Question: anyone can help with this Thanks Question 2 (1 point) Your local corner store has sales of $5,000 and a tax rate of 30%. Just

anyone can help with this

Thanks

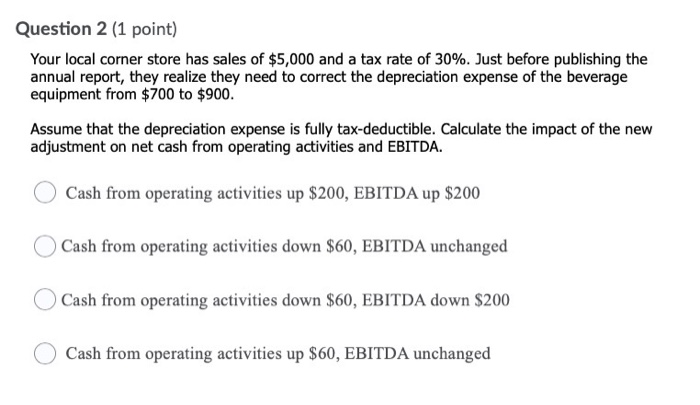

Question 2 (1 point) Your local corner store has sales of $5,000 and a tax rate of 30%. Just before publishing the annual report, they realize they need to correct the depreciation expense of the beverage equipment from $700 to $900. Assume that the depreciation expense is fully tax-deductible. Calculate the impact of the new adjustment on net cash from operating activities and EBITDA. Cash from operating activities up $200, EBITDA up $200 Cash from operating activities down $60, EBITDA unchanged Cash from operating activities down $60, EBITDA down $200 Cash from operating activities up $60, EBITDA unchanged

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock