Question: answers to the nearest cent. If the answer is zero, enter 0 . Use a minus sign to enter negative values, if any. 1.

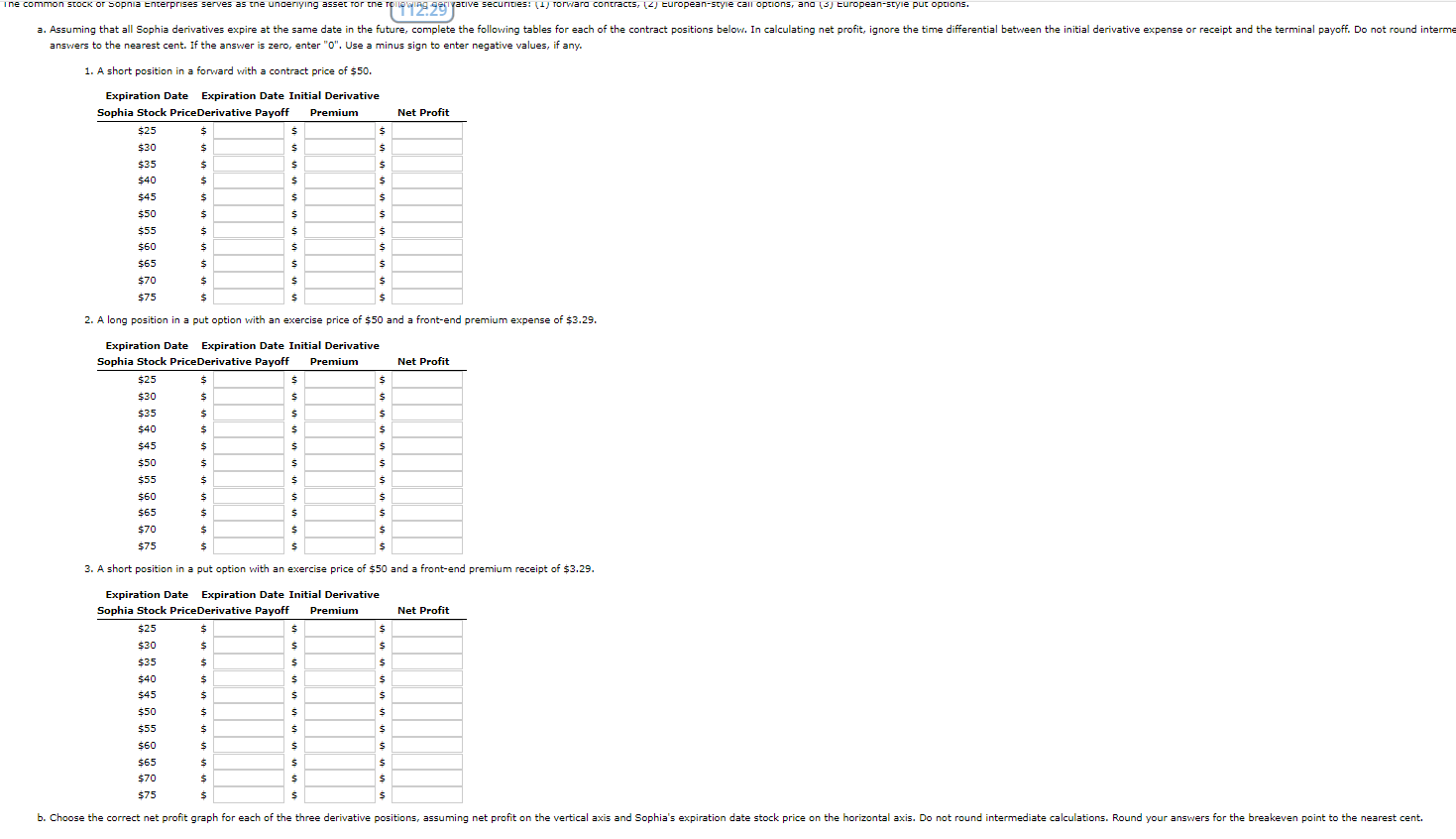

answers to the nearest cent. If the answer is zero, enter " 0 ". Use a minus sign to enter negative values, if any. 1. A short position in a forward with a contract price of $50. Expiration Date Expiration Date Initial Derivative 2. A long position in a put option with an exercise price of $50 and a front-end premium expense of $3.29. Expiration Date Expiration Date Initial Derivative 3. A short position in a put option with an exercise price of $50 and a front-end premium receipt of $3.29 Expiration Date Expiration Date Initial Derivative answers to the nearest cent. If the answer is zero, enter " 0 ". Use a minus sign to enter negative values, if any. 1. A short position in a forward with a contract price of $50. Expiration Date Expiration Date Initial Derivative 2. A long position in a put option with an exercise price of $50 and a front-end premium expense of $3.29. Expiration Date Expiration Date Initial Derivative 3. A short position in a put option with an exercise price of $50 and a front-end premium receipt of $3.29 Expiration Date Expiration Date Initial Derivative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts