Question: Not sure if what I put for the first question is correct, please help with both parts! Sebrele Enterprises Inc. is a U.S.-based firm evaluating

Not sure if what I put for the first question is correct, please help with both parts!

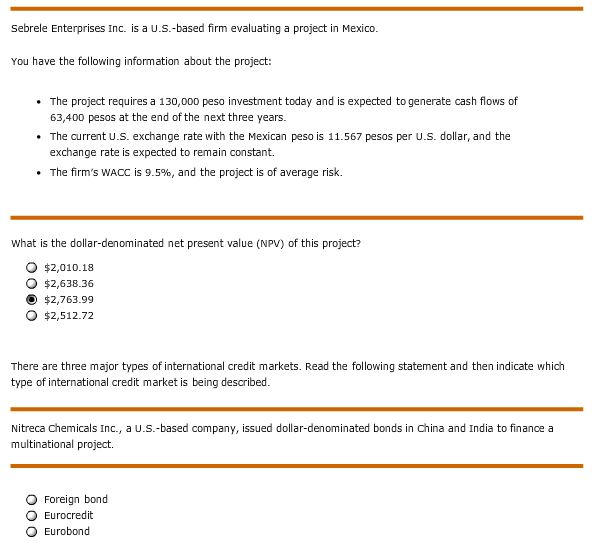

Sebrele Enterprises Inc. is a U.S.-based firm evaluating a project in Mexico. You have the following information about the project: The project requires a 130,000 peso investment today and is expected to generate cash flows of 63,400 pesos at the end of the next three years. . The current U.S. exchange rate with the Mexican peso is 11.567 pesos per U.S. dollar, and the exchange rate is expected to remain constant The firm's WACC is 9.5%, and the project is of average risk. . what is the dollar-denominated net present value (NPV) of this projecta O $2,010.18 o $2,638.36 O $2,763.99 O $2,512.72 There are three major types of international credit markets. Read the following statement and then indicate which type of international credit market is being described. Nitreca Chemicals Inc., a u.S.-based company, issued dollar-denominated bonds in China and India to finance a multinational project. O Foreign bond O Eurocredit O Eurobond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts