Question: ANY CODE NEEDS TO BE IN R PLEASE Question 2 - Risk-Free Assets The following case is similar to the case covered in Session 3.

ANY CODE NEEDS TO BE IN R PLEASE

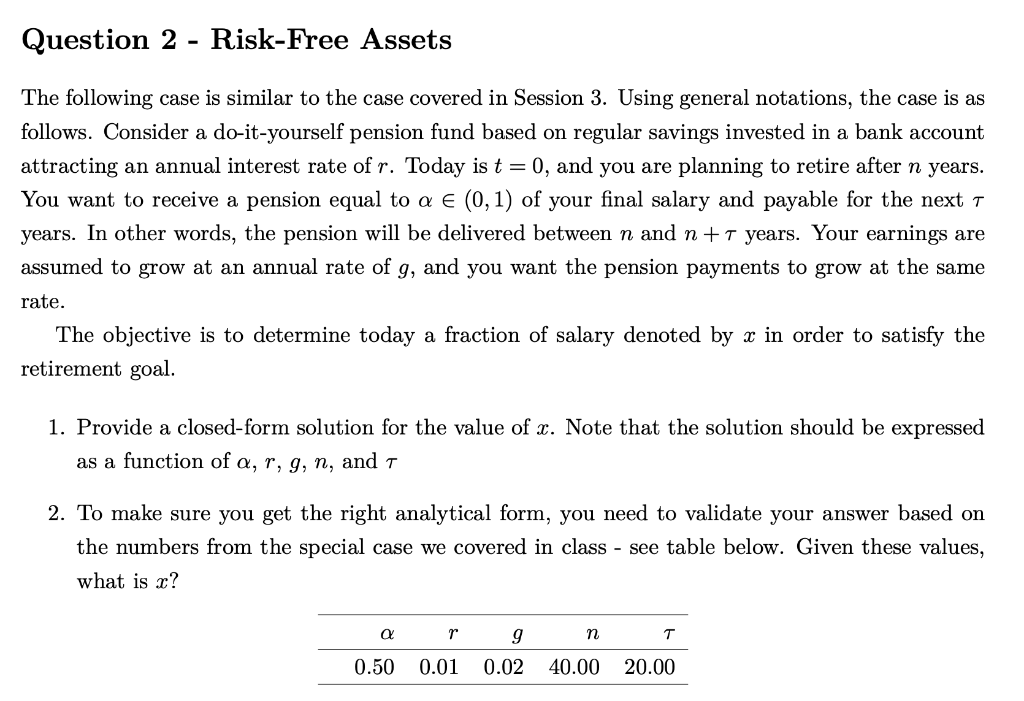

Question 2 - Risk-Free Assets The following case is similar to the case covered in Session 3. Using general notations, the case is as follows. Consider a do-it-yourself pension fund based on regular savings invested in a bank account attracting an annual interest rate of r. Today is t = 0, and you are planning to retire after n years. You want to receive a pension equal to a (0,1) of your final salary and payable for the next t years. In other words, the pension will be delivered between n and n +7 years. Your earnings are assumed to grow at an annual rate of g, and you want the pension payments to grow at the same rate. The objective is to determine today a fraction of salary denoted by x in order to satisfy the retirement goal. 1. Provide a closed-form solution for the value of x. Note that the solution should be expressed as a function of a, r, g, n, and T 2. To make sure you get the right analytical form, you need to validate your answer based on the numbers from the special case we covered in class - see table below. Given these values, what is c? r n 9 0.02 0.50 0.01 40.00 20.00 Question 2 - Risk-Free Assets The following case is similar to the case covered in Session 3. Using general notations, the case is as follows. Consider a do-it-yourself pension fund based on regular savings invested in a bank account attracting an annual interest rate of r. Today is t = 0, and you are planning to retire after n years. You want to receive a pension equal to a (0,1) of your final salary and payable for the next t years. In other words, the pension will be delivered between n and n +7 years. Your earnings are assumed to grow at an annual rate of g, and you want the pension payments to grow at the same rate. The objective is to determine today a fraction of salary denoted by x in order to satisfy the retirement goal. 1. Provide a closed-form solution for the value of x. Note that the solution should be expressed as a function of a, r, g, n, and T 2. To make sure you get the right analytical form, you need to validate your answer based on the numbers from the special case we covered in class - see table below. Given these values, what is c? r n 9 0.02 0.50 0.01 40.00 20.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts