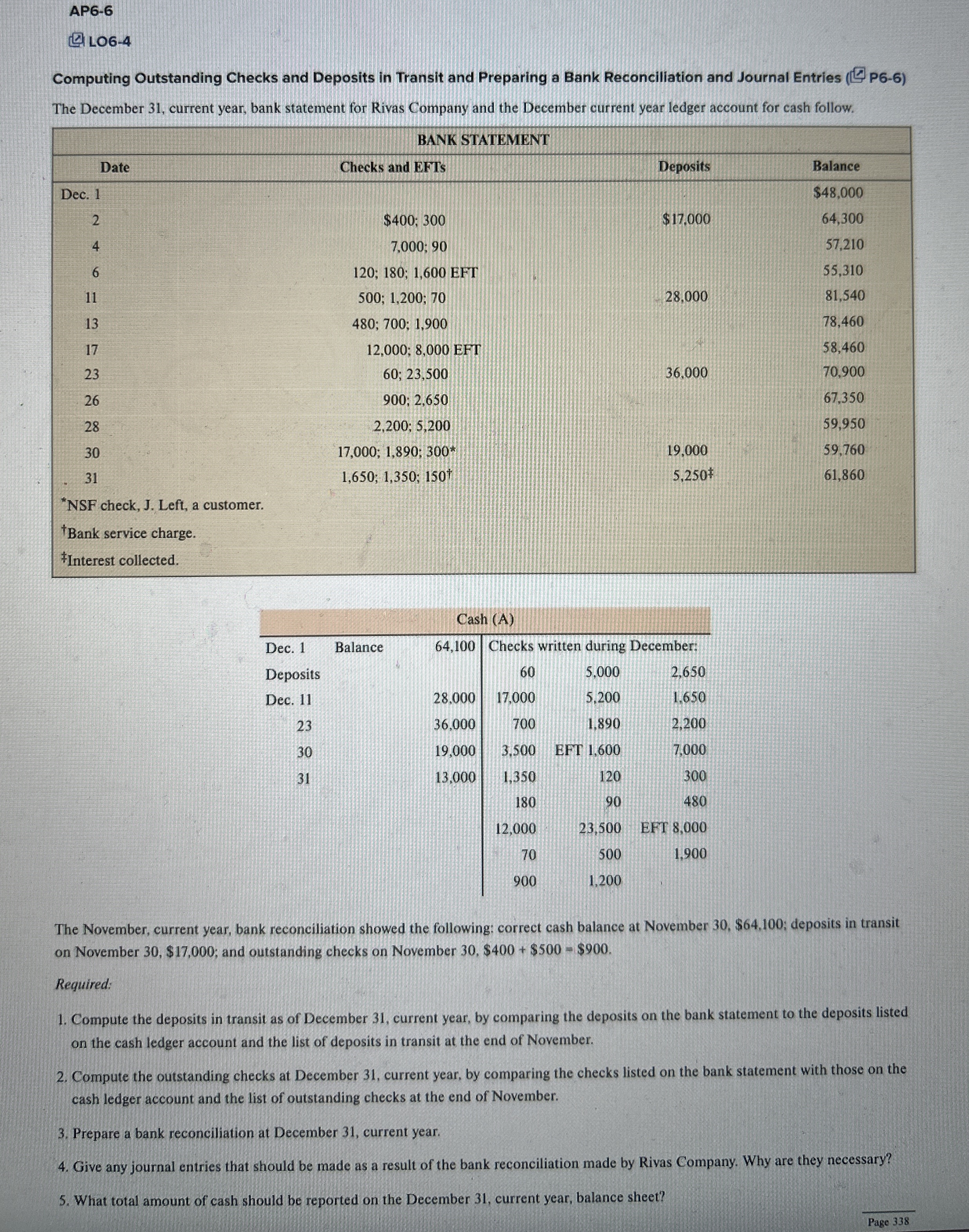

Question: AP 6 - 6 Computing outstanding checks and deposits in transit and preparing a bank reonciliation and journal entries. The december 3 1 , current

AP Computing outstanding checks and deposits in transit and preparing a bank reonciliation and journal entries. The december current year, bank statement for rivas company and the decemeber current year ledger account for cash flow. The novemeber, current year, bank reconciliation showed the following: correct cash balance at november $; deposits in transit on November $; and outstanding check on November $ $$

Required:

Compute the deposits in transit as of December current year, by comparing the deposits on the bank statement to the deposits listed on the cash ledger account and list of deposits in transit at the end of november

Compute the outstanding checks at december current year, by comparing the checks listed on the bank statement with those on the cash ledger account and the list of outstanding checks at the end of november

Prepare a bank reconciliation at december current year.

Give any journal entries that should be made as a result of the bank reconciliation made by

Rivas Company. Why are they necessary?

What total amount of cash should be reported on the december current year, balance sheet?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock