Question: AP 6 - 8 ( Work Space in Home Expenses and CCA ) Billy Jow is a music instructor at a local high school in

AP Work Space in Home Expenses and CCA

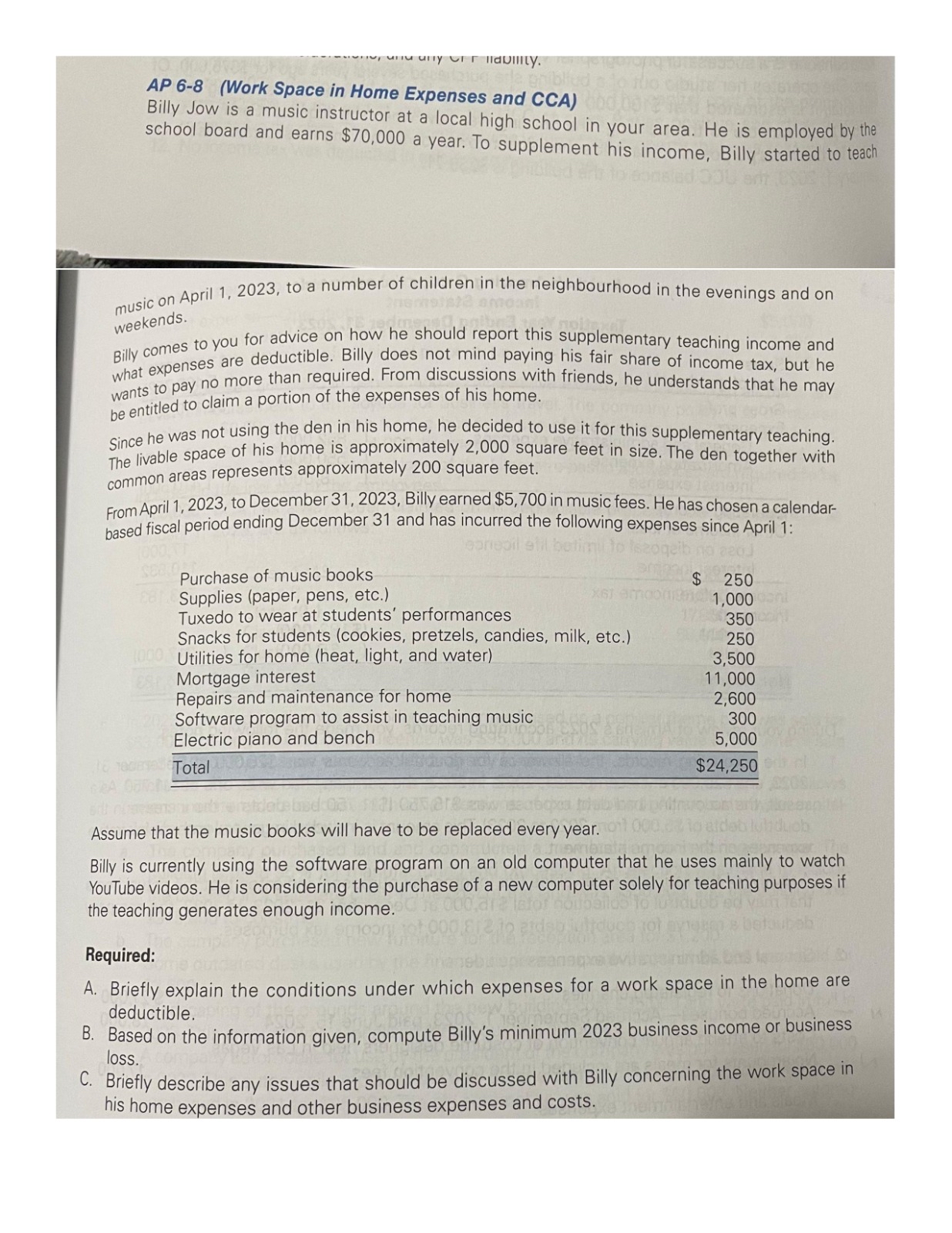

Billy Jow is a music instructor at a local high school in your area. He is employed by the school board and earns $ a year. To supplement his income, Billy started to teach

music on April to a number of children in the neighbourhood in the evenings and on weekends.

Billy comes to you for advice on how he should report this supplementary teaching income and what expenses are deductible. Billy does not mind paying his fair share of income tax, but he wants to pay no more than required. From discussions with friends, he understands that he may be entitled to claim a portion of the expenses of his home.

Since he was not using the den in his home, he decided to use it for this supplementary teaching. The livable space of his home is approximately square feet in size. The den together with common areas represents approximately square feet.

From April to December Billy earned $ in music fees. He has chosen a calendarbased fiscal period ending December and has incurred the following expenses since April :

tablePurchase of music books,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock