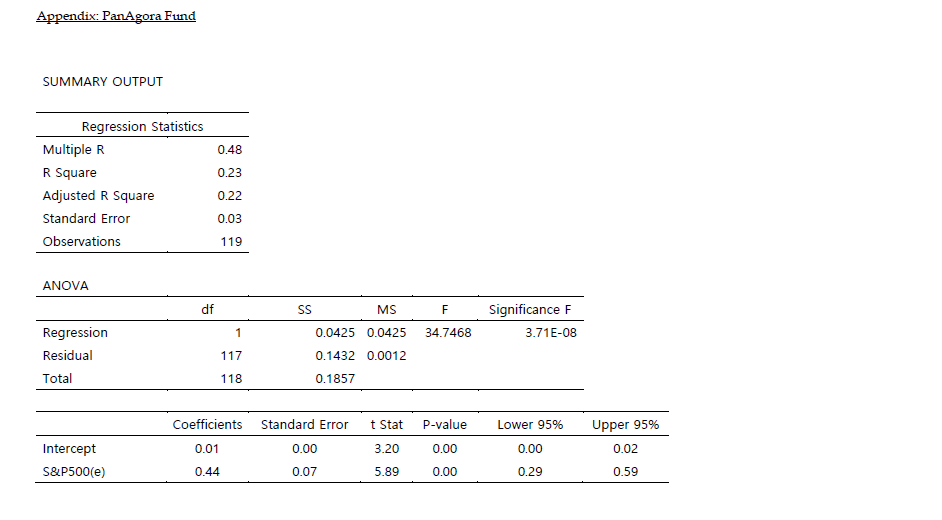

Question: Appendix: PanAgora Fund SUMMARY OUTPUT Regression Statistics Multiple R 0.48 R Square 0.23 Adjusted R Square 0.22 Standard Error 0.03 Observations 119 ANOVA df SS

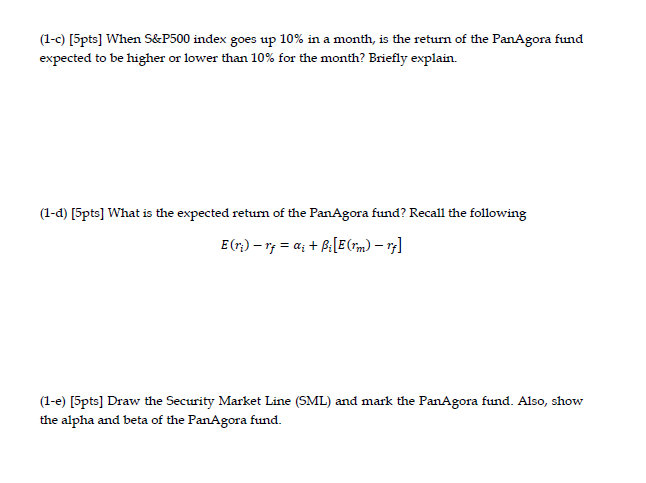

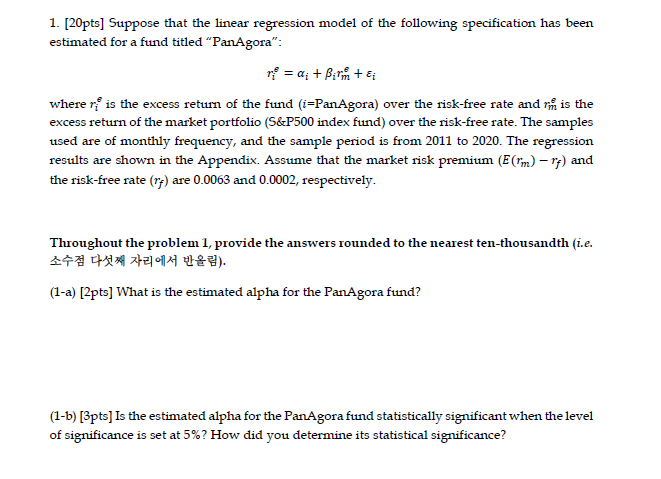

Appendix: PanAgora Fund SUMMARY OUTPUT Regression Statistics Multiple R 0.48 R Square 0.23 Adjusted R Square 0.22 Standard Error 0.03 Observations 119 ANOVA df SS MS F Significance F Regression 1 0.0425 0.0425 34.7468 3.71E-08 Residual 117 0.1432 0.0012 Total 118 0.1857 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Intercept 0.01 0.00 3.20 0.00 0.00 0.02 S&P500(e) 0.44 0.07 5.89 0.00 0.29 0.59(1-c) [5pts] When 5&P500 index goes up 10% in a month, is the return of the PanAgora fund expected to be higher or lower than 10% for the month? Briefly explain. (1-d) [5pts] What is the expected return of the PanAgora fund? Recall the following E(n) - r = a; + Bi[E(mm) - r;] (1-e) [5pts] Draw the Security Market Line (SML) and mark the PanAgora fund. Also, show the alpha and beta of the PanAgora fund.1. [20pts] Suppose that the linear regression model of the following specification has been estimated for a fund titled "PanAgora": rf = dit Birm + where r is the excess return of the fund (i=PanAgora) over the risk-free rate and mm is the excess return of the market portfolio (5&P500 index fund) over the risk-free rate. The samples used are of monthly frequency, and the sample period is from 2011 to 2020. The regression results are shown in the Appendix. Assume that the market risk premium (E(rm) - ry) and the risk-free rate (ry) are 0.0063 and 0.0002, respectively. Throughout the problem 1, provide the answers rounded to the nearest ten-thousandth (i.e. (1-a) [2pts] What is the estimated alpha for the PanAgora fund? (1-b) [3pts] Is the estimated alpha for the PanAgora fund statistically significant when the level of significance is set at 5%? How did you determine its statistical significance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts