Question: Answers needed for each part with step by step solution thanks :) A company writes a number of different lines of business. One of these

Answers needed for each part with step by step solution thanks :)

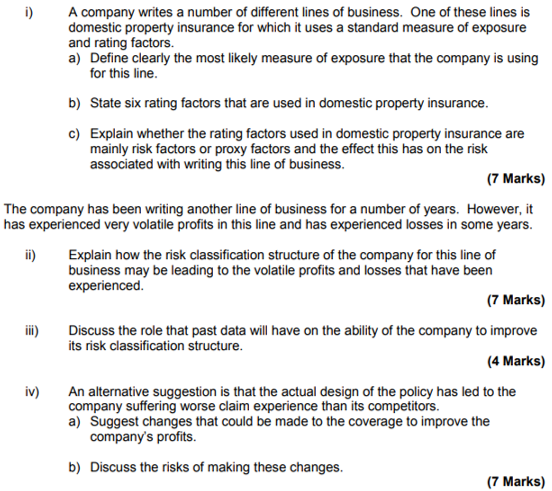

A company writes a number of different lines of business. One of these lines is domestic property insurance for which it uses a standard measure of exposure and rating factors a) Define clearly the most likely measure of exposure that the company is using for this line. i) b) State six rating factors that are used in domestic property insurance. c) Explain whether the rating factors used in domestic property insurance are mainly risk factors or proxy factors and the effect this has on the risk associated with writing this line of business. (7 Marks) The company has been writing another line of business for a number of years. However, it has experienced very volatile profits in this line and has experienced losses in some years. Explain how the risk classification structure of the company for this line of i) business may be leading to the volatile profits and losses that have been experienced (7 Marks) Discuss the role that past data will have on the ability of the company to improve its risk classification structure (4 Marks) iv) An alternative suggestion is that the actual design of the policy has led to the company suffering worse claim experience than its competitors a) Suggest changes that could be made to the coverage to improve the company's profits b) Discuss the risks of making these changes (7 Marks) A company writes a number of different lines of business. One of these lines is domestic property insurance for which it uses a standard measure of exposure and rating factors a) Define clearly the most likely measure of exposure that the company is using for this line. i) b) State six rating factors that are used in domestic property insurance. c) Explain whether the rating factors used in domestic property insurance are mainly risk factors or proxy factors and the effect this has on the risk associated with writing this line of business. (7 Marks) The company has been writing another line of business for a number of years. However, it has experienced very volatile profits in this line and has experienced losses in some years. Explain how the risk classification structure of the company for this line of i) business may be leading to the volatile profits and losses that have been experienced (7 Marks) Discuss the role that past data will have on the ability of the company to improve its risk classification structure (4 Marks) iv) An alternative suggestion is that the actual design of the policy has led to the company suffering worse claim experience than its competitors a) Suggest changes that could be made to the coverage to improve the company's profits b) Discuss the risks of making these changes (7 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts