Question: aper.pdf Instruction(s): Attempt all questions Open with Google Docs Question 1: (15+5=20) A. Following is given the premerger information about firm X (acquirer) and firm

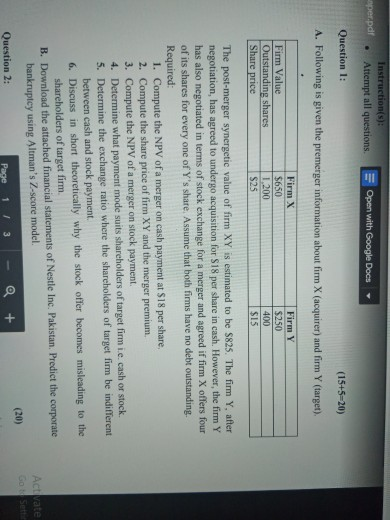

aper.pdf Instruction(s): Attempt all questions Open with Google Docs Question 1: (15+5=20) A. Following is given the premerger information about firm X (acquirer) and firm Y(target), Firm Value Outstanding shares Share price Firm X $650 1.200 $25 Firm Y $250 400 $15 The post-merger synergetic value of firm XY is estimated to be $825. The firm Y. after negotiation, has agreed to undergo acquisition for S18 per share in cash. However, the firm Y has also negotiated in terms of stock exchange for a merger and agreed if firm X offers four of its shares for every one of Y's share. Assume that both firms have no debt outstanding Required: 1. Compute the NPV of a merger on cash payment at $18 per share, 2. Compute the share price of firm XY and the merger premium, 3. Compute the NPV of a merger on stock payment. 4. Determine what payment mode suits shareholders of target firm i.e. cash or stock. 5. Determine the exchange ratio where the shareholders of target firm be indifferent between cash and stock payment. 6. Discuss in short theoretically why the stock offer becomes misleading to the shareholders of target firm B. Download the attached financial statements of Nestle Inc. Pakistan. Predict the corporate bankruptcy using Altman's Z-score model Question 2: (20) Page 1 / 3 Act Vate Gol Sett

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts