Question: Anyone know what the answer is to the bottom question? Sebrele Enterprises Inc. is a Canadian-based firm evaluating a project in Mexico. You have the

Anyone know what the answer is to the bottom question?

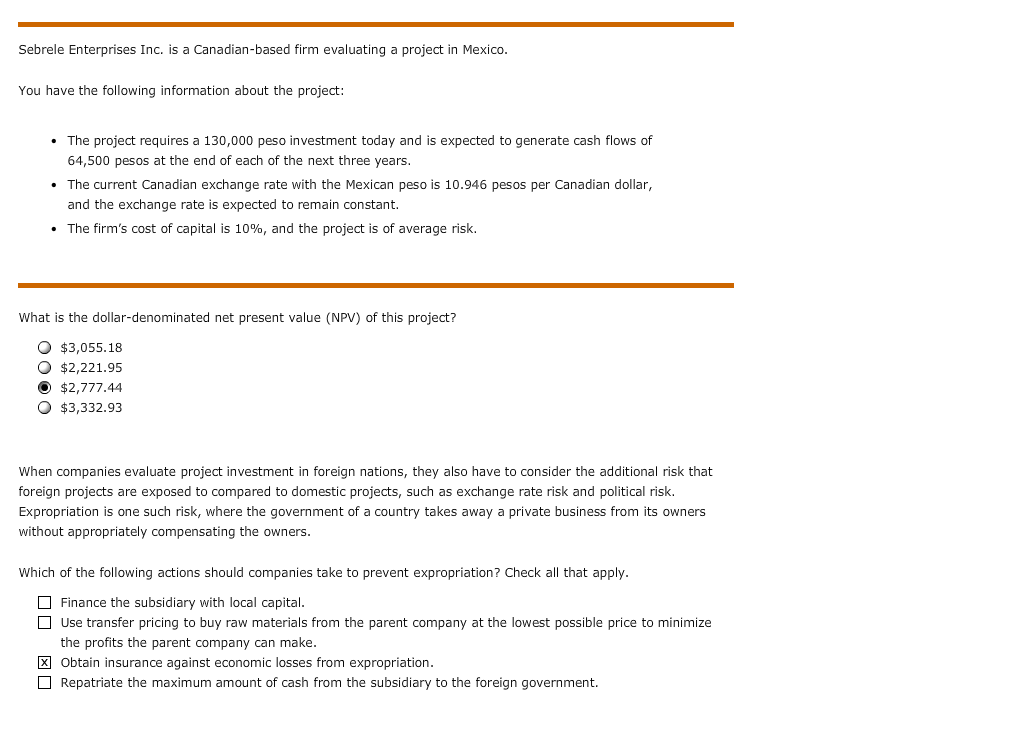

Sebrele Enterprises Inc. is a Canadian-based firm evaluating a project in Mexico. You have the following information about the project: The project requires a 130,000 peso investment today and is expected to generate cash flows of 64,500 pesos at the end of each of the next three years. The current Canadian exchange rate with the Mexican peso is 10.946 pesos per Canadian dollar, and the exchange rate is expected to remain constant. The firm's cost of capital is 10%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? $3,055.18 $2,221.95 $2,777.44 $3,332.93 When companies evaluate project investment in foreign nations, they also have to consider the additional risk that foreign projects are exposed to compared to domestic projects, such as exchange rate risk and political risk. Expropriation is one such risk, where the government of a country takes away a private business from its owners without appropriately compensating the owners. Which of the following actions should companies take to prevent expropriation? Check all that apply. Finance the subsidiary with local capital. Use transfer pricing to buy raw materials from the parent company at the lowest possible price to minimize the profits the parent company can make. X Obtain insurance against economic losses from expropriation. O Repatriate the maximum amount of cash from the subsidiary to the foreign government

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts