Question: appendix b appendix d Given the following information concerning a convertible bond: Principal: $1,000 - Coupon: 6 percent . Maturity: 12 years Call price: $1,060

appendix b

appendix d

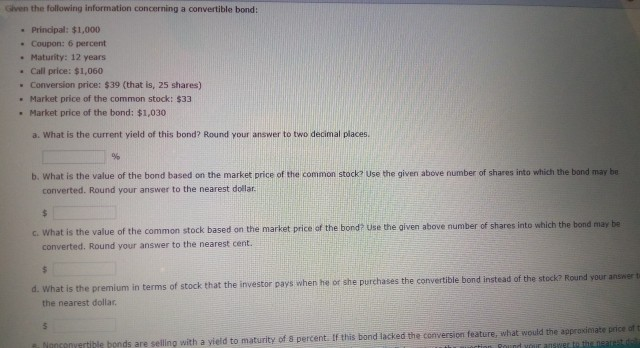

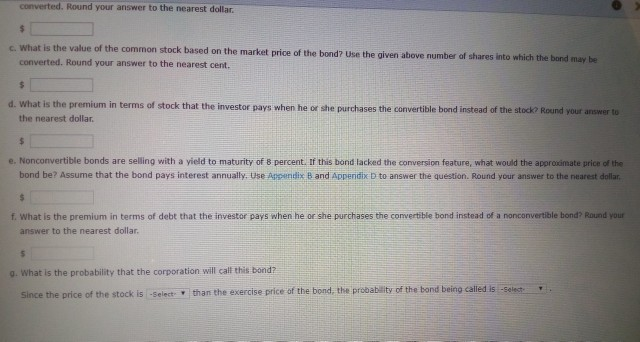

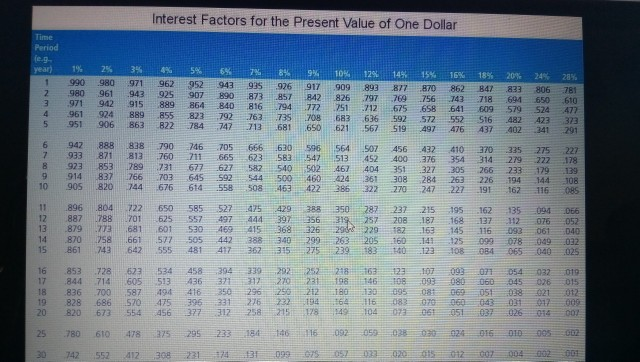

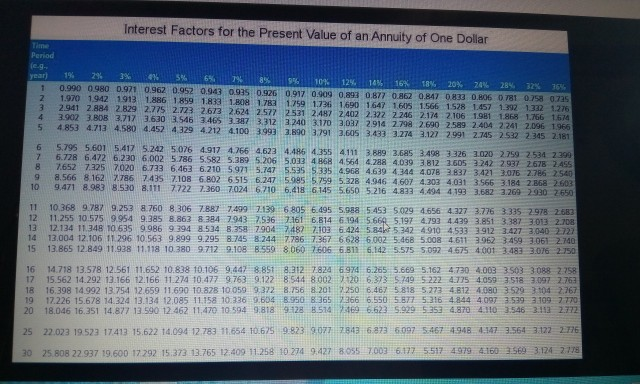

Given the following information concerning a convertible bond: Principal: $1,000 - Coupon: 6 percent . Maturity: 12 years Call price: $1,060 Conversion price: $39 (that is, 25 shares) Market price of the common stock: $33 Market price of the bond: $1,030 a. What is the current yield of this bond? Round your answer to two decimal places b. What is the value of the bond based on the market price of the common stock Use the given above number of shares into which the band may be converted. Round your answer to the nearest dollar c. What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the bond may converted. Round your answer to the nearest cent. d. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock round your the nearest dollar e bonds are selling with a vield to maturity of percent. If this bond lacked the conversion feature, what would the approximate p converted, Round your answer to the nearest dollar What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the bond maybe converted, Round your answer to the nearest cent. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock Round your answert the nearest dollar Nonconvertible bonds are selling with a yield to maturity of 8 percent. If this bond lacked the conversion feature, what would the approximate price of the bond be? Assume that the bond pays interest annually. Use Andix Band Appendix D to answer the question. Round your answer to the nearest dollar f. What is the premium in terms of debt that the investor pays when he or she purchases the convertible bond instead of a nonconvertible bond? Round your answer to the nearest dollar 9. What is the probability that the corporation will call this bond? Since the price of the stock is select than the exercise price of the bond, the probability of the band being called is select Interest Factors for the Present Value of One Dollar Time Period E5% 90 % , Oh, 101 19 27 Fe, HA406 TE 19951 12 10 ) 871 - 8ch T V 41 16 All 19719215 399 Hill E40 PM 77 | | | FANT 6 7 H8541 | ETH 1,636-3925721552-51648243373 TFB14 : 11 19,637 138 8115 97159 14 83766 | 405 2 144 64 5 ww 1998 1887 88 01 bus_? 13879 1980 | bill | 64285 81 4 EP SEP 3% 4367aa278 151 327 5 66 33 1 10 18 CBA 61 2 01440B 10247 2279167 16 1985 187 % % % 19 Deb 1 2 - 1 _69-4 ||| (1) B un 23108 TECH (1 ) 5 - 6 1 . 75 - 788471-636 188367 1982 Ep 50 20 820 31 EP 1776 610478 25 23:12 6002 0 2014) 20 14 _099 0 5/03 ww 0.00 12 96010-02DD? 08- 01-01-004 120 Interest Factors for the Present Value of an Annuity of One Dollar Period year 1 Z 3 4 5 1% 25 % 5% 6% 7% 8% 9% 10% 12% 10% 16% 10% 20% 20% 28% 22% 355 0.990 OGRO 0.971 0.962 0.952 0.943 0.9250 926 0917 0 909 0.893 0877 6. ORT OR33 O RO6 781 075872 1970 1912 1913 1.6 1899 1R 1 BOR 1787 1759 1726 1690 1641 160 1566 1528 1.657 1021121275 2941 2884 229 2.775 2.723 2673 2624 2577 2531 2487 2402223222246 2174 2 106 111 1166 1674 3902 3.BOB 3.717 3.630 3.546 3465 3.387 3,312 3240 3170 307 2914 2.708 2.6902.59 2.404 2.241 2.096 1966 4853 4.713 4.580 4.452 4329 4.212 4.100 399 2.890 3.791 3.605 3.433 1.274 3.127 2.991 2.145 25322345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.266 4.623 4.486 4355 4.1113 9 2.68534033326 3.020 2759 2.534 2399 5.778 6 472 62306 002 5.786 5.582 5.389 5206 5,032 4 86B 464 4.288 4.03038121605242 29372675 2.455 76527325 7020 6.73 6.463 6.210 5 971 5.747 5.535 5335 4.968 4.639 4,144 4.078 3837 3.421 3.075 276 2540 8.566 81622786 7.435 ZION 6 B02 6 515 6.247 5.095 5.759 5.328 40464 GOY 4.307 4031 3 566 3 184 2.368 2.603 9.471 8.983 8.50 8.111 7722 7.360 70246.210 6.418 6145 5.650 5 216 4.833 4.4944 1933.682 2.269 290 2650 11 10.368 07879.252 760 B 306 707 7499 7,1396 805 6.495 59885453 5.0991654.27 3.7763335 29782653 12 11.255 10.575 9 954 9.385 8862 8.784 7943 7536 716 6.814 6 1945 660 5.1974 .791 4.439 3.51 3.387 3013 2.108 13 12.134 1348 10 635 996 194 514 8.35879047482710364245 5.342 4910 4533 1912 142730402727 14 13 004 12 106 11 206 10 563 9.899 9.295 .745 8.244 77867367 6628 6.0025.468 5.00 4611 3962 3459 3061 2.740 15 13.865 12.849 11.928 11.118 100 9712 9.108 8.559 8060 7606 6 811 6.142 5.575 5.09246754001 3483 3.076 2750 16 14 718 13.578 12 561 11.652 10.838 10 106 9,44788518212724697 6265 56605.162 473040033503 3088 2258 17 15 562 14.292 12 166 12 166 11 274 10.477 9763 9.122 8 544 8002712063735.295 22247254059751830972763 18 16 398 14992 13.75 12 659 11 600 10 828 10 0599372 8756201250667581852724312 40035304767 19 17.226 15.678 14 224 13 134 12085 11.158 10.336 9.604 3950 365 366 5550 5577516 4 0971593 109 2720 20 18.046 16.35 14.877 13 500 12 462 11.470 10 5949 818 928.516 2965235929524 0411015.6311122 25 22.023 19.523 17413 15 622 14.094 12.783 1654 10.675 9.823 9077 7543 6873 6097 5.467 494 4.17 3.564 2.1 2.776 30 25 808 22937 19.500 17 292 15.373 13.765 12.409 11:258 10 274 9.427 3.0551003 6.177 5517 4979 4.160 3560 3.124 2.718 Given the following information concerning a convertible bond: Principal: $1,000 - Coupon: 6 percent . Maturity: 12 years Call price: $1,060 Conversion price: $39 (that is, 25 shares) Market price of the common stock: $33 Market price of the bond: $1,030 a. What is the current yield of this bond? Round your answer to two decimal places b. What is the value of the bond based on the market price of the common stock Use the given above number of shares into which the band may be converted. Round your answer to the nearest dollar c. What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the bond may converted. Round your answer to the nearest cent. d. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock round your the nearest dollar e bonds are selling with a vield to maturity of percent. If this bond lacked the conversion feature, what would the approximate p converted, Round your answer to the nearest dollar What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the bond maybe converted, Round your answer to the nearest cent. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock Round your answert the nearest dollar Nonconvertible bonds are selling with a yield to maturity of 8 percent. If this bond lacked the conversion feature, what would the approximate price of the bond be? Assume that the bond pays interest annually. Use Andix Band Appendix D to answer the question. Round your answer to the nearest dollar f. What is the premium in terms of debt that the investor pays when he or she purchases the convertible bond instead of a nonconvertible bond? Round your answer to the nearest dollar 9. What is the probability that the corporation will call this bond? Since the price of the stock is select than the exercise price of the bond, the probability of the band being called is select Interest Factors for the Present Value of One Dollar Time Period E5% 90 % , Oh, 101 19 27 Fe, HA406 TE 19951 12 10 ) 871 - 8ch T V 41 16 All 19719215 399 Hill E40 PM 77 | | | FANT 6 7 H8541 | ETH 1,636-3925721552-51648243373 TFB14 : 11 19,637 138 8115 97159 14 83766 | 405 2 144 64 5 ww 1998 1887 88 01 bus_? 13879 1980 | bill | 64285 81 4 EP SEP 3% 4367aa278 151 327 5 66 33 1 10 18 CBA 61 2 01440B 10247 2279167 16 1985 187 % % % 19 Deb 1 2 - 1 _69-4 ||| (1) B un 23108 TECH (1 ) 5 - 6 1 . 75 - 788471-636 188367 1982 Ep 50 20 820 31 EP 1776 610478 25 23:12 6002 0 2014) 20 14 _099 0 5/03 ww 0.00 12 96010-02DD? 08- 01-01-004 120 Interest Factors for the Present Value of an Annuity of One Dollar Period year 1 Z 3 4 5 1% 25 % 5% 6% 7% 8% 9% 10% 12% 10% 16% 10% 20% 20% 28% 22% 355 0.990 OGRO 0.971 0.962 0.952 0.943 0.9250 926 0917 0 909 0.893 0877 6. ORT OR33 O RO6 781 075872 1970 1912 1913 1.6 1899 1R 1 BOR 1787 1759 1726 1690 1641 160 1566 1528 1.657 1021121275 2941 2884 229 2.775 2.723 2673 2624 2577 2531 2487 2402223222246 2174 2 106 111 1166 1674 3902 3.BOB 3.717 3.630 3.546 3465 3.387 3,312 3240 3170 307 2914 2.708 2.6902.59 2.404 2.241 2.096 1966 4853 4.713 4.580 4.452 4329 4.212 4.100 399 2.890 3.791 3.605 3.433 1.274 3.127 2.991 2.145 25322345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.266 4.623 4.486 4355 4.1113 9 2.68534033326 3.020 2759 2.534 2399 5.778 6 472 62306 002 5.786 5.582 5.389 5206 5,032 4 86B 464 4.288 4.03038121605242 29372675 2.455 76527325 7020 6.73 6.463 6.210 5 971 5.747 5.535 5335 4.968 4.639 4,144 4.078 3837 3.421 3.075 276 2540 8.566 81622786 7.435 ZION 6 B02 6 515 6.247 5.095 5.759 5.328 40464 GOY 4.307 4031 3 566 3 184 2.368 2.603 9.471 8.983 8.50 8.111 7722 7.360 70246.210 6.418 6145 5.650 5 216 4.833 4.4944 1933.682 2.269 290 2650 11 10.368 07879.252 760 B 306 707 7499 7,1396 805 6.495 59885453 5.0991654.27 3.7763335 29782653 12 11.255 10.575 9 954 9.385 8862 8.784 7943 7536 716 6.814 6 1945 660 5.1974 .791 4.439 3.51 3.387 3013 2.108 13 12.134 1348 10 635 996 194 514 8.35879047482710364245 5.342 4910 4533 1912 142730402727 14 13 004 12 106 11 206 10 563 9.899 9.295 .745 8.244 77867367 6628 6.0025.468 5.00 4611 3962 3459 3061 2.740 15 13.865 12.849 11.928 11.118 100 9712 9.108 8.559 8060 7606 6 811 6.142 5.575 5.09246754001 3483 3.076 2750 16 14 718 13.578 12 561 11.652 10.838 10 106 9,44788518212724697 6265 56605.162 473040033503 3088 2258 17 15 562 14.292 12 166 12 166 11 274 10.477 9763 9.122 8 544 8002712063735.295 22247254059751830972763 18 16 398 14992 13.75 12 659 11 600 10 828 10 0599372 8756201250667581852724312 40035304767 19 17.226 15.678 14 224 13 134 12085 11.158 10.336 9.604 3950 365 366 5550 5577516 4 0971593 109 2720 20 18.046 16.35 14.877 13 500 12 462 11.470 10 5949 818 928.516 2965235929524 0411015.6311122 25 22.023 19.523 17413 15 622 14.094 12.783 1654 10.675 9.823 9077 7543 6873 6097 5.467 494 4.17 3.564 2.1 2.776 30 25 808 22937 19.500 17 292 15.373 13.765 12.409 11:258 10 274 9.427 3.0551003 6.177 5517 4979 4.160 3560 3.124 2.718

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts