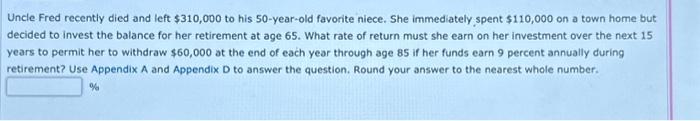

Question: Appendix A Appendix D Uncle Fred recently died and left $310,000 to his 50 -year-old favorite niece. She immediately spent $110,000 on a town home

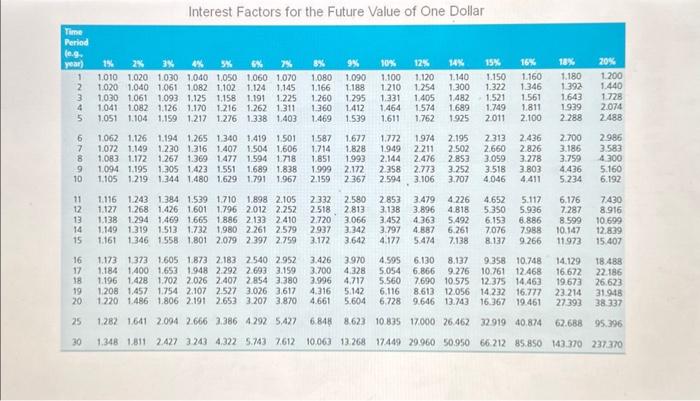

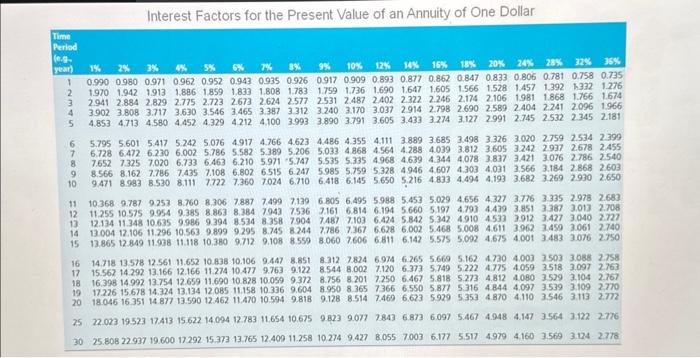

Uncle Fred recently died and left $310,000 to his 50 -year-old favorite niece. She immediately spent $110,000 on a town home but decided to invest the balance for her retirement at age 65 . What rate of return must she earn on her investment over the next 15 years to permit her to withdraw $60,000 at the end of each year through age 85 if her funds earn 9 percent annually during retirement? Use Appendix A and Appendix D to answer the question. Round your answer to the nearest whole number. Interect Fantors for the Precent Value of an Annuitv of One Dollar Uncle Fred recently died and left $310,000 to his 50 -year-old favorite niece. She immediately spent $110,000 on a town home but decided to invest the balance for her retirement at age 65 . What rate of return must she earn on her investment over the next 15 years to permit her to withdraw $60,000 at the end of each year through age 85 if her funds earn 9 percent annually during retirement? Use Appendix A and Appendix D to answer the question. Round your answer to the nearest whole number. Interest Factors for the Future Value of One Dollar Uncle Fred recently died and left $310,000 to his 50 -year-old favorite niece. She immediately spent $110,000 on a town home but decided to invest the balance for her retirement at age 65 . What rate of return must she earn on her investment over the next 15 years to permit her to withdraw $60,000 at the end of each year through age 85 if her funds earn 9 percent annually during retirement? Use Appendix A and Appendix D to answer the question. Round your answer to the nearest whole number. Interest Factors for the Future Value of One Dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts