Question: Computing EPS: Convertible Debt Shaffer Corporation issued 100, $1,000, 10% convertible bonds in the prior year at face value. Each bond is convertible into 100

Computing EPS: Convertible Debt

Shaffer Corporation issued 100, $1,000, 10% convertible bonds in the prior year at face value. Each bond is convertible into 100 shares of common stock. The companys net income for the current year is $1,824,000 ($2,432,000 before tax). Excluding the convertible bonds, average common shares outstanding for the year were 1,010,000.

Note: In the following calculations, enter the earnings per share amounts in dollars and cents, rounded to the nearest penny.

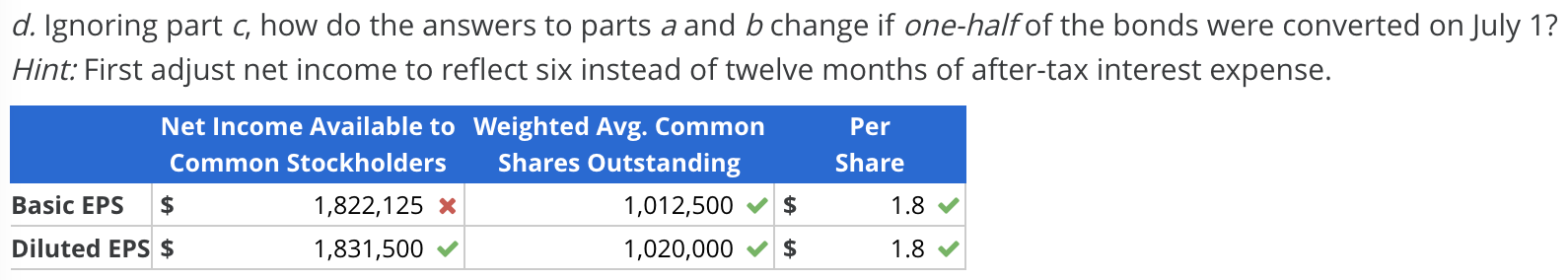

d. Ignoring part c, how do the answers to parts a and b change if one-half of the bonds were converted on July 1? Hint: First adjust net income to reflect six instead of twelve months of after-tax interest expense.

d. Ignoring part c, how do the answers to parts a and b change if one-half of the bonds were converted on July 1 ? Hint: First adjust net income to reflect six instead of twelve months of after-tax interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts