Question: Any expert can help me solve this ques for that all 6 column? The followings are the cash flows for Project KLM4 and RST5 that

Any expert can help me solve this ques for that all 6 column?

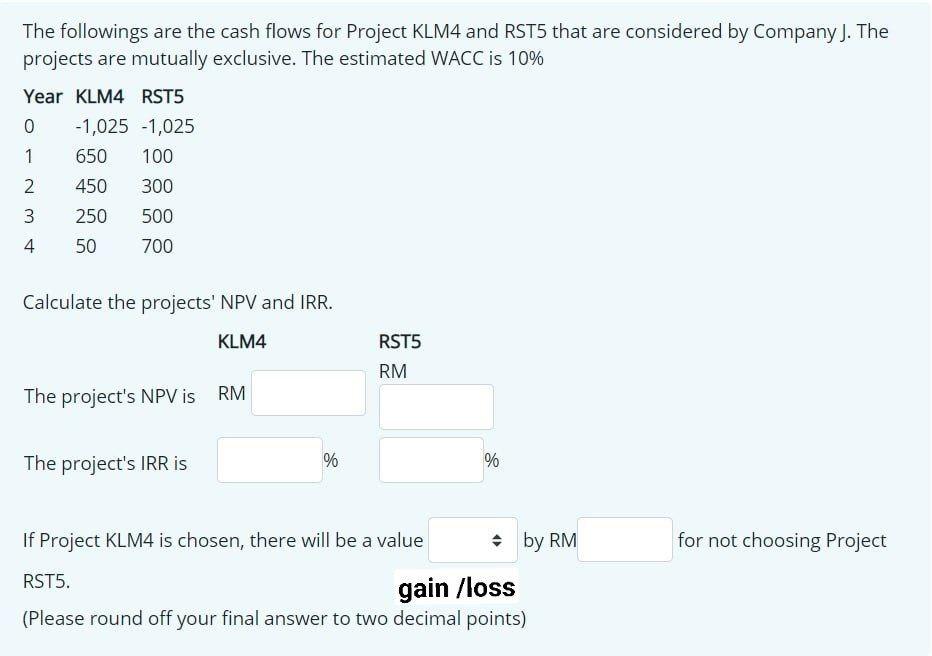

The followings are the cash flows for Project KLM4 and RST5 that are considered by Company ). The projects are mutually exclusive. The estimated WACC is 10% Year KLM4 RST5 0 -1,025 -1,025 1 650 100 2 450 300 3 250 500 4 50 700 Calculate the projects' NPV and IRR. KLM4 RST5 RM The project's NPV is RM The project's IRR is % % If Project KLM4 is chosen, there will be a value by RM for not choosing Project RST5. (Please round off your final answer to two decimal points) gain /loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts