Question: Apollo Planning Audit Mini Case In this mini-case you will perform some procedures required as a part of audit planning. For ease your audit

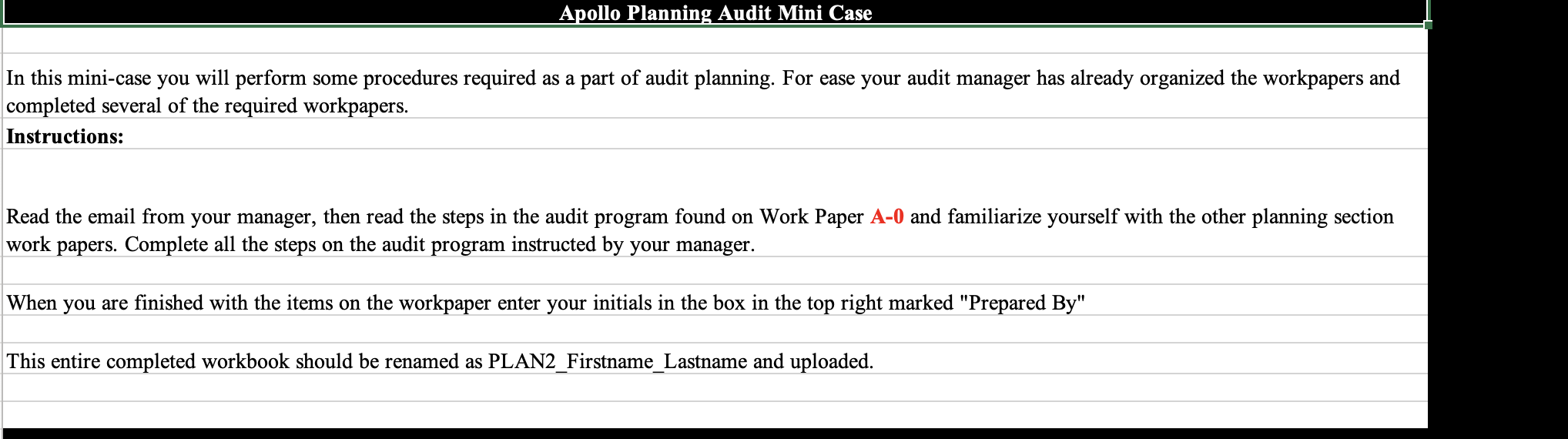

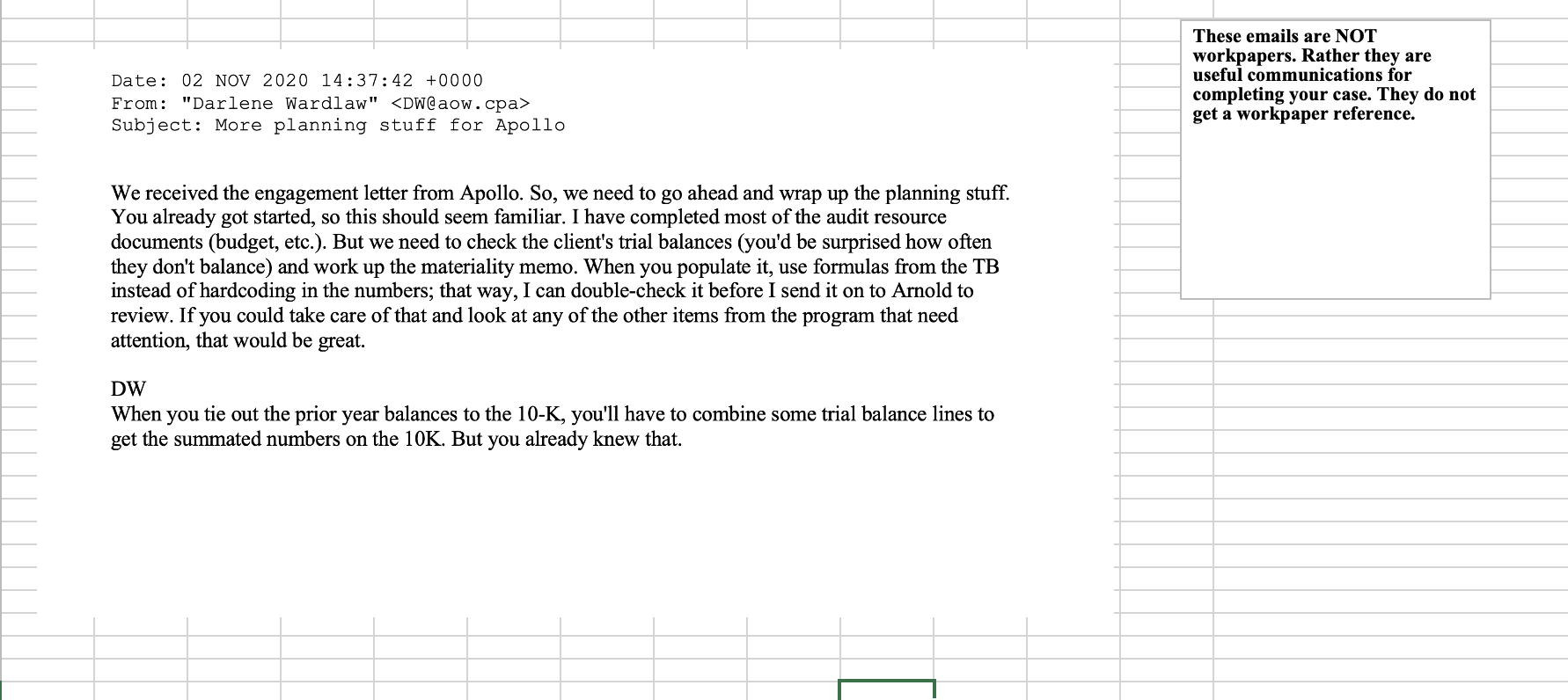

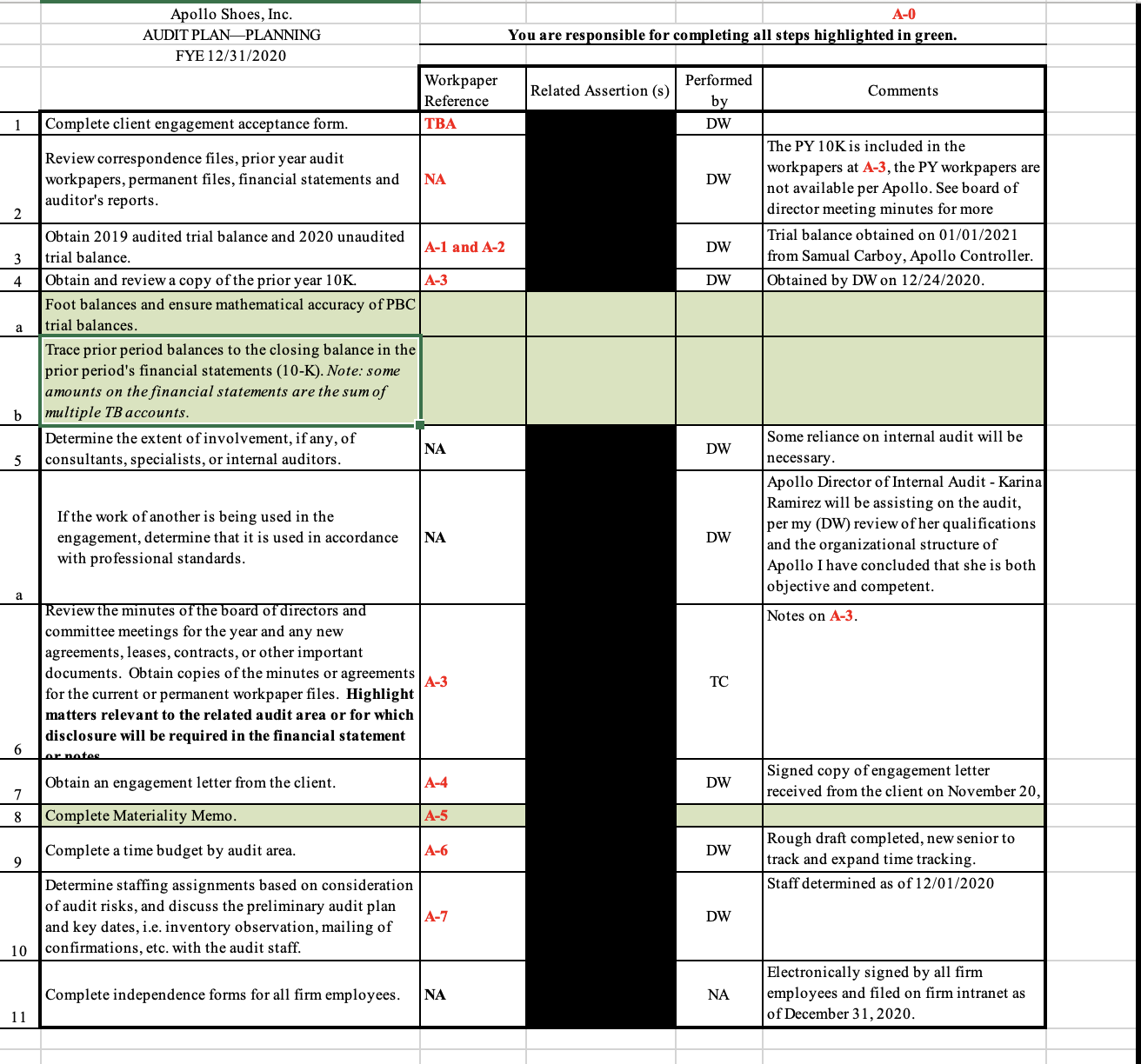

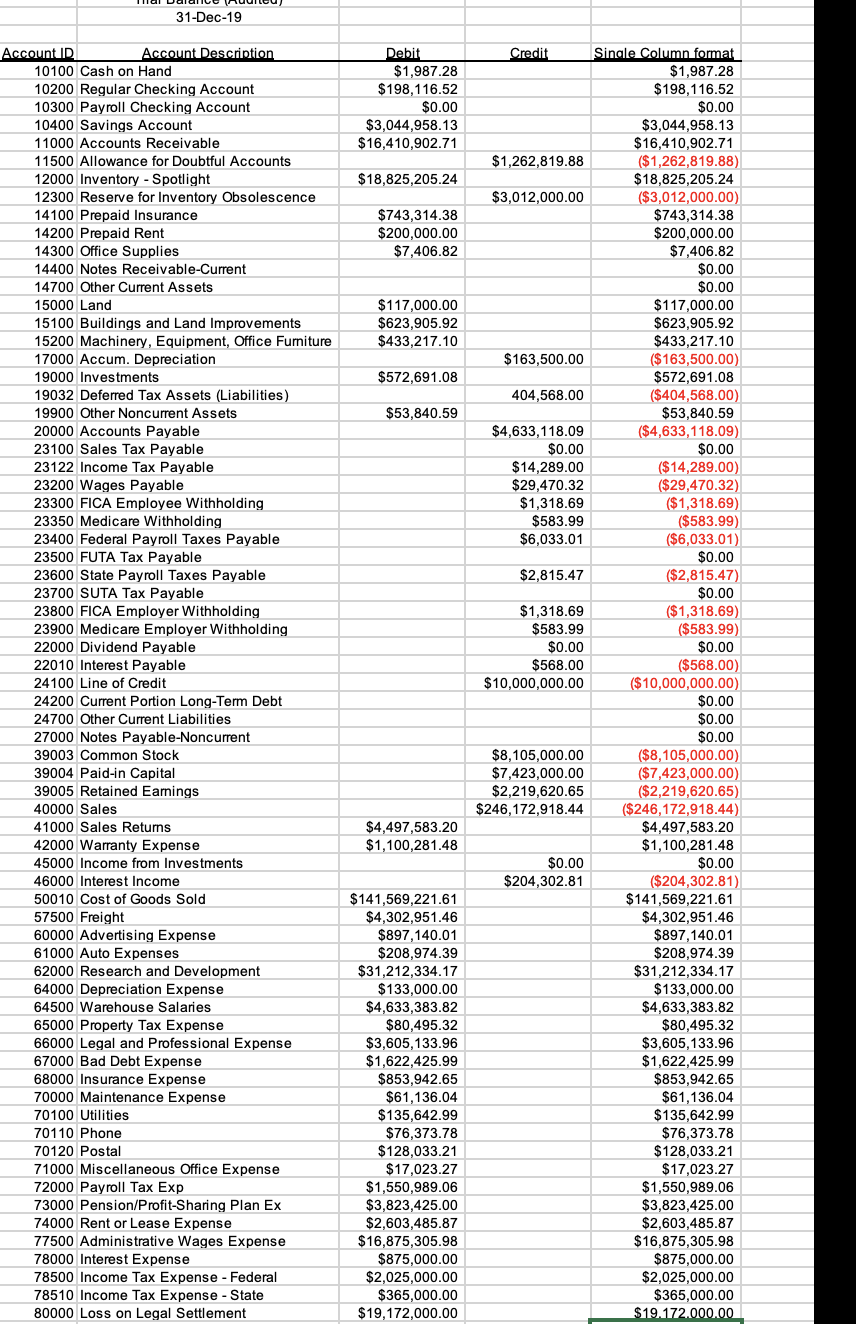

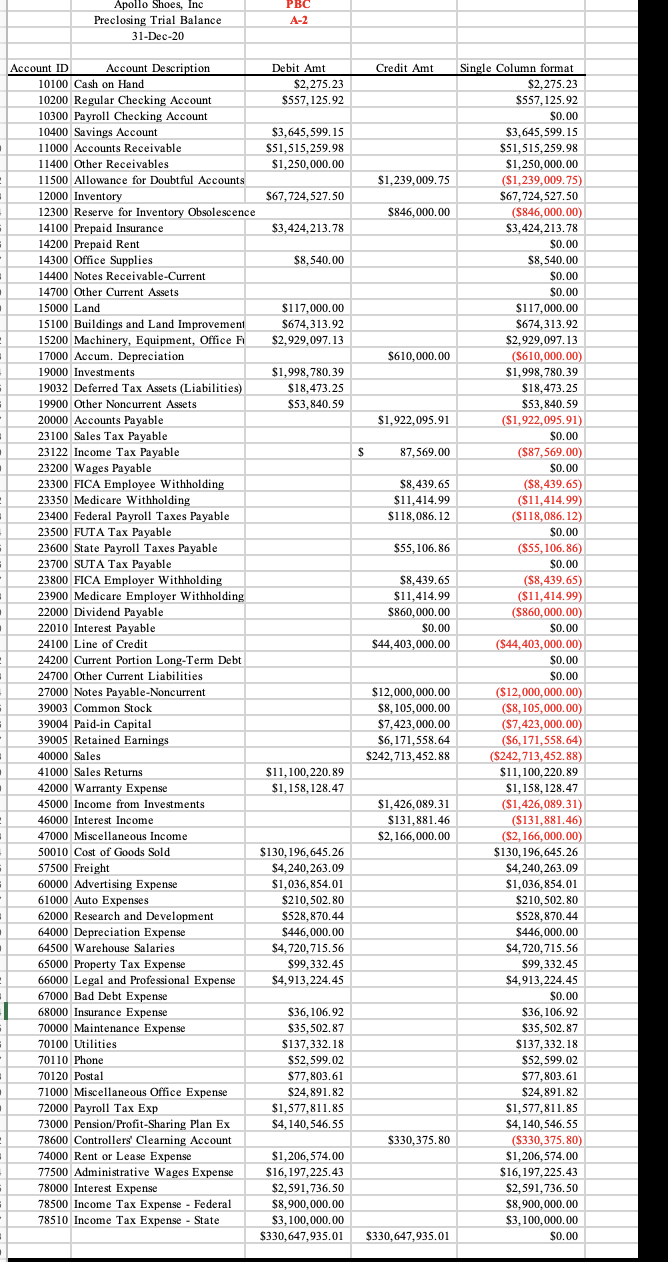

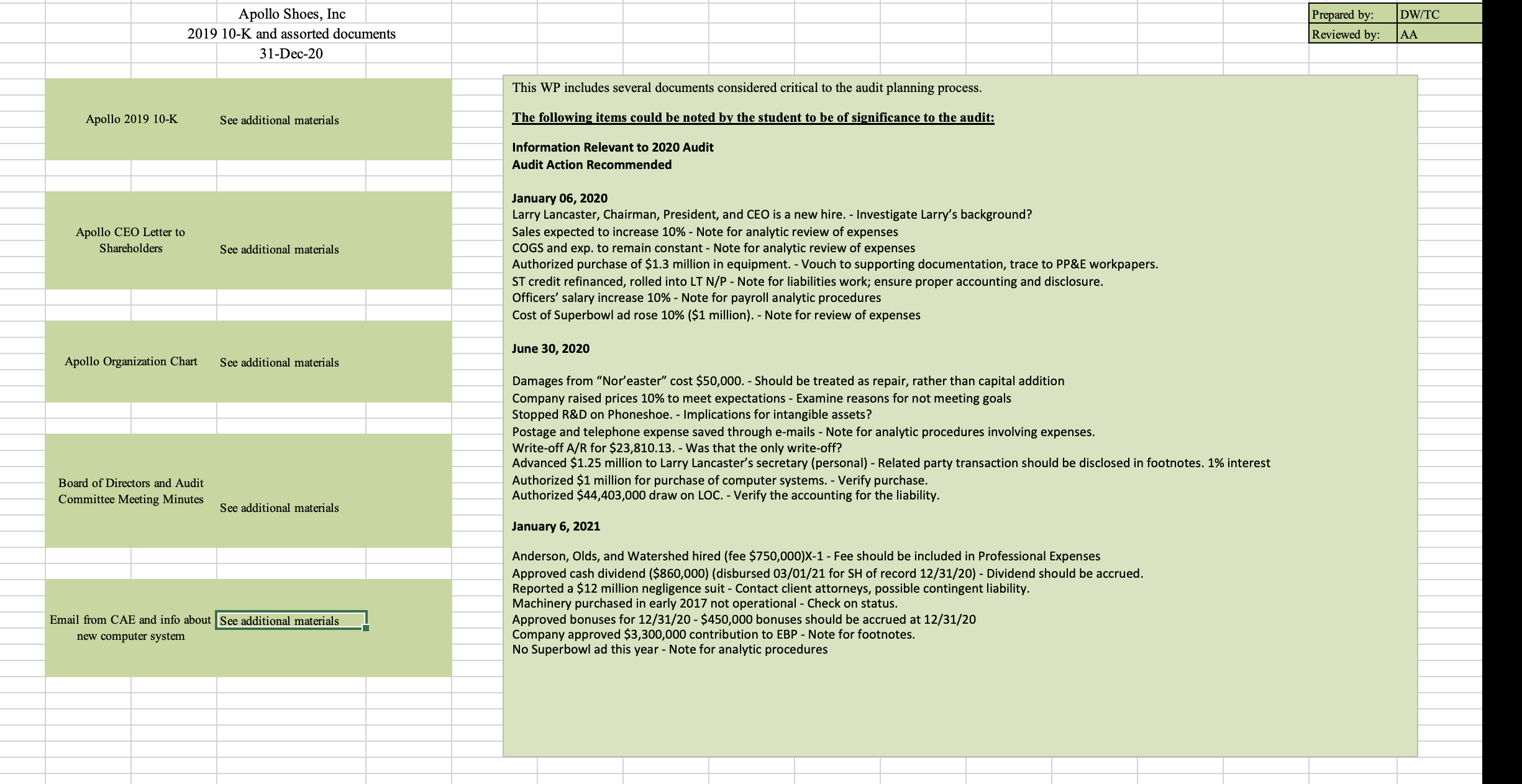

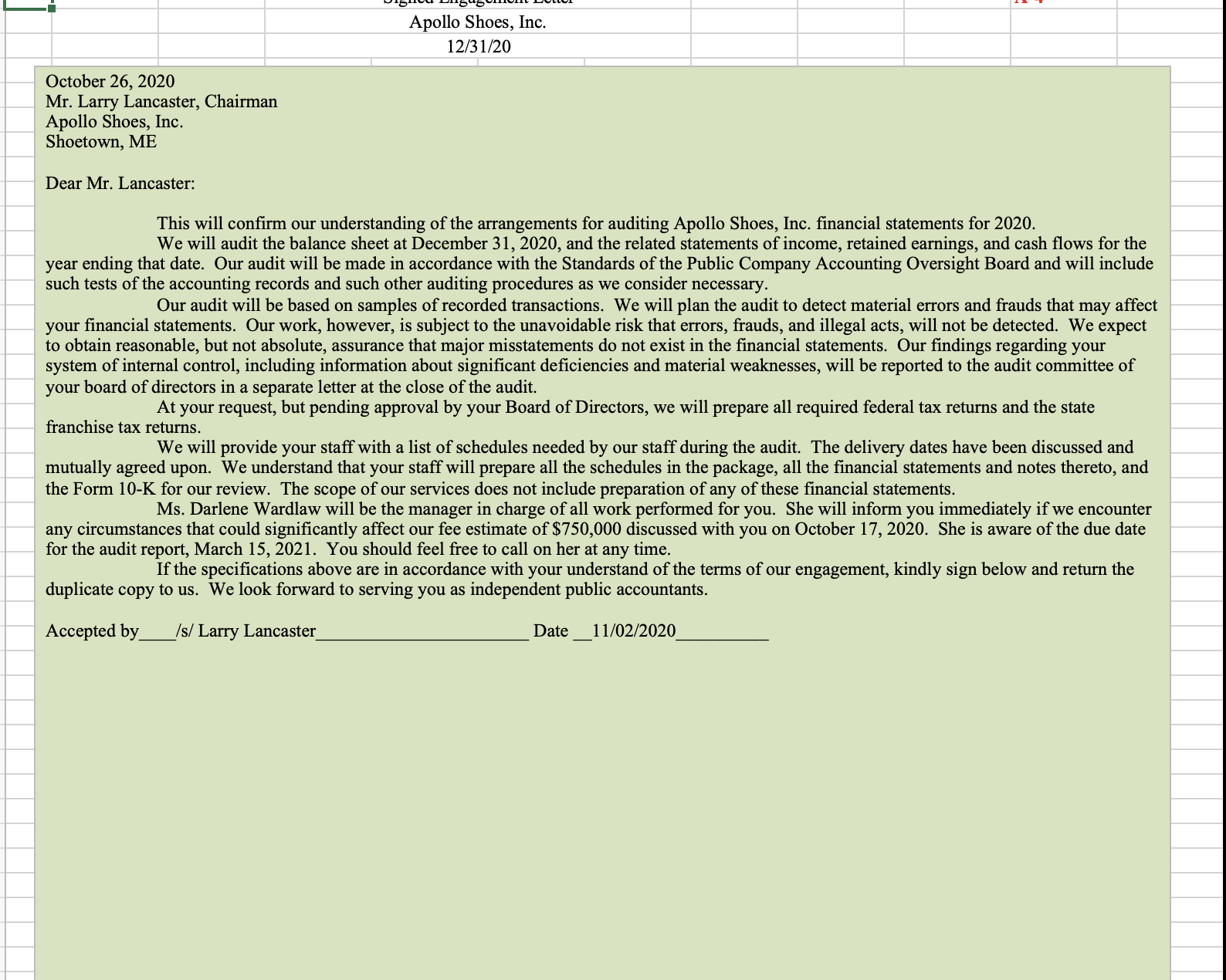

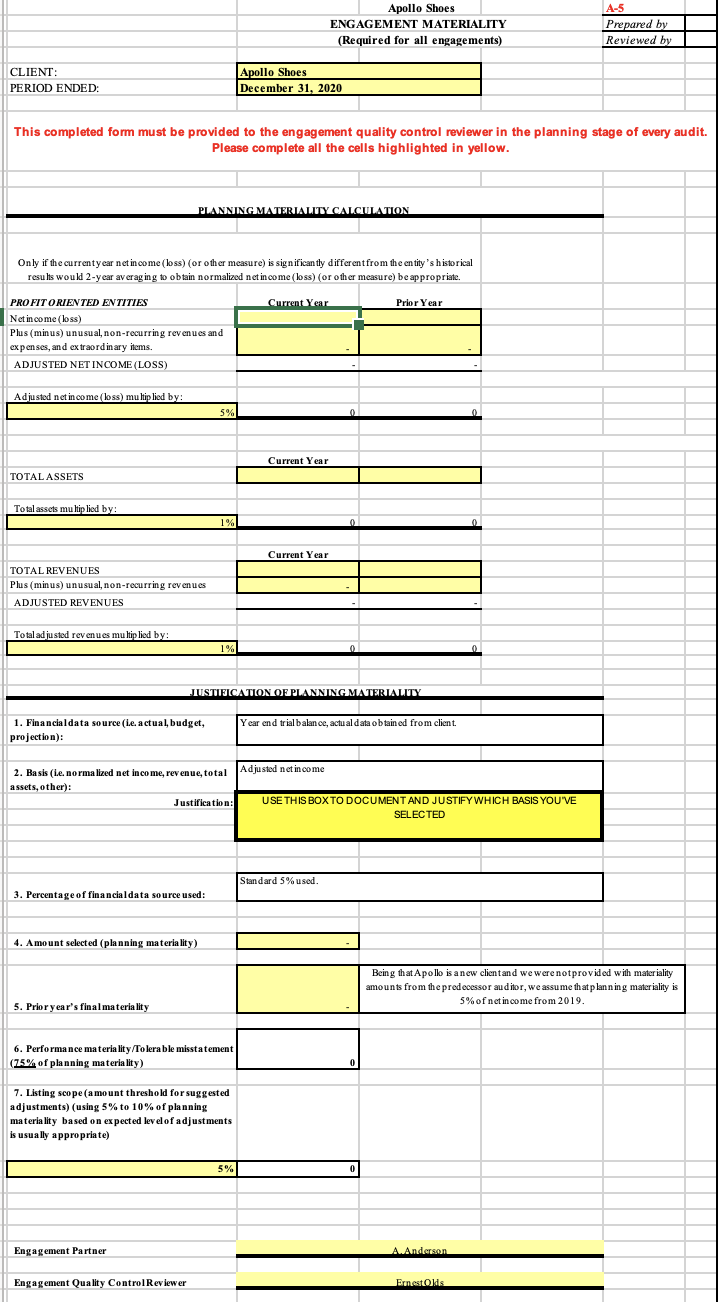

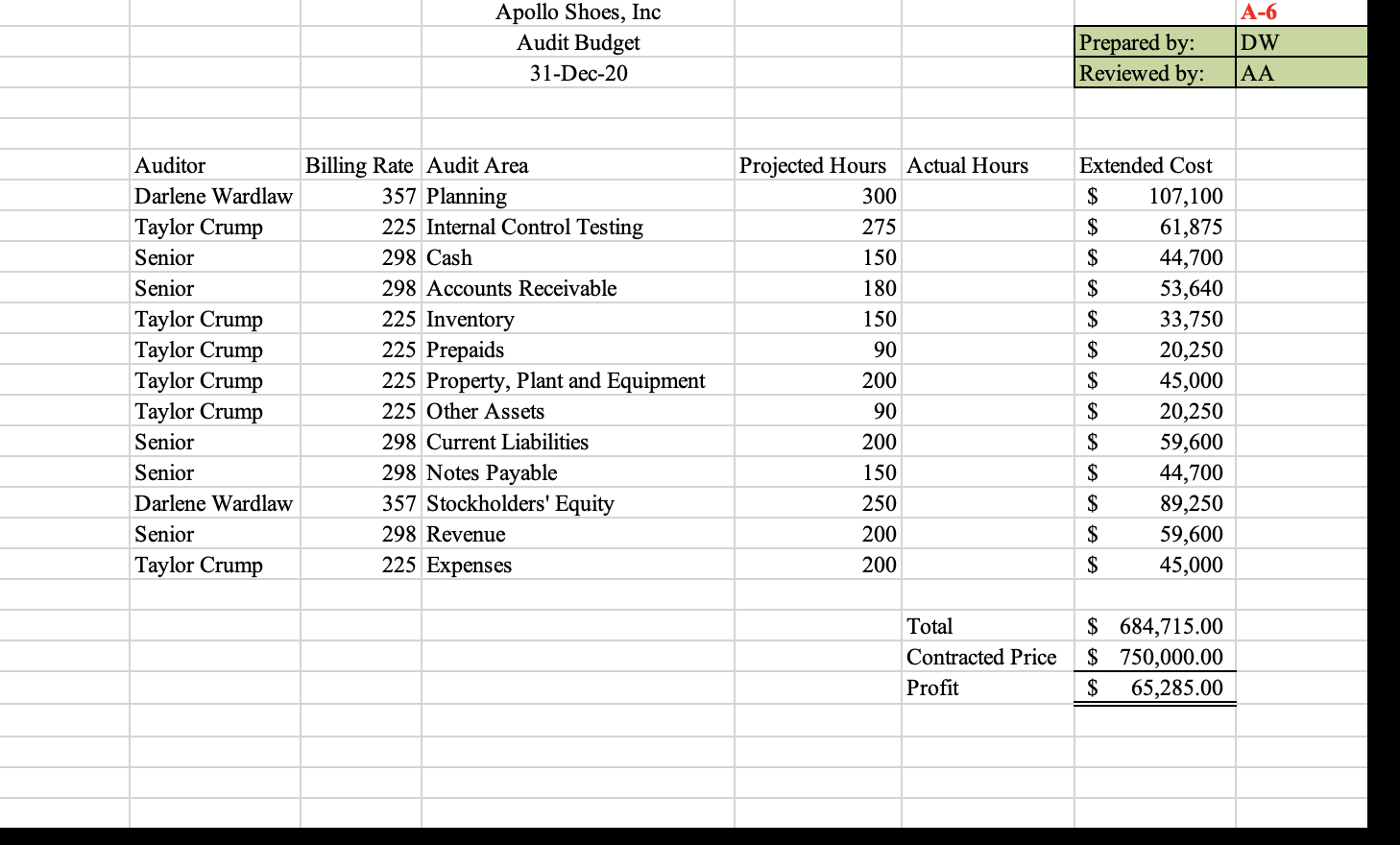

Apollo Planning Audit Mini Case In this mini-case you will perform some procedures required as a part of audit planning. For ease your audit manager has already organized the workpapers and completed several of the required workpapers. Instructions: Read the email from your manager, then read the steps in the audit program found on Work Paper A-0 and familiarize yourself with the other planning section work papers. Complete all the steps on the audit program instructed by your manager. When you are finished with the items on the workpaper enter your initials in the box in the top right marked "Prepared By" This entire completed workbook should be renamed as PLAN2_Firstname_Lastname and uploaded. Date: 02 NOV 2020 14:37:42 +0000 From: "Darlene Wardlaw" Subject: More planning stuff for Apollo We received the engagement letter from Apollo. So, we need to go ahead and wrap up the planning stuff. You already got started, so this should seem familiar. I have completed most of the audit resource documents (budget, etc.). But we need to check the client's trial balances (you'd be surprised how often they don't balance) and work up the materiality memo. When you populate it, use formulas from the TB instead of hardcoding in the numbers; that way, I can double-check it before I send it on to Arnold to review. If you could take care of that and look at any of the other items from the program that need attention, that would be great. When you tie out the prior year balances to the 10-K, you'll have to combine some trial balance lines to get the summated numbers on the 10K. But you already knew that. These emails are NOT workpapers. Rather they are useful communications for completing your case. They do not get a workpaper reference. Apollo Shoes, Inc. AUDIT PLAN-PLANNING FYE 12/31/2020 A-0 You are responsible for completing all steps highlighted in green. Workpaper Performed Related Assertion (s) Reference by TBA Comments 1 Complete client engagement acceptance form. Review correspondence files, prior year audit workpapers, permanent files, financial statements and NA DW auditor's reports. The PY 10K is included in the workpapers at A-3, the PY workpapers are not available per Apollo. See board of director meeting minutes for more 2 3 Obtain 2019 audited trial balance and 2020 unaudited trial balance. Trial balance obtained on 01/01/2021 A-1 and A-2 DW 4 Obtain and review a copy of the prior year 10K. A-3 from Samual Carboy, Apollo Controller. Obtained by DW on 12/24/2020. a b Foot balances and ensure mathematical accuracy of PBC trial balances. Trace prior period balances to the closing balance in the prior period's financial statements (10-K). Note: some amounts on the financial statements are the sum of multiple TB accounts. Determine the extent of involvement, if any, of NA 5 consultants, specialists, or internal auditors. Some reliance on internal audit will be necessary. If the work of another is being used in the engagement, determine that it is used in accordance NA with professional standards. a Review the minutes of the board of directors and 6 committee meetings for the year and any new agreements, leases, contracts, or other important documents. Obtain copies of the minutes or agreements A-3 for the current or permanent workpaper files. Highlight matters relevant to the related audit area or for which disclosure will be required in the financial statement or notes TC Apollo Director of Internal Audit - Karina Ramirez will be assisting on the audit, per my (DW) review of her qualifications and the organizational structure of Apollo I have concluded that she is both objective and competent. Notes on A-3. Obtain an engagement letter from the client. 7 A-4 8 Complete Materiality Memo. A-5 Complete a time budget by audit area. Signed copy of engagement letter received from the client on November 20, Rough draft completed, new senior to A-6 9 track and expand time tracking. 10 Determine staffing assignments based on consideration of audit risks, and discuss the preliminary audit plan and key dates, i.e. inventory observation, mailing of confirmations, etc. with the audit staff. Staff determined as of 12/01/2020 A-7 Complete independence forms for all firm employees. NA NA Electronically signed by all firm employees and filed on firm intranet as 11 of December 31, 2020. 31-Dec-19 Account ID 10100 Cash on Hand 10200 Regular Checking Account Account Description Debit Credit Single Column format $1,987.28 $198,116.52 10300 Payroll Checking Account $0.00 $1,987.28 $198,116.52 $0.00 10400 Savings Account $3,044,958.13 $3,044,958.13 11000 Accounts Receivable $16,410,902.71 $16,410,902.71 11500 Allowance for Doubtful Accounts $1,262,819.88 ($1,262,819.88) 12000 Inventory - Spotlight $18,825,205.24 $18,825,205.24 12300 Reserve for Inventory Obsolescence $3,012,000.00 ($3,012,000.00) 14100 Prepaid Insurance $743,314.38 $743,314.38 14200 Prepaid Rent $200,000.00 $200,000.00 $7,406.82 14300 Office Supplies 14400 Notes Receivable-Current 14700 Other Current Assets 15000 Land $7,406.82 $0.00 $0.00 $117,000.00 $117,000.00 15100 Buildings and Land Improvements $623,905.92 $623,905.92 15200 Machinery, Equipment, Office Furniture $433,217.10 $433,217.10 17000 Accum. Depreciation $163,500.00 ($163,500.00) 19000 Investments $572,691.08 19032 Deferred Tax Assets (Liabilities) 404,568.00 $572,691.08 ($404,568.00) 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable $53,840.59 23122 Income Tax Payable 23200 Wages Payable $4,633,118.09 $0.00 $14,289.00 $53,840.59 ($4,633,118.09) $0.00 ($14,289.00) $29,470.32 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23800 FICA Employer Withholding $1,318.69 $583.99 $6,033.01 ($29,470.32) ($1,318.69) ($583.99) ($6,033.01) $0.00 $2,815.47 ($2,815.47) 23700 SUTA Tax Payable 23900 Medicare Employer Withholding $0.00 $1,318.69 ($1,318.69) $583.99 22000 Dividend Payable 22010 Interest Payable $0.00 $568.00 ($583.99) $0.00 ($568.00) 24100 Line of Credit $10,000,000.00 ($10,000,000.00) 24200 Current Portion Long-Term Debt $0.00 24700 Other Current Liabilities $0.00 27000 Notes Payable-Noncurrent $0.00 39003 Common Stock $8,105,000.00 ($8,105,000.00) 39004 Paid-in Capital $7,423,000.00 ($7,423,000.00) 39005 Retained Earnings 40000 Sales $2,219,620.65 ($2,219,620.65) $246,172,918.44 ($246,172,918.44) 41000 Sales Returns $4,497,583.20 $4,497,583.20 42000 Warranty Expense $1,100,281.48 $1,100,281.48 45000 Income from Investments $0.00 $0.00 46000 Interest Income $204,302.81 ($204,302.81) 50010 Cost of Goods Sold $141,569,221.61 $141,569,221.61 57500 Freight $4,302,951.46 $4,302,951.46 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense $3,605,133.96 67000 Bad Debt Expense $1,622,425.99 68000 Insurance Expense 70000 Maintenance Expense 70100 Utilities 70110 Phone 70120 Postal 71000 Miscellaneous Office Expense $897,140.01 $208,974.39 $31,212,334.17 $133,000.00 $4,633,383.82 $80,495.32 $853,942.65 $61,136.04 $135,642.99 $76,373.78 $128,033.21 $17,023.27 $897,140.01 $208,974.39 $31,212,334.17 $133,000.00 $4,633,383.82 $80,495.32 $3,605,133.96 $1,622,425.99 $853,942.65 $135,642.99 $76,373.78 $128,033.21 $61,136.04 72000 Payroll Tax Exp $1,550,989.06 73000 Pension/Profit-Sharing Plan Ex $3,823,425.00 74000 Rent or Lease Expense $2,603,485.87 77500 Administrative Wages Expense $16,875,305.98 $17,023.27 $1,550,989.06 $3,823,425.00 $2,603,485.87 $16,875,305.98 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State 80000 Loss on Legal Settlement $875,000.00 $2,025,000.00 $365,000.00 $19,172,000.00 $875,000.00 $2,025,000.00 $365,000.00 $19.172.000.00 Account ID Apollo Shoes, Inc Preclosing Trial Balance 31-Dec-20 PBC A-2 Account Description Debit Amt 10100 Cash on Hand 10200 Regular Checking Account $2,275.23 $557,125.92 Credit Amt Single Column format $2,275.23 $557,125.92 $0.00 10300 Payroll Checking Account 10400 Savings Account 11000 Accounts Receivable $3,645,599.15 $51,515,259.98 $3,645,599.15 $51,515,259.98 11400 Other Receivables $1,250,000.00 $1,250,000.00 11500 Allowance for Doubtful Accounts $1,239,009.75 ($1,239,009.75) 12000 Inventory $67,724,527.50 $67,724,527.50 12300 Reserve for Inventory Obsolescence $846,000.00 ($846,000.00) 14100 Prepaid Insurance $3,424,213.78 $3,424,213.78 14200 Prepaid Rent 14300 Office Supplies 14400 Notes Receivable-Current 14700 Other Current Assets 15000 Land $0.00 $8,540.00 $8,540.00 $0.00 $0.00 $117,000.00 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding $117,000.00 15100 Buildings and Land Improvement $674,313.92 $674,313.92 15200 Machinery, Equipment, Office F $2,929,097.13 $2,929,097.13 17000 Accum. Depreciation $610,000.00 ($610,000.00) 19000 Investments 19032 Deferred Tax Assets (Liabilities) 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable 23122 Income Tax Payable 23200 Wages Payable $1,998,780.39 $1,998,780.39 $18,473.25 $18,473.25 $53,840.59 $1,922,095.91 $0.00 $ 87,569.00 ($87,569.00) $0.00 $8,439.65 $11,414.99 ($8,439.65) $118,086.12 ($11,414.99) ($118,086.12) $0.00 $55,106.86 ($55,106.86) $0.00 ($8,439.65) $53,840.59 ($1,922,095.91) 23900 Medicare Employer Withholding 22000 Dividend Payable $8,439.65 $11,414.99 $860,000.00 ($11,414.99) ($860,000.00) 22010 Interest Payable $0.00 $0.00 24100 Line of Credit $44,403,000.00 ($44,403,000.00)| 24200 Current Portion Long-Term Debt $0.00 24700 Other Current Liabilities $0.00 27000 Notes Payable-Noncurrent $12,000,000.00 ($12,000,000.00) 39003 Common Stock $8,105,000.00 ($8,105,000.00) 39004 Paid-in Capital $7,423,000.00 ($7,423,000.00) 39005 Retained Earnings 40000 Sales $6,171,558.64 $242,713,452.88 ($6,171,558.64) ($242,713,452.88) 41000 Sales Returns $11,100,220.89 $11,100,220.89 42000 Warranty Expense $1,158,128.47 $1,158,128.47 45000 Income from Investments 46000 Interest Income 47000 Miscellaneous Income $1,426,089.31 $131,881.46 $2,166,000.00 ($1,426,089.31) ($131,881.46) 50010 Cost of Goods Sold $130,196,645.26 ($2,166,000.00) $130,196,645.26 57500 Freight $4,240,263.09 $4,240,263.09 60000 Advertising Expense $1,036,854.01 $1,036,854.01 61000 Auto Expenses $210,502.80 $210,502.80 62000 Research and Development $528,870.44 $528,870.44 64000 Depreciation Expense $446,000.00 $446,000.00 64500 Warehouse Salaries $4,720,715.56 $4,720,715.56 65000 Property Tax Expense $99,332.45 66000 Legal and Professional Expense $4,913,224.45 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense $35,502.87 $36,106.92 $99,332.45 $4,913,224.45 $0.00 $36,106.92 $35,502.87 70100 Utilities $137,332.18 70110 Phone $52,599.02 $137,332.18 $52,599.02 70120 Postal $77,803.61 $77,803.61 71000 Miscellaneous Office Expense $24,891.82 $24,891.82 72000 Payroll Tax Exp $1,577,811.85 $1,577,811.85 73000 Pension/Profit-Sharing Plan Ex $4,140,546.55 $4,140,546.55 78600 Controllers' Clearning Account $330,375.80 ($330,375.80) 74000 Rent or Lease Expense $1,206,574.00 $1,206,574.00 77500 Administrative Wages Expense 78000 Interest Expense $16,197,225.43 $16,197,225.43 $2,591,736.50 $2,591,736.50 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State $8,900,000.00 $3,100,000.00 $330,647,935.01 $8,900,000.00 $3,100,000.00 $330,647,935.01 $0.00 Apollo Shoes, Inc 2019 10-K and assorted documents 31-Dec-20 Apollo 2019 10-K See additional materials Apollo CEO Letter to Shareholders See additional materials Apollo Organization Chart See additional materials Board of Directors and Audit Committee Meeting Minutes See additional materials Email from CAE and info about See additional materials new computer system This WP includes several documents considered critical to the audit planning process. The following items could be noted by the student to be of significance to the audit: Information Relevant to 2020 Audit Audit Action Recommended January 06, 2020 Larry Lancaster, Chairman, President, and CEO is a new hire. - Investigate Larry's background? Sales expected to increase 10% - Note for analytic review of expenses COGS and exp. to remain constant - Note for analytic review of expenses Authorized purchase of $1.3 million in equipment. - Vouch to supporting documentation, trace to PP&E workpapers. ST credit refinanced, rolled into LT N/P - Note for liabilities work; ensure proper accounting and disclosure. Officers' salary increase 10% - Note for payroll analytic procedures Cost of Superbowl ad rose 10% ($1 million). - Note for review of expenses June 30, 2020 Damages from "Nor'easter" cost $50,000. - Should be treated as repair, rather than capital addition Company raised prices 10% to meet expectations - Examine reasons for not meeting goals Stopped R&D on Phoneshoe. - Implications for intangible assets? Postage and telephone expense saved through e-mails - Note for analytic procedures involving expenses. Write-off A/R for $23,810.13. - Was that the only write-off? Advanced $1.25 million to Larry Lancaster's secretary (personal) - Related party transaction should be disclosed in footnotes. 1% interest Authorized $1 million for purchase of computer systems. - Verify purchase. Authorized $44,403,000 draw on LOC. - Verify the accounting for the liability. January 6, 2021 Anderson, Olds, and Watershed hired (fee $750,000)X-1 - Fee should be included in Professional Expenses Approved cash dividend ($860,000) (disbursed 03/01/21 for SH of record 12/31/20) - Dividend should be accrued. Reported a $12 million negligence suit - Contact client attorneys, possible contingent liability. Machinery purchased in early 2017 not operational - Check on status. Approved bonuses for 12/31/20 - $450,000 bonuses should be accrued at 12/31/20 Company approved $3,300,000 contribution to EBP - Note for footnotes. No Superbowl ad this year - Note for analytic procedures Prepared by: DW/TC Reviewed by: AA Apollo Shoes, Inc. 12/31/20 October 26, 2020 Mr. Larry Lancaster, Chairman Apollo Shoes, Inc. Shoetown, ME Dear Mr. Lancaster: This will confirm our understanding of the arrangements for auditing Apollo Shoes, Inc. financial statements for 2020. We will audit the balance sheet at December 31, 2020, and the related statements of income, retained earnings, and cash flows for the year ending that date. Our audit will be made in accordance with the Standards of the Public Company Accounting Oversight Board and will include such tests of the accounting records and such other auditing procedures as we consider necessary. Our audit will be based on samples of recorded transactions. We will plan the audit to detect material errors and frauds that may affect your financial statements. Our work, however, is subject to the unavoidable risk that errors, frauds, and illegal acts, will not be detected. We expect to obtain reasonable, but not absolute, assurance that major misstatements do not exist in the financial statements. Our findings regarding your system of internal control, including information about significant deficiencies and material weaknesses, will be reported to the audit committee of your board of directors in a separate letter at the close of the audit. At your request, but pending approval by your Board of Directors, we will prepare all required federal tax returns and the state franchise tax returns. We will provide your staff with a list of schedules needed by our staff during the audit. The delivery dates have been discussed and mutually agreed upon. We understand that your staff will prepare all the schedules in the package, all the financial statements and notes thereto, and the Form 10-K for our review. The scope of our services does not include preparation of any of these financial statements. Ms. Darlene Wardlaw will be the manager in charge of all work performed for you. She will inform you immediately if we encounter any circumstances that could significantly affect our fee estimate of $750,000 discussed with you on October 17, 2020. She is aware of the due date for the audit report, March 15, 2021. You should feel free to call on her at any time. If the specifications above are in accordance with your understand of the terms of our engagement, kindly sign below and return the duplicate copy to us. We look forward to serving you as independent public accountants. Accepted by /s/ Larry Lancaster Date 11/02/2020 CLIENT: PERIOD ENDED: Apollo Shoes ENGAGEMENT MATERIALITY (Required for all engagements) Apollo Shoes December 31, 2020 A-5 Prepared by Reviewed by This completed form must be provided to the engagement quality control reviewer in the planning stage of every audit. Please complete all the cells highlighted in yellow. PLANNING MATERIALITY CALCULATION Only if the current year net income (loss) (or other measure) is significantly different from the entity's historical results would 2-year averaging to obtain normalized net income (loss) (or other measure) be appropriate. PROFIT ORIENTED ENTITIES Current Year Net income (loss) Plus (minus) unusual, non-recurring revenues and expenses, and extraordinary items. ADJUSTED NET INCOME (LOSS) Adjusted net income (loss) multiplied by: 5% TOTAL ASSETS Total assets multiplied by: 1% TOTAL REVENUES Plus (minus) unusual, non-recurring revenues ADJUSTED REVENUES Total adjusted revenues multiplied by: Current Year Current Year Prior Year 0 0 JUSTIFICATION OF PLANNING MATERIALITY 1. Financial data source (ie. actual, budget, projection): Year end trial balance, actual data obtained from client. 2. Basis (ie. normalized net income, revenue, total Adjusted net income assets, other): Justification: USE THIS BOX TO DOCUMENT AND JUSTIFY WHICH BASIS YOU'VE SELECTED Standard 5% used. 3. Percentage of financial data source used: 4. Amount selected (planning materiality) 5. Prior year's final materiality 6. Performance materiality/Tolerable misstatement (75% of planning materiality) 7. Listing scope (amount threshold for suggested adjustments) (using 5% to 10% of planning materiality based on expected level of adjustments is usually appropriate) Engagement Partner Engagement Quality Control Reviewer 5% Being that Apollo is a new client and we were not provided with materiality amounts from the predecessor auditor, we assume that planning materiality is 5% of net income from 2019. A. Anderson Ernest Olds Apollo Shoes, Inc Audit Budget 31-Dec-20 A-6 Prepared by: DW Reviewed by: AA Auditor Darlene Wardlaw Taylor Crump Billing Rate Audit Area 357 Planning 225 Internal Control Testing Projected Hours Actual Hours Extended Cost 300 $ 107,100 275 $ 61,875 Senior Senior 298 Cash 150 $ 44,700 298 Accounts Receivable 180 S 53,640 Taylor Crump 225 Inventory 150 S 33,750 Taylor Crump 225 Prepaids 90 $ 20,250 Taylor Crump 225 Property, Plant and Equipment 200 $ 45,000 Taylor Crump 225 Other Assets 90 $ 20,250 Senior 298 Current Liabilities 200 $ 59,600 Senior 298 Notes Payable 150 $ 44,700 Darlene Wardlaw Senior 357 Stockholders' Equity 250 S 89,250 298 Revenue 200 S 59,600 Taylor Crump 225 Expenses 200 $ 45,000 Total $ 684,715.00 Contracted Price $ 750,000.00 Profit S 65,285.00 A-7 Prepared by: DW Reviewed by: AA Apollo Shoes, Inc. Audit Staffing Memo - A-7 December 31, 2020 Based on the information reviewed in the Apollo Shoes 10-K, minutes of the board of directors, and other documents, I believe that the audit team will require the following specialized expertise: a. Special expertise in Apollo's business and products is probably not necessary. The products are ordinary shoes. The company gave no indication of dealing in complicated transactions such as rubber futures hedging. Auditors with general retail and wholesale experience ought to be able to cope with the expertise demands. b. The audit team will need some special expertise in several areas: (1) the tax personnel probably know how to prepare the state franchise tax return, and that expertise might not be very special, (2) auditors with SEC knowledge and experience will need to participate, and (3) the team will need people with computer expertise on the engagement.

Step by Step Solution

There are 3 Steps involved in it

To address the given minicase efficiently follow these steps to complete the audit planning procedures as required Steps for Completing the Audit Plan... View full answer

Get step-by-step solutions from verified subject matter experts