Question: appendix b appendix d What should be the prices of the following preferred stocks if comparable securities yield 8 percent? Use Appendix B and Appendix

appendix b

appendix d

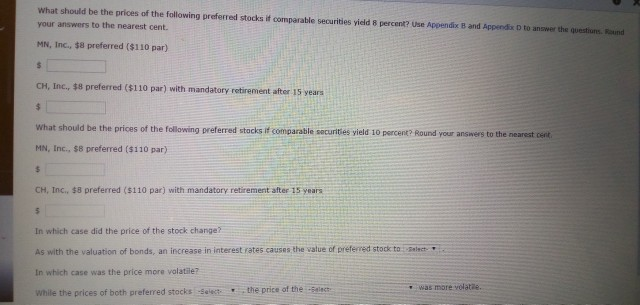

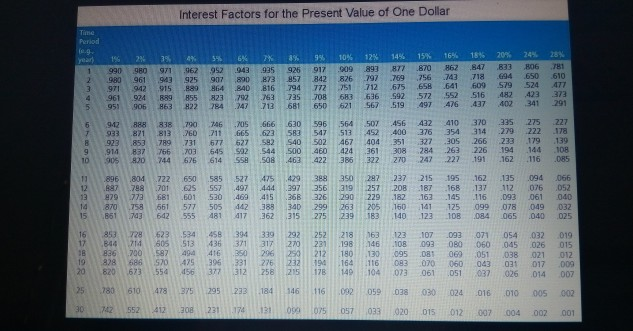

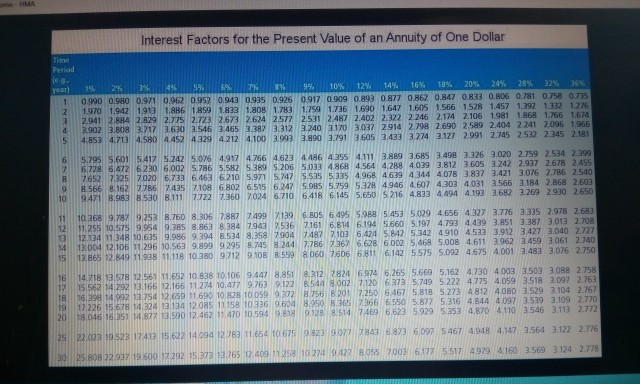

What should be the prices of the following preferred stocks if comparable securities yield 8 percent? Use Appendix B and Appendix D to answer the questiurs. Round your answers to the nearest cent. MN, Inc., $8 preferred ($110 par) CH, Inc., $8 preferred ($110 par) with mandatory retirement after 15 years $ What should be the prices of the following preferred stocks if comparable securities vield 10 percent? Round your answers to the nearest cent MN, Inc., $8 preferred ($110 par) CH, Inc., $8 preferred ($110 par) with mandatory retirement after 15 years In which case did the price of the stock change? As with the valuation of bonds, an increase in interest rates causes the value of preferred stock to elect In which case was the price more volatile? was more volatle. the price of the -Salect While the prices of both preferred stocks -Select Interest Factors for the Present Value of One Dollar Period e.9 year 15% 16 8 18% 20% 24% 10% 12% 14% 3% 8% 9% 15% 23% 4% 6% 833 909 893 1 002 001 e-HMA Interest Factors for the Present Value of an Annuity of One Dollar Time Periad (e.g- year) 28% 32% 36% 20% 24% 18% 10% 12% 14% 16% 4% 5% 95% 2% 1% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0917 0909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1 2 1.970 1.942 1913 1.886 1859 1.833 1.808 1.783 1759 1.736 1690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1276 2.941 2.884 2.829 2.775 2.723 2673 2624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3 3902 3.808 3.717 3.630 3.546 3.465 3387 3.312 3240 3.170 3.037 2914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4 4.853 4.713 4.580 4.452 4329 4.212 4.100 3.003 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2 532 2.345 2.181 5 5.795 5.601 5.417 5.242 5.076 4.917 4766 4.623 4486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4868 4.564 4.288 4039 3.812 3.605 3242 2.937 2678 2.455 7652 7:325 7.020 6.733 6.463 6.210 5.971 5,247 5.535 5.335 4968 4.639 4.344 4.078 3837 3.421 3.076 2.786 2.540 8.566 8162 7786 7435 7108 6.802 6.515 6.247 5.985 5.759 5328 4.946 4.607 4.303 4.031 3566 3.184 2.868 2.603 9471 8.983 8.530 8.111 7.722 7360 7024 6.710 6418 6145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 10 10.368 9.787 9.253 8.760 8.306 7887 7499 7139 6.805 6.495 5.988 5.453 5.029 4.656 4 327 3.776 3335 2.978 2.683 11 11.255 10.575 9.954 9.385 8.863 8.384 7943 7.536 7161 6.814 6.194 5.660 5.197 4.793 4439 3.851 3.387 3.013 2.708 3.427 3.040 2.727 12.134 11.348 10.635 9.986 9.394 8.534 8.35s8 7904 7487 7103 6.424 S,842 5.342 4910 4.533 3.9 13 13.004 12.106 11.296 10 563 9.899 9.295 8.745 8.244 7.786 7367 6.628 6.002 5,468 5.008 4.611 3962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9712 9108 8.559 8060 7606 6811 6.142 5575 S.092 4.675 4.001 3.483 3.076 2750 14 15 14718 13 578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7824 6974 6.265 5.669 5.162 4.730 4.003 3.503 3088 2.758 16 17 15.562 14.292 13.166 12.166 11 274 10.477 9.763 9.122 8544 8.002 7120 6.373 5749 5222 4.775 4.059 3.518 3.097 2.763 18 16398 14.992 13.754 12.659 11.690 10 828 10.059 9372 8.756 8201 7.250 6.467 5.818 5.273 4812 4.080 3.529 3.104 2.767 17 226 15 678 14 324 13134 12 085 11.158 10336 9604 8.050 8.365 7366 6550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 19 18.046 16.351 14.877 13 590 12462 11.470 10.594 9.8189128 8514 7469 6,623 5929 5.353 4.870 4.110 3.546 3.113 2.772 20 25 22 023 19.523 17412 15.622 14094 12 783 11.654 10 675 9.823 9077 7843 6823 6.097 5467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19 600 17292 15.37 13265 12400 11258 10274 9427 8.055 7003 6.177 5517 4979 4.160 3.569 3.124 2778

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts