Question: anyone know how to do it in step by step I will thumb it up A B D E F H 1 J K L

anyone know how to do it in step by step I will thumb it up

anyone know how to do it in step by step I will thumb it up

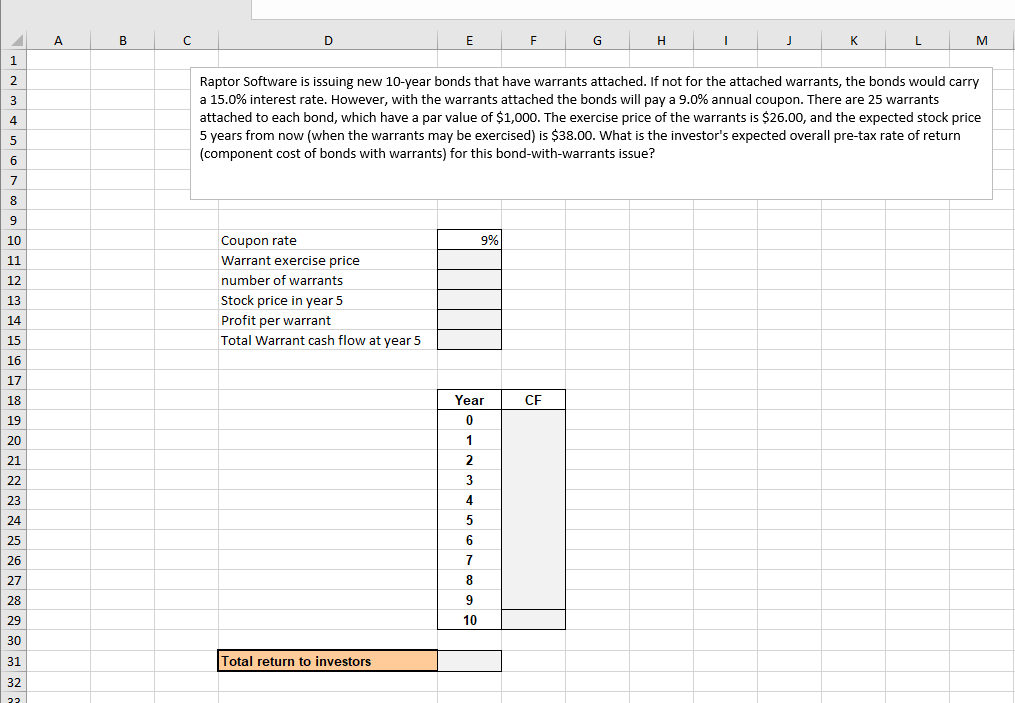

A B D E F H 1 J K L M 1 2 3 4 Raptor Software is issuing new 10-year bonds that have warrants attached. If not for the attached warrants, the bonds would carry a 15.0% interest rate. However, with the warrants attached the bonds will pay a 9.0% annual coupon. There are warrants attached to each bond, which have a par value of $1,000. The exercise price of the warrants is $26.00, and the expected stock price 5 years from now (when the warrants may be exercised) is $38.00. What is the investor's expected overall pre-tax rate of return (component cost of bonds with warrants) for this bond-with-warrants issue? 5 6 7 8 9 10 9% 11 12 Coupon rate Warrant exercise price number of warrants Stock price in year 5 Profit per warrant Total Warrant cash flow at year 5 13 14 15 16 17 18 Year CF 0 19 20 21 1 2 3 4 22 5 23 24 25 26 27 6 7 8 28 9 10 29 30 31 Total return to investors 32 22 A B D E F H 1 J K L M 1 2 3 4 Raptor Software is issuing new 10-year bonds that have warrants attached. If not for the attached warrants, the bonds would carry a 15.0% interest rate. However, with the warrants attached the bonds will pay a 9.0% annual coupon. There are warrants attached to each bond, which have a par value of $1,000. The exercise price of the warrants is $26.00, and the expected stock price 5 years from now (when the warrants may be exercised) is $38.00. What is the investor's expected overall pre-tax rate of return (component cost of bonds with warrants) for this bond-with-warrants issue? 5 6 7 8 9 10 9% 11 12 Coupon rate Warrant exercise price number of warrants Stock price in year 5 Profit per warrant Total Warrant cash flow at year 5 13 14 15 16 17 18 Year CF 0 19 20 21 1 2 3 4 22 5 23 24 25 26 27 6 7 8 28 9 10 29 30 31 Total return to investors 32 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts