Question: Appendix B -Employer Costs CPP 1 X employee cost EI 1.4 X employe cost EHT 1.95% of employment income box 14 WSIB Dept: CALL ,

| Appendix B -Employer Costs | | | | |

| | | | | | | |

| CPP | 1 X employee cost | | | | |

| EI | 1.4 X employe cost | | | | |

| EHT | 1.95% of employment income box 14 | | |

| WSIB | Dept: CALL , 1.96% of employment income box 14 | |

| | Dept: FNDC, 6.4% of employment income box 14 | |

| | | | | | | |

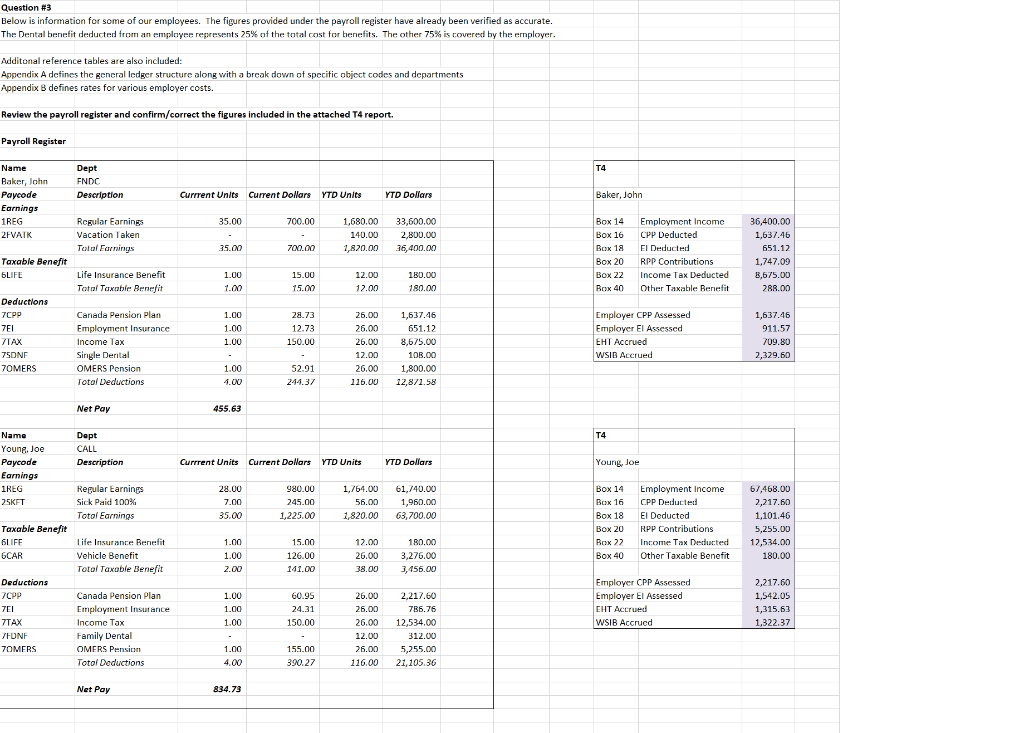

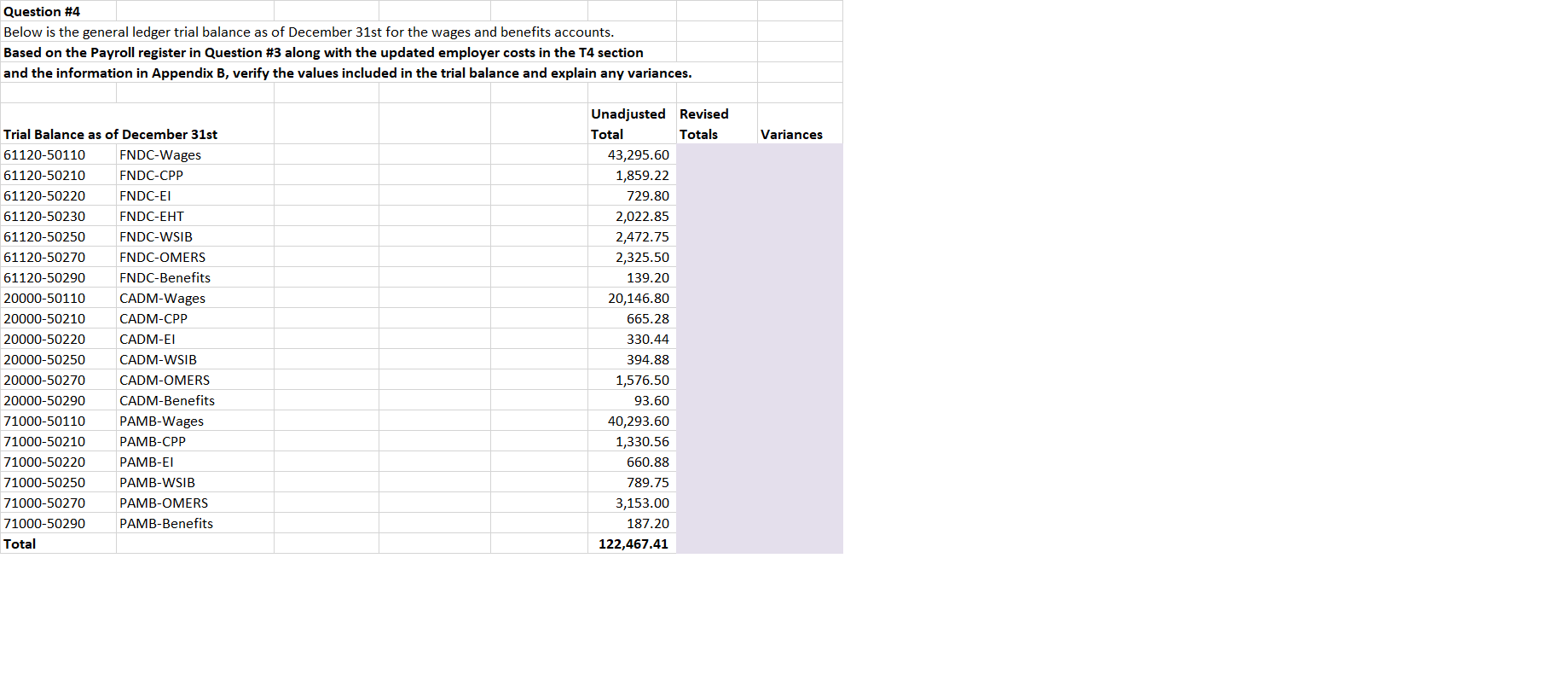

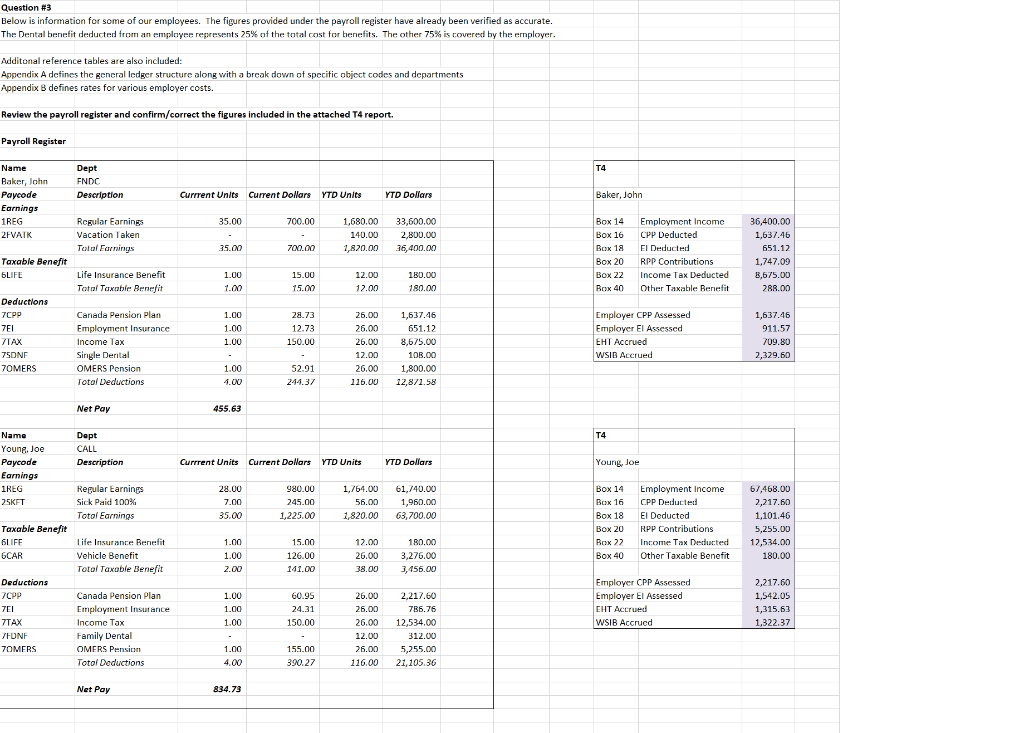

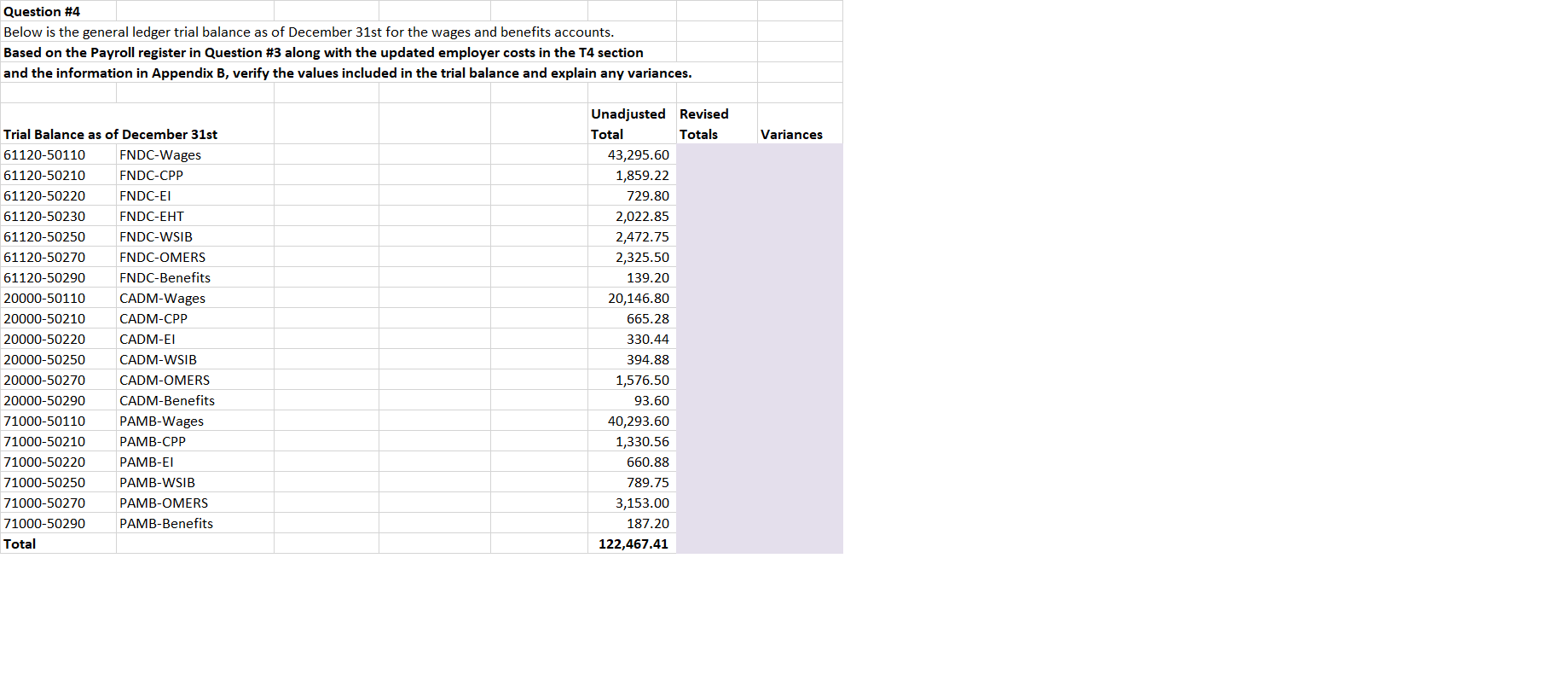

Question #3 Below is information for some of our employees. The figures provided under the payroll register have already been verified as accurate. The Dental benefit deducted from an employee represents 25% of the total cost for benefits. The other 75% is covered by the employer. Additonal reference tables are also included: Appendix A defines the general ledger structure along with a break down of specific object codes and departments Appendix B defines rates for various employer costs. Review the payroll register and confirm/correct the figures included in the attached T4 report. Payroll Register Name T4 Dept FNDC Description Currrent Units Current Dollars YTD Units YTD Dollars Baker, John Baker, John Paycode Earnings 1REG 2FVAIK 35.00 700.00 Regular Earnings Vacation Taken Total Farrings 1,680.00 140.00 1,820.00 33,600.00 2,800.00 16,400.00 35.00 700.00 Box 14 Box 16 Box 18 Box 20 Box 22 Box 40 Employment Income CPP Deducted El Deducted RPP Contributions Income Tax Deducted Other Taxable Renefit 36,400.00 1,637.46 651.12 1,747.09 8,675.00 288.00 Taxable Benefit LIFE 1.00 Life Insurance Benefit Total Taxable Benefit 15.00 15.00 12.00 12.00 180.00 180.00 Deductions 7CPP 7EI ZTAX 75DNF 70MERS 1.00 1.00 1.00 28.73 12.73 150.00 Canada Pension Plan Employment Insurance Income Tax Single Dental OMERS Pension Total Deductions 26.00 26.00 26.00 12.00 26.00 116.00 1,637.46 651.12 8,675.00 100.00 1,800.00 12,871.58 Employer CPP Assessed Employer El Assessed EHT Accrued WSIB Accrued 1,637.46 911.57 709.80 2,329.60 1.00 4.00 52.91 244.37 Net Pay 455.63 T4 Dept CALL Description Currrent Units Current Dollars YTD Units YTD Dollars Young, Joe Name Young, Joe Paycode Earnings 1REG 25KFT Regular Earnings Sick Paid 100% Total Earnings 28.00 7.00 35.00 980.00 245.00 1,225.00 1,764.00 56.00 1,820.00 61,740.00 1,960.00 63,700.00 Box 14 Box 16 Box 18 Box 20 Box 22 Box 40 Employment Income CPP Deducted El Deducted RPP Contributions Income Tax Deducted Other Taxable Benefit 67,468.00 2,217.60 1,101.46 5,255.00 12,534.00 180.00 Taxable Benefit LIFE GCAR 180.00 Life Insurance Benefit Vehicle Benefit Total Taxable Benefit 1.00 1.00 15.00 126.00 141.00 12.00 26.00 38.00 3,276.00 3,456.00 2.00 1.00 Deductions 7CPP ZEI 7TAX ZEDNF 70MERS 60.95 24.31 150.00 2,217,60 1.542.05 1,315.63 1,322.37 1.00 1.00 Canada Pension Plan Employment Insurance Income Tax Family Dental OMERS Pension Totol Deductions Employer CPP Assessed Employer El Assessed EHT Accrued WSIB Accrucd 26.00 26.00 26.00 12.00 26.00 116.00 2.217.60 786.76 12,534.00 312.00 5,255.00 21,105.36 1.00 4.00 155.00 390.27 Net Pay 834.73 Question #4 Below is the general ledger trial balance as of December 31st for the wages and benefits accounts. Based on the Payroll register in Question #3 along with the updated employer costs in the T4 section and the information in Appendix B, verify the values included in the trial balance and explain any variances. Variances Trial Balance as of December 31st 61120-50110 FNDC-Wages 61120-50210 FNDC-CPP 61120-50220 FNDC-EI 61120-50230 FNDC-EHT 61120-50250 FNDC-WSIB 61120-50270 FNDC-OMERS 61120-50290 FNDC-Benefits 20000-50110 CADM-Wages 20000-50210 CADM-CPP 20000-50220 CADM-EI 20000-50250 CADM-WSIB 20000-50270 CADM-OMERS 20000-50290 CADM-Benefits 71000-50110 PAMB-Wages 71000-50210 PAMB-CPP 71000-50220 PAMB-EI 71000-50250 PAMB-WSIB 71000-50270 PAMB-OMERS 71000-50290 PAMB-Benefits Total Unadjusted Revised Total Totals 43,295.60 1,859.22 729.80 2,022.85 2,472.75 2,325.50 139.20 20,146.80 665.28 330.44 394.88 1,576.50 93.60 40,293.60 1,330.56 660.88 789.75 3,153.00 187.20 122,467.41 Appendix A - General Ledger structure Account number is made up of department and object XXXXX-YYYYY XXXXX YYYYY Department Object Department Name General Ledger Distribution CADM CALL 20000 61120 20000 71000 61120 71000 100% 10% 30% 60% 100% 100% FNDC PAMB Object General Ledger Description 50110 Wages 50210 CPP 50220 EI 50230 EHT 50250 WSIB 50270 OMERS 50290 Benefits Example: Wages for department PAMB would be account 71000-50110