Question: appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 3.1.1 Calculate the Payback Period of Project A (answer expressed

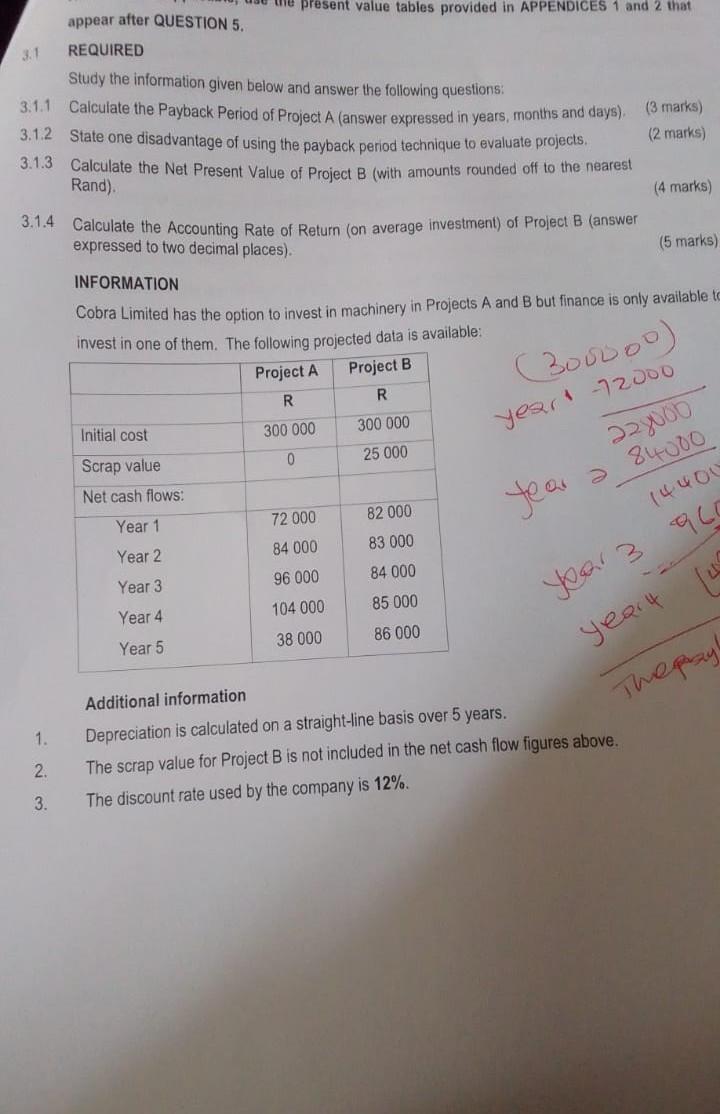

appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 3.1.1 Calculate the Payback Period of Project A (answer expressed in years, months and days). (3 marks) 3.1.2 State one disadvantage of using the payback period technique to evaluate projects. (2 marks) 3.1.3 Calculate the Net Present Value of Project B (with amounts rounded off to the nearest Rand). 3.1.4 Calculate the Accounting Rate of Return (on average investment) of Project B (answer (4 marks) expressed to two decimal places). (5 marks) INFORMATION Cobra Limited has the option to invest in machinery in Projects A and B but finance is only available to invest in one of them. The following projected data is available: Additional information 1. Depreciation is calculated on a straight-line basis over 5 years. 2. The scrap value for Project B is not included in the net cash flow figures above. 3. The discount rate used by the company is 12%. appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 3.1.1 Calculate the Payback Period of Project A (answer expressed in years, months and days). (3 marks) 3.1.2 State one disadvantage of using the payback period technique to evaluate projects. (2 marks) 3.1.3 Calculate the Net Present Value of Project B (with amounts rounded off to the nearest Rand). 3.1.4 Calculate the Accounting Rate of Return (on average investment) of Project B (answer (4 marks) expressed to two decimal places). (5 marks) INFORMATION Cobra Limited has the option to invest in machinery in Projects A and B but finance is only available to invest in one of them. The following projected data is available: Additional information 1. Depreciation is calculated on a straight-line basis over 5 years. 2. The scrap value for Project B is not included in the net cash flow figures above. 3. The discount rate used by the company is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts