Question: anyone know what I did wrong? Computing EPS: Convertible Debt Shaffer Corporation issued 220, $1,000, 10% convertible bonds in 2019 at face value. Each bond

anyone know what I did wrong?

anyone know what I did wrong?

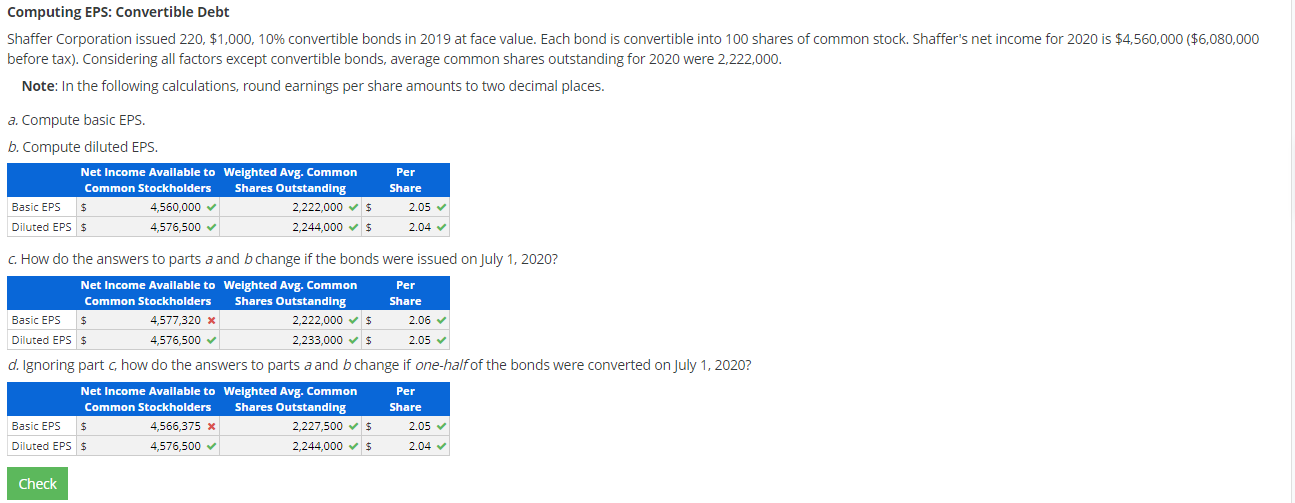

Computing EPS: Convertible Debt Shaffer Corporation issued 220, $1,000, 10% convertible bonds in 2019 at face value. Each bond is convertible into 100 shares of common stock. Shaffer's net income for 2020 is $4,560,000 ($6,080,000 before tax). Considering all factors except convertible bonds, average common shares outstanding for 2020 were 2,222,000. Note: In the following calculations, round earnings per share amounts to two decimal places. a. Compute basic EPS. b. Compute diluted EPS. Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding Basic EPS $ 4,560,000 2,222,000 Diluted EPS $ 4,576,500 2,244,000 $ $ Per Share 2.05 2.04 c. How do the answers to parts a and b change if the bonds were issued on July 1, 2020? Net Income Available to Weighted Avg. Common Per Common Stockholders Shares Outstanding Share Basic EPS $ 4,577,320 x 2,222,000 $ 2.06 Diluted EPS $ 4,576,500 2,233,000 $ 2.05 d. Ignoring part chow do the answers to parts a and b change if one-half of the bonds were converted on July 1, 2020? Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding Basic EPS $ 4,566,375 x 2,227,500 Diluted EPS $ 4,576,500 2,244,000 $ $ Per Share 2.05 2.04 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts