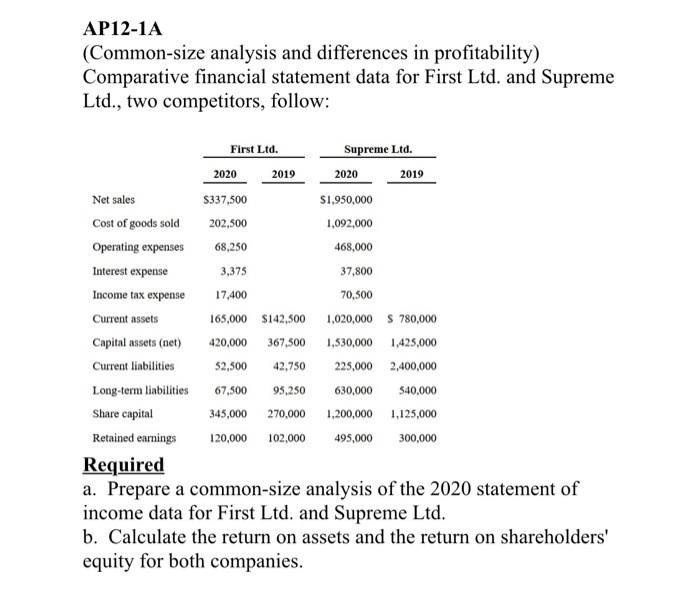

Question: AP12-1A (Common-size analysis and differences in profitability) Comparative financial statement data for First Ltd. and Supreme Ltd., two competitors, follow: First Ltd. Supreme Ltd. 2020

AP12-1A (Common-size analysis and differences in profitability) Comparative financial statement data for First Ltd. and Supreme Ltd., two competitors, follow: First Ltd. Supreme Ltd. 2020 2019 2020 2019 Net sales $337,500 $1,950,000 Cost of goods sold 202,500 1,092,000 Operating expenses 68,250 468,000 Interest expense 3,375 37,800 Income tax expense 17,400 70,500 Current assets 165,000 $142,500 1,020,000 S 780,000 Capital assets (net) 420,000 367,500 1,530,000 1,425,000 Current liabilities 52,500 42,750 225,000 2,400,000 Long-term liabilities 67,500 95,250 630,000 540,000 Share capital 345,000 270,000 1,200,000 1,125,000 Retained earnings 20,000 102,000 495,000 300,000 Required a. Prepare a common-size analysis of the 2020 statement of income data for First Ltd. and Supreme Ltd. b. Calculate the return on assets and the return on shareholders' equity for both companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts