Question: Anyone know how to do this?? Please explain and show your work for a thumbs up. The asset price process, {Sninz0, follows the binomial tree

Anyone know how to do this?? Please explain and show your work for a thumbs up.

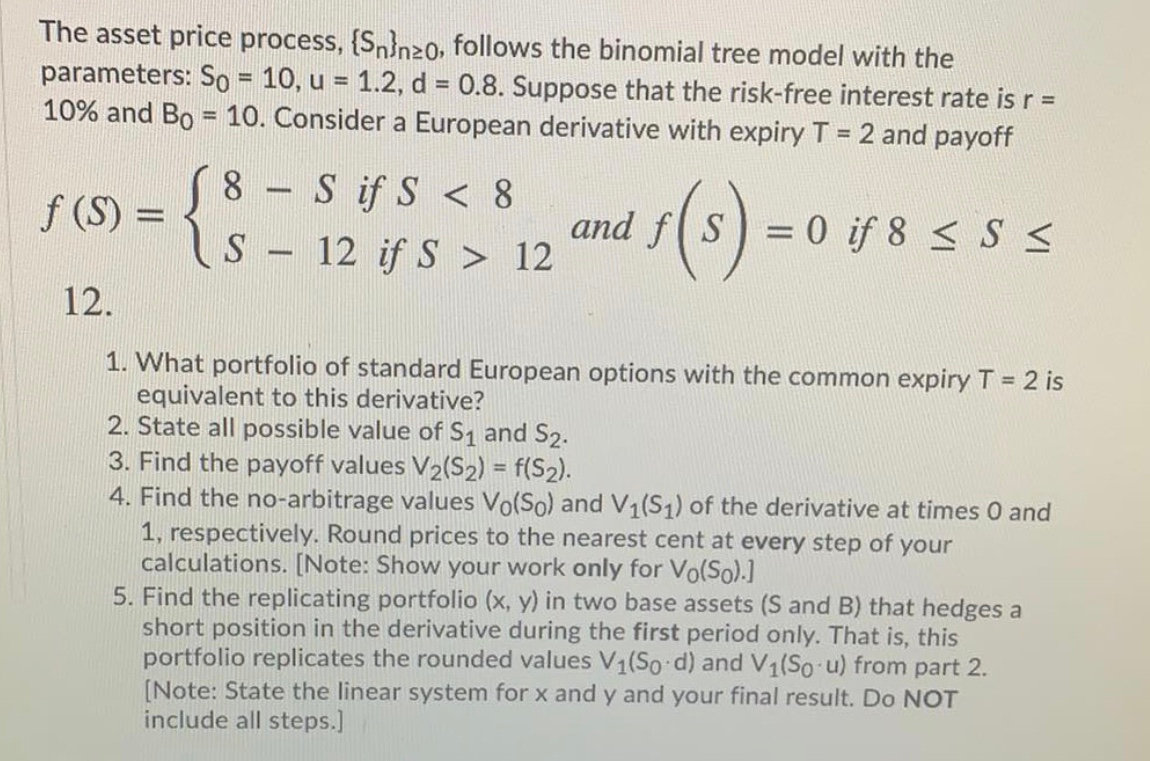

The asset price process, {Sninz0, follows the binomial tree model with the parameters: So = 10, u = 1.2, d = 0.8. Suppose that the risk-free interest rate is r = 10% and Bo = 10. Consider a European derivative with expiry T = 2 and payoff 8 - S if S 12 12. me s(s) - 1. What portfolio of standard European options with the common expiry T = 2 is equivalent to this derivative? 2. State all possible value of S1 and S2. 3. Find the payoff values V2(S2) = f(S2). 4. Find the no-arbitrage values Vo(So) and V1(S1) of the derivative at times O and 1, respectively. Round prices to the nearest cent at every step of your calculations. [Note: Show your work only for Vo(So).] 5. Find the replicating portfolio (x, y) in two base assets (S and B) that hedges a short position in the derivative during the first period only. That is, this portfolio replicates the rounded values V1(So. d) and V1(Sou) from part 2. [Note: State the linear system for x and y and your final result. Do NOT include all steps.] The asset price process, {Sninz0, follows the binomial tree model with the parameters: So = 10, u = 1.2, d = 0.8. Suppose that the risk-free interest rate is r = 10% and Bo = 10. Consider a European derivative with expiry T = 2 and payoff 8 - S if S 12 12. me s(s) - 1. What portfolio of standard European options with the common expiry T = 2 is equivalent to this derivative? 2. State all possible value of S1 and S2. 3. Find the payoff values V2(S2) = f(S2). 4. Find the no-arbitrage values Vo(So) and V1(S1) of the derivative at times O and 1, respectively. Round prices to the nearest cent at every step of your calculations. [Note: Show your work only for Vo(So).] 5. Find the replicating portfolio (x, y) in two base assets (S and B) that hedges a short position in the derivative during the first period only. That is, this portfolio replicates the rounded values V1(So. d) and V1(Sou) from part 2. [Note: State the linear system for x and y and your final result. Do NOT include all steps.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts