit its accounts for the 2014 accounting year. This company is a subsidiary company that specialises in annual travel insurance policies You have been given the following information Written premium in 2016 was 30m and this increased by 10.0% in 2017 At the end of 2016 the company had total assets worth 35m The company finds that it sells 25% of its policies uniformly during July, 25% of its policies uniformly during August and the remaining policies uniformly during the remainder of the months Risk is considered to be uniform over the duration of the policy Investment income in 2017 was 2 % on the reserves backing the policies at the start of the year and 6% on the free reserves at the start of the year Reserves for outstanding claims (both reported and IBNR) were 4m at 31/12/2016, and 5m at 31/12/2017 The claim ratio for 2017 was 80 % Initial Expenses and Commission are 10% of the written premium Other expenses are 5% of written premium Tax is payable at 20 % of total profit The company paid dividends of 10% of post-tax profits The company calculates its DAC values based on commission and initial expenses The company has no reinsurance treaties a) Prepare the profit and loss account for 2017 and Balance Sheets for the end of 2016 and 2017 (13 Marks) b) Comment on the assumptions of how premiums are written during the calendar year; and the assumed uniform exposure of risk that each policy is subject to. (4 Marks) i) The following data (all in m) has been extracted from two companies for the years 2016 and 2017. Both companies only sell one line of business which is not the same as the other company's line. Company A 2016 2017 Written Premium 30.0 35.9 24.2 25.9 Net Written Premium Paid Claims Reinsurance Recoveries Net Outstanding Claim Reserves 28.8 30.2 5.2 5.9 6.1 8.2 98292 Company B 2016 2017 Written Premium Net Written Premium Paid Claims Reinsurance Recoveries Net Outstanding Claim Reserves 35.2 29.9 37.3 31.2 22.2 43.8 1,2 21.2 65.3 68.7 Compare and contrast the companies suggesting the types of business they are writing. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts